Choosing a Super Fund How to Complete Your Standar 2021-2026

Understanding the Choosing A Super Fund Form

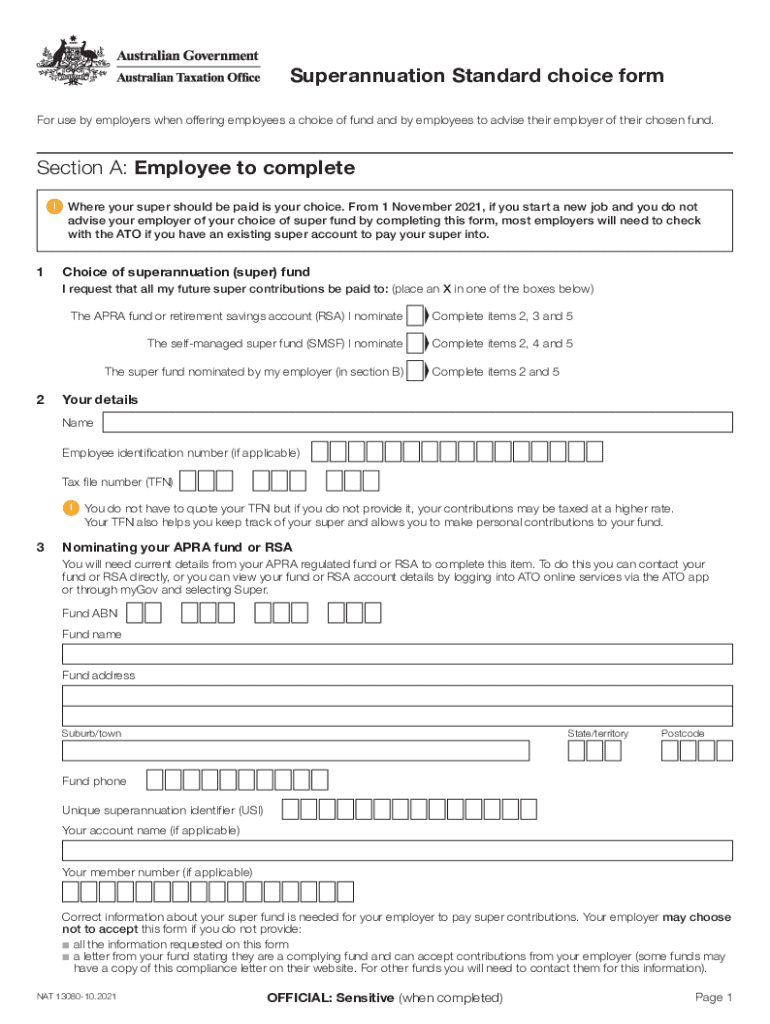

The Choosing A Super Fund form is essential for individuals looking to make informed decisions regarding their superannuation. This form allows users to select a super fund that aligns with their financial goals and retirement plans. Understanding its purpose helps ensure that individuals can navigate the complexities of superannuation effectively.

Steps to Complete the Choosing A Super Fund Form

Completing the Choosing A Super Fund form involves several key steps:

- Gather necessary information, such as your personal details and existing super fund information.

- Review different super fund options available to you, considering factors like fees, investment options, and performance.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your information for accuracy before submission.

- Submit the form through the preferred method, whether online or via mail.

Legal Use of the Choosing A Super Fund Form

The Choosing A Super Fund form must be used in compliance with relevant regulations governing superannuation in the United States. It is crucial to understand the legal implications of selecting a super fund, as this decision can impact your retirement savings and tax obligations. Ensure that you are aware of your rights and responsibilities when completing this form.

Required Documents for the Choosing A Super Fund Form

When completing the Choosing A Super Fund form, you may need to provide several documents to support your application. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Details of your current super fund, if applicable.

- Financial statements or records that may help in selecting the appropriate fund.

Eligibility Criteria for the Choosing A Super Fund Form

To complete the Choosing A Super Fund form, individuals must meet certain eligibility criteria. Generally, you need to be:

- A resident of the United States.

- Of legal age to enter into contracts, typically eighteen years or older.

- Currently employed or have a source of income that qualifies you for superannuation contributions.

Form Submission Methods

The Choosing A Super Fund form can be submitted through various methods, ensuring convenience for users. Common submission methods include:

- Online submission through the super fund's website, which is often the fastest option.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at a local office of the super fund, if available.

Quick guide on how to complete choosing a super fund how to complete your standar

Easily Prepare Choosing A Super Fund How To Complete Your Standar on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal sustainable option to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage Choosing A Super Fund How To Complete Your Standar on any platform with airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

How to Modify and eSign Choosing A Super Fund How To Complete Your Standar Effortlessly

- Obtain Choosing A Super Fund How To Complete Your Standar and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional signature in ink.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Choosing A Super Fund How To Complete Your Standar and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct choosing a super fund how to complete your standar

Create this form in 5 minutes!

How to create an eSignature for the choosing a super fund how to complete your standar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the code 19905422981701 in airSlate SignNow?

The code 19905422981701 is a unique identifier for specific features and functionalities within airSlate SignNow. It helps users access tailored solutions that enhance document management and eSigning processes. Understanding this code can streamline your experience with our platform.

-

How does airSlate SignNow pricing work for the 19905422981701 plan?

The 19905422981701 plan offers competitive pricing designed to fit various business needs. It includes essential features for document signing and management, ensuring you get the best value for your investment. For detailed pricing information, visit our pricing page.

-

What features are included in the 19905422981701 package?

The 19905422981701 package includes a comprehensive set of features such as document templates, real-time tracking, and secure eSigning. These tools are designed to enhance productivity and streamline workflows for businesses of all sizes. Explore our features page for more details.

-

What are the benefits of using airSlate SignNow with the 19905422981701 code?

Using airSlate SignNow with the 19905422981701 code provides numerous benefits, including increased efficiency in document handling and enhanced security for sensitive information. This solution is user-friendly and cost-effective, making it ideal for businesses looking to optimize their signing processes.

-

Can I integrate airSlate SignNow with other applications using the 19905422981701 code?

Yes, airSlate SignNow supports integrations with various applications when using the 19905422981701 code. This allows you to connect with tools like CRM systems, cloud storage, and more, enhancing your overall workflow. Check our integrations page for a complete list of compatible applications.

-

Is there a free trial available for the 19905422981701 plan?

Yes, airSlate SignNow offers a free trial for the 19905422981701 plan, allowing you to explore its features without any commitment. This trial period is a great opportunity to assess how our solution can meet your document signing needs. Sign up today to get started.

-

How secure is the airSlate SignNow platform with the 19905422981701 code?

The airSlate SignNow platform, including the 19905422981701 code, prioritizes security with advanced encryption and compliance with industry standards. Your documents and data are protected throughout the signing process, ensuring peace of mind for your business. Learn more about our security measures on our website.

Get more for Choosing A Super Fund How To Complete Your Standar

Find out other Choosing A Super Fund How To Complete Your Standar

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer