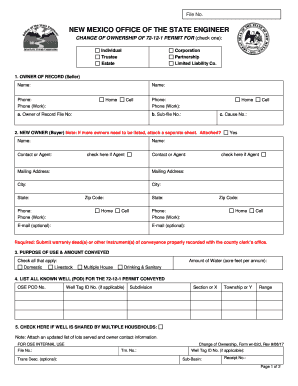

OWNER of RECORD Seller 2017-2026

What is the seller of record?

The seller of record refers to the individual or entity that is legally recognized as the seller in a transaction. This designation is crucial for various business operations, including tax reporting and compliance. In the context of U.S. law, the seller of record holds the responsibility for ensuring that all sales are conducted in accordance with applicable regulations. This includes collecting sales tax, maintaining accurate records, and fulfilling any legal obligations associated with the sale of goods or services.

Key elements of the seller of record

Understanding the key elements of the seller of record is essential for businesses. These elements include:

- Legal Identity: The seller must have a registered legal identity, such as a business name or corporation.

- Tax Obligations: The seller of record is responsible for collecting and remitting sales tax to the appropriate authorities.

- Record Keeping: Accurate records of sales transactions must be maintained for compliance and auditing purposes.

- Liability: The seller is liable for any issues arising from the sale, including product defects or disputes.

Steps to complete the seller of record

Completing the seller of record involves several important steps:

- Determine Eligibility: Ensure that the individual or entity meets the legal requirements to act as a seller of record.

- Register Your Business: Complete the necessary registration with state and local authorities to establish your business legally.

- Set Up Tax Accounts: Register for sales tax permits and other relevant tax accounts with the state.

- Maintain Documentation: Keep all records related to sales, including invoices and receipts, organized and accessible.

Legal use of the seller of record

The legal use of the seller of record is governed by various regulations and laws. It is essential for businesses to understand these legal frameworks to avoid penalties. Key legal considerations include:

- Compliance with Tax Laws: The seller of record must comply with federal, state, and local tax laws.

- Consumer Protection Laws: Sellers must adhere to laws designed to protect consumers, including return policies and product safety standards.

- Contractual Obligations: Any agreements made during the sale must be honored, and sellers must ensure that their terms are clear and enforceable.

Examples of using the seller of record

Understanding practical examples can clarify the role of the seller of record. Common scenarios include:

- Retail Sales: A retail store acting as the seller of record for products sold to consumers.

- Online Marketplaces: An online seller who lists products on platforms like e-commerce websites is the seller of record for those transactions.

- Service Providers: A company providing services, such as consulting or repairs, acts as the seller of record for those services rendered.

Required documents for the seller of record

To establish and maintain the status of a seller of record, several documents are typically required:

- Business Registration: Proof of business registration with state authorities.

- Sales Tax Permit: Documentation of sales tax registration for collecting and remitting taxes.

- Identification: Valid identification for the individual or individuals responsible for the business.

- Financial Records: Documentation of financial transactions, including sales records and tax filings.

Quick guide on how to complete owner of record seller

Handle OWNER OF RECORD Seller anywhere, anytime

Your daily organizational tasks might require extra focus when managing state-specific business documents. Reclaim your working hours and cut down on the printing costs related to document-driven processes with airSlate SignNow. airSlate SignNow offers you a wide array of pre-uploaded business forms, including OWNER OF RECORD Seller, which you can utilize and share with your business associates. Handle your OWNER OF RECORD Seller effortlessly with powerful editing and eSignature features and send it directly to your recipients.

How to obtain OWNER OF RECORD Seller in just a few clicks:

- Select a form that pertains to your state.

- Click on Learn More to view the document and ensure it is accurate.

- Click on Get Form to start working on it.

- OWNER OF RECORD Seller will automatically appear in the editor. No additional steps are needed.

- Utilize airSlate SignNow’s advanced editing functionalities to complete or modify the form.

- Locate the Sign feature to create your signature and eSign your document.

- When finished, simply click Done, save changes, and access your document.

- Share the form via email or SMS, or use a fillable link option with your partners or allow them to download the document.

airSlate SignNow signNowly reduces your time spent managing OWNER OF RECORD Seller and enables you to find necessary documents in one place. A comprehensive library of forms is organized and designed to address essential business processes vital for your company. The advanced editor decreases the likelihood of mistakes, as you can effortlessly rectify errors and review your documents on any device before sending them out. Start your free trial today to discover all the benefits of airSlate SignNow for your everyday business workflows.

Create this form in 5 minutes or less

Find and fill out the correct owner of record seller

FAQs

-

How do I fill out form 26QB for TDS in case of more than one buyer and seller?

Hi,Please select Yes in the column of Whether more than one Buyer/seller as applicable, and enter the Primary Member details in the Address of Transferee/Transferor & no need of secondary person details.The reason to include this is to know whether the agreement includes more than one buyer/seller, so the option is enabled.Hope it is useful.

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

How should form 26QB be filled in the case of a joint ownership property and multiple sellers?

For each buyer and seller a separate Form 26QB is to be filed.Say A & B buy a property from X & Y for Rs.1 crore in equal proportionate.In that case 4 Form 26QB to be filed.Buyer A - Seller X for sale consideration of Rs.25,00,000Buyer A - Seller Y for sale consideration of Rs.25,00,000Buyer B - Seller X for sale consideration of Rs.25,00,000Buyer B - Seller Y for sale consideration of Rs.25,00,000

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the owner of record seller

How to generate an electronic signature for the Owner Of Record Seller in the online mode

How to create an eSignature for your Owner Of Record Seller in Google Chrome

How to make an electronic signature for signing the Owner Of Record Seller in Gmail

How to generate an eSignature for the Owner Of Record Seller from your mobile device

How to create an eSignature for the Owner Of Record Seller on iOS devices

How to make an electronic signature for the Owner Of Record Seller on Android devices

People also ask

-

What is ose nm, and how does it relate to airSlate SignNow?

Ose nm is a vital concept that helps businesses understand the efficiency of their document management systems. With airSlate SignNow, you can leverage ose nm to streamline your document workflows while ensuring that important agreements are eSigned quickly and securely.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans that accommodate various business needs. Customers can choose from several tiers that are designed to provide cost-effective solutions for eSigning documents while maximizing the benefits of ose nm in their operations.

-

What features does airSlate SignNow provide to optimize ose nm?

AirSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking that enhance ose nm. These tools enable businesses to manage their documents more effectively, ensuring that every agreement is completed efficiently and accurately.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow provides numerous benefits, such as reduced turnaround times and improved document security, all while optimizing ose nm. Businesses can enhance their productivity and focus on core operations, knowing that their contracts are signed seamlessly and securely.

-

Does airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your business’s ability to utilize ose nm across platforms. By connecting with popular tools such as Google Workspace and Salesforce, you can improve workflow efficiency and document management.

-

How does airSlate SignNow enhance collaboration among team members?

AirSlate SignNow enhances collaboration by allowing team members to share and sign documents in real time. This feature not only speeds up the signing process but also aligns with the principles of ose nm, maximizing transparency and communication within the team.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security, employing encryption and top-notch authentication methods to protect sensitive information. This commitment to security ensures that your documents are safe while using the platform and aligns with best practices related to ose nm.

Get more for OWNER OF RECORD Seller

- National safety council ma form

- Form pr 26 horry county government horrycounty

- Habib bank limited centre of excellence in art amp design muet cead edu form

- Cav renewal form bethel 6 jobsdaughtersinternational

- Ignition interlock removal form

- Southington police department pistol permit form

- Custodianship certificate to support claim on behalf of minor children of deceased members of the armed forces omb no form

- Ammendment contract template form

Find out other OWNER OF RECORD Seller

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy