Prudential Federal ID Number 2019-2026

What is the Prudential Federal ID Number?

The Prudential Federal ID Number is a unique identifier assigned to businesses by the Internal Revenue Service (IRS). This number is essential for tax purposes, allowing the IRS to track a business's financial activities. It is commonly referred to as an Employer Identification Number (EIN) and is used to identify a business entity for various federal tax filings. The number is crucial for LLCs and other business structures, as it helps in managing tax obligations and compliance with federal regulations.

How to Obtain the Prudential Federal ID Number

Obtaining the Prudential Federal ID Number involves a straightforward process. Businesses can apply for this number online through the IRS website, by mail, or by fax. The online application is the quickest method, allowing businesses to receive their EIN immediately upon completion. When applying, it is important to have all necessary information ready, including the legal name of the business, structure type, and the owner's Social Security Number or Individual Taxpayer Identification Number.

Steps to Complete the Prudential Federal ID Number Application

To complete the application for the Prudential Federal ID Number, follow these steps:

- Visit the IRS website and navigate to the EIN application page.

- Select the type of entity you are applying for, such as an LLC.

- Provide the required information, including business name, address, and owner details.

- Review the information for accuracy before submitting the application.

- Submit the application and receive your EIN immediately if applied online.

Legal Use of the Prudential Federal ID Number

The Prudential Federal ID Number serves multiple legal purposes. It is required for filing federal taxes, opening a business bank account, and applying for business licenses. Additionally, this number is necessary for hiring employees, as it is used to report employment taxes to the IRS. Ensuring the proper use of the EIN is vital for maintaining compliance with federal regulations and avoiding potential legal issues.

Required Documents for the Prudential Federal ID Number Application

When applying for the Prudential Federal ID Number, certain documents may be required to verify the business entity. These typically include:

- Legal name of the business.

- Business structure information (e.g., LLC, corporation).

- Owner's Social Security Number or Individual Taxpayer Identification Number.

- Business address and contact information.

IRS Guidelines for the Prudential Federal ID Number

The IRS provides specific guidelines for obtaining and using the Prudential Federal ID Number. Businesses must ensure they apply for the number only when necessary, such as when starting a new business or hiring employees. The IRS also emphasizes the importance of keeping the EIN secure to prevent identity theft and fraud. Additionally, businesses should update their EIN information with the IRS if there are any changes to the business structure or ownership.

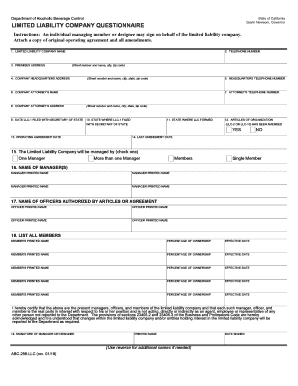

Quick guide on how to complete limited liability company questionnaire california abc

Manage Prudential Federal Id Number anywhere, anytime

Your daily business operations may need additional focus when handling state-specific forms. Reclaim your work hours and minimize the paper costs tied to document-based workflows with airSlate SignNow. airSlate SignNow offers a variety of pre-uploaded business forms, including Prudential Federal Id Number, which you can utilize and share with your business associates. Administer your Prudential Federal Id Number effortlessly with robust editing and eSignature features and send it directly to your recipients.

Steps to obtain Prudential Federal Id Number in a few clicks:

- Choose a form appropriate for your state.

- Simply click Learn More to access the document and ensure it is correct.

- Select Get Form to begin using it.

- Prudential Federal Id Number will automatically appear in the editor. No further actions are required.

- Employ airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Opt for the Sign feature to create your signature and eSign your form.

- When everything is ready, click on Done, save changes, and access your document.

- Send the form via email or text, or use a link-to-fill option with partners or allow them to download the document.

airSlate SignNow signNowly conserves your time managing Prudential Federal Id Number and enables you to locate important documents in one place. A vast library of forms is organized and designed to cover crucial business functions vital for your enterprise. The advanced editor decreases the chance of mistakes, allowing you to easily correct errors and review your documents on any device before dispatching them. Start your free trial today to discover all the advantages of airSlate SignNow for your daily business processes.

Create this form in 5 minutes or less

Find and fill out the correct limited liability company questionnaire california abc

FAQs

-

How much does it cost to set up a Limited Liability Company in California?

Go to the online portal for the State of California. From there either type in LLC or a phrase or look for the link to the Office of the Sec of State. You should find a link to laws and regulations that cover getting started as an LLC.You will need to file your Articles of Organization with the state and to the best of my recollection there was no fee involved. There is a nominal fee paid every other year however the $800 Franchise Tax Fee is due every year. Depending on the type of business you register, you may also be subject to paying yearly local tax and licensing.As far as I know a formal Operating Agreement is not required in the state of California but if you are in partnership with another person I strongly urge you to have an attorney who specializes in LLCs / business law, to write up a basic but comprehensive Operating Agreement for you. Believe me when I tell you this is a must have. Even if you are in business by yourself, the attorney may recommend some form of an Operating Agreement that covers you against personal liability and other important aspects of the law.It’s vital that you sit down with a California attorney either way and preferably one in the county and even better, the city where you wish to establish a business. Do your homework and Google the heck out of a few names to find one that appears to be a good fit.Good Luck.Carol

-

Up to how many members can a limited liability company (LLC) have in California?

There is no limit on the number of members that a limited liability company (LLC) may have as far as California law is concerned.However, the LLC’s Articles of Organization or Operating Agreement may, but is not required to, place a limit on the number of members the LLC may have.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I am forming a Limited Liability Company. Do I need to file taxes separate for my company and how frequent should I file?

If you are the only owner of the LLC, the default tax classification as "sole proprietor," which means that the LLC itself is disregarded for tax purposes (i.e. it does not exist for tax purposes). In that case, you would include all of the company's business income and loss on your personal income tax return (Form 1040, filed annually), in a Schedule C attachment.If the LLC has more than one owner, the default tax classification is partnership, which means you would have to file a partnership tax return annually (Form 1065). The LLC would report any profit or loss to you via a Schedule K-1, and then you would include that income on your personal income tax return.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the limited liability company questionnaire california abc

How to make an eSignature for the Limited Liability Company Questionnaire California Abc in the online mode

How to generate an eSignature for the Limited Liability Company Questionnaire California Abc in Chrome

How to generate an eSignature for putting it on the Limited Liability Company Questionnaire California Abc in Gmail

How to generate an eSignature for the Limited Liability Company Questionnaire California Abc straight from your mobile device

How to make an electronic signature for the Limited Liability Company Questionnaire California Abc on iOS devices

How to make an eSignature for the Limited Liability Company Questionnaire California Abc on Android

People also ask

-

What is California ABC LLC?

California ABC LLC is a legal business structure that allows for limited liability, protecting your personal assets. By forming a California ABC LLC, you can enjoy tax advantages and flexibility in management. This structure is suitable for various types of businesses looking to operate in California.

-

How does airSlate SignNow support California ABC LLCs?

airSlate SignNow provides California ABC LLCs with an efficient way to send and eSign documents, simplifying business transactions. Our platform is tailored to meet the unique needs of LLCs in California, allowing for quick and secure signatures on important documents. This streamlines operations and enhances productivity for California ABC LLCs.

-

What are the pricing options for using airSlate SignNow for a California ABC LLC?

airSlate SignNow offers competitive pricing plans designed for businesses, including California ABC LLCs. Our transparent pricing structure includes monthly and annual subscription options, ensuring you find a plan that fits your budget. Regardless of your choice, you will benefit from all essential features to manage your LLC efficiently.

-

What features are included in airSlate SignNow for California ABC LLCs?

The airSlate SignNow platform includes features such as document templates, advanced signing options, and secure cloud storage, ideal for California ABC LLCs. You can easily create, manage, and send documents for electronic signatures, which brings efficiency to your business processes. These features help optimize the workflows specific to LLC operations.

-

What are the benefits of using airSlate SignNow for California ABC LLCs?

Utilizing airSlate SignNow allows California ABC LLCs to save time and reduce costs by minimizing paperwork and streamlining document management. The software enhances collaboration and ensures compliance with California regulations. Plus, the ease of use means that even those unfamiliar with technology can leverage the platform effectively.

-

Can airSlate SignNow integrate with other tools used by California ABC LLCs?

Yes, airSlate SignNow offers seamless integrations with various tools that California ABC LLCs commonly use, such as CRM systems, cloud storage solutions, and project management apps. These integrations help centralize document workflows and enhance productivity. By using our platform, you can ensure that your essential applications work together efficiently.

-

Is airSlate SignNow secure for California ABC LLC transactions?

Absolutely! airSlate SignNow prioritizes security with advanced encryption methods that protect all transactions for California ABC LLCs. Compliance with industry standards ensures your data remains safe and secure while you send and eSign documents. Our commitment to privacy helps you maintain peace of mind in all business dealings.

Get more for Prudential Federal Id Number

- Student engagement instrument form

- Il 1023 ces tax illinois form

- Application for waiver under p d no 1466 no freight form

- Ky fillable in 725 form

- Special authority form

- Application for alien fianc e uscis legalforms

- Mhs fbla dlc performance forms fillable pdf application

- Borang tempahan nombor pendaftaran form

Find out other Prudential Federal Id Number

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile