MO C Missouri Dividends Deduction Schedule 2022

What is the MO C Missouri Dividends Deduction Schedule

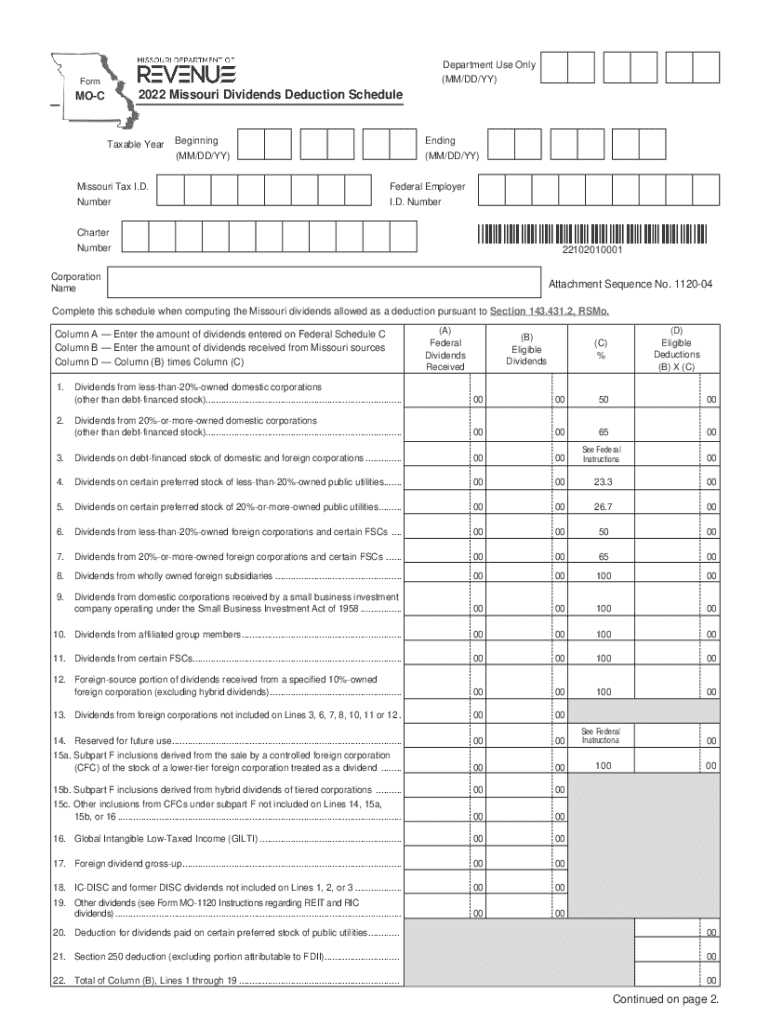

The MO C Missouri Dividends Deduction Schedule is a tax form used by residents of Missouri to claim a deduction for dividends received from certain corporations. This schedule is specifically designed to help taxpayers reduce their taxable income by allowing them to deduct qualifying dividends from their total income. Understanding this form is crucial for individuals and businesses seeking to maximize their tax benefits in compliance with Missouri tax laws.

How to use the MO C Missouri Dividends Deduction Schedule

Using the MO C Missouri Dividends Deduction Schedule involves several steps. First, gather all required financial documents that detail the dividends received. Next, accurately fill out the schedule by entering the dividend amounts in the appropriate sections. Ensure that you provide the necessary information regarding the corporations from which the dividends were received. Finally, attach the completed schedule to your Missouri income tax return to claim the deduction.

Steps to complete the MO C Missouri Dividends Deduction Schedule

Completing the MO C Missouri Dividends Deduction Schedule requires careful attention to detail. Begin by entering your personal information at the top of the form. Next, list each corporation from which you received dividends, including their names and the amounts of dividends received. Ensure that you adhere to the specific guidelines for qualifying dividends to avoid errors. After filling out all necessary sections, review the form for accuracy before submission.

Key elements of the MO C Missouri Dividends Deduction Schedule

Key elements of the MO C Missouri Dividends Deduction Schedule include the identification of qualifying dividends, the requirement for supporting documentation, and the calculation of the total deduction amount. Taxpayers must ensure that the dividends claimed meet the criteria set forth by the Missouri Department of Revenue. Additionally, accurate record-keeping is essential to substantiate the claims made on this schedule.

Eligibility Criteria

To be eligible for the MO C Missouri Dividends Deduction Schedule, taxpayers must receive dividends from specific types of corporations, such as Missouri-based companies or those that meet certain regulatory requirements. It is important to verify that the dividends qualify under state tax laws. Moreover, individuals must be residents of Missouri and file a state income tax return to utilize this deduction.

Filing Deadlines / Important Dates

Filing deadlines for the MO C Missouri Dividends Deduction Schedule align with the general Missouri state income tax return deadlines. Typically, the deadline for filing is April 15 of each year, unless it falls on a weekend or holiday, in which case it may be extended. Taxpayers should be aware of any changes in deadlines or extensions granted by the Missouri Department of Revenue to ensure timely submission.

Quick guide on how to complete mo c missouri dividends deduction schedule

Effortlessly Prepare MO C Missouri Dividends Deduction Schedule on Any Device

Digital document management has gained traction among both companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage MO C Missouri Dividends Deduction Schedule on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and electronically sign MO C Missouri Dividends Deduction Schedule with ease

- Locate MO C Missouri Dividends Deduction Schedule and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or misfiled documents, tedious form searching, or inaccuracies that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign MO C Missouri Dividends Deduction Schedule and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo c missouri dividends deduction schedule

Create this form in 5 minutes!

How to create an eSignature for the mo c missouri dividends deduction schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO C Missouri Dividends Deduction Schedule?

The MO C Missouri Dividends Deduction Schedule is a form used by businesses in Missouri to report dividend income and claim deductions. This schedule helps ensure that businesses accurately calculate their taxable income by accounting for dividends received. Understanding this schedule is crucial for compliance and optimizing tax liabilities.

-

How can airSlate SignNow assist with the MO C Missouri Dividends Deduction Schedule?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign documents related to the MO C Missouri Dividends Deduction Schedule. With our user-friendly interface, you can streamline the process of gathering necessary signatures and ensure timely submissions. This helps businesses stay organized and compliant with state regulations.

-

What are the pricing options for using airSlate SignNow for the MO C Missouri Dividends Deduction Schedule?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that facilitate the completion of the MO C Missouri Dividends Deduction Schedule, ensuring you get the best value for your investment. You can choose a plan that fits your budget while accessing essential tools for document management.

-

What features does airSlate SignNow offer for managing the MO C Missouri Dividends Deduction Schedule?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the MO C Missouri Dividends Deduction Schedule. These tools help simplify the documentation process and enhance collaboration among team members. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Can airSlate SignNow integrate with accounting software for the MO C Missouri Dividends Deduction Schedule?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, making it easier to manage the MO C Missouri Dividends Deduction Schedule. This integration allows for automatic data transfer, reducing the risk of errors and saving time. By connecting your accounting tools with airSlate SignNow, you can streamline your financial processes.

-

What are the benefits of using airSlate SignNow for the MO C Missouri Dividends Deduction Schedule?

Using airSlate SignNow for the MO C Missouri Dividends Deduction Schedule offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick document turnaround times, ensuring that you meet all deadlines. Additionally, the secure eSigning feature provides peace of mind that your documents are legally binding.

-

Is airSlate SignNow suitable for small businesses handling the MO C Missouri Dividends Deduction Schedule?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing the MO C Missouri Dividends Deduction Schedule. Our cost-effective solution provides essential features that help small businesses stay organized and compliant without breaking the bank. You can easily manage your documents and streamline your processes with our user-friendly platform.

Get more for MO C Missouri Dividends Deduction Schedule

Find out other MO C Missouri Dividends Deduction Schedule

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF