Form Mo C 2024

What is the Form Mo c

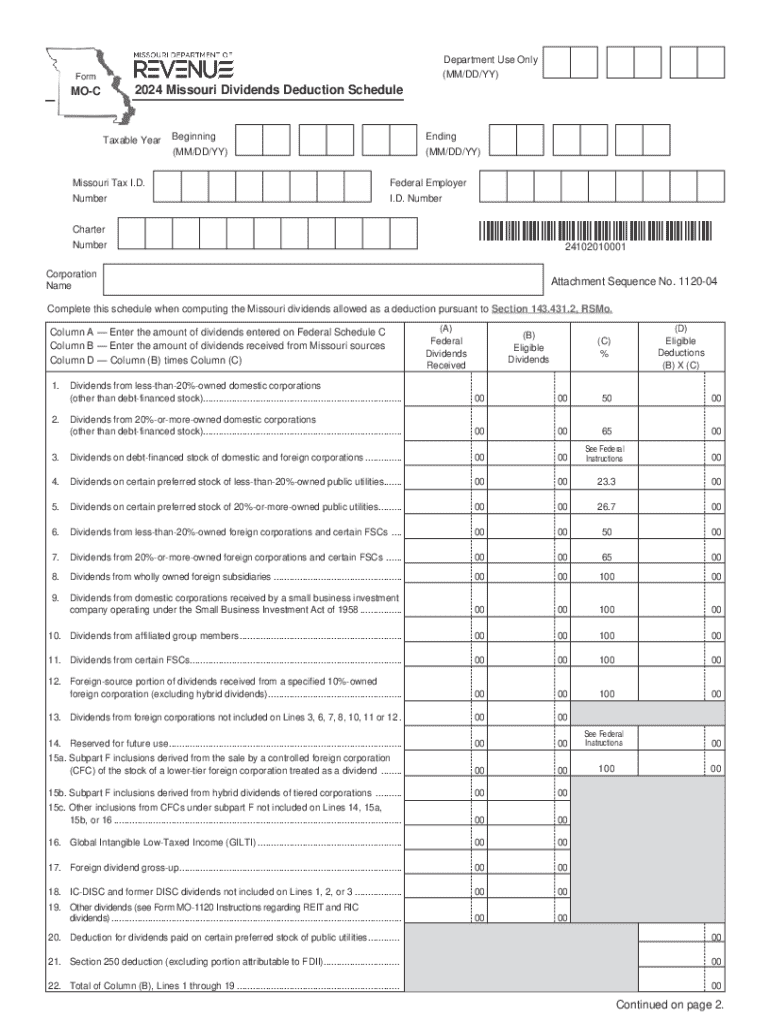

The Form Mo c is a specific document used for various legal and administrative purposes in the United States. It serves as a formal request or declaration, often related to compliance with state or federal regulations. Understanding the purpose of this form is essential for individuals and businesses to ensure they meet necessary legal requirements.

How to use the Form Mo c

Using the Form Mo c involves several straightforward steps. First, gather all required information, which may include personal identification details, financial data, or business information. Next, fill out the form accurately, ensuring that all sections are completed as required. Once completed, the form can be submitted according to the specified guidelines, which may include online submission or mailing it to the appropriate office.

Steps to complete the Form Mo c

Completing the Form Mo c requires attention to detail. Here are key steps to follow:

- Review the form instructions carefully to understand the requirements.

- Gather all necessary documents and information before starting to fill out the form.

- Complete each section of the form, ensuring accuracy and clarity.

- Double-check your entries for any errors or omissions.

- Sign and date the form where required.

- Submit the form through the designated method, whether online or by mail.

Legal use of the Form Mo c

The Form Mo c has specific legal implications and uses. It may be required for compliance with certain regulations or to fulfill obligations under state or federal law. Proper use of this form can help avoid legal complications and ensure that all necessary disclosures are made. It is important to understand the legal context in which this form is utilized to ensure compliance.

Required Documents

When preparing to submit the Form Mo c, certain documents may be required. These can include:

- Identification documents, such as a driver's license or social security number.

- Financial statements or tax documents, depending on the form's purpose.

- Business registration documents, if applicable.

Having these documents ready will facilitate a smoother completion and submission process.

Filing Deadlines / Important Dates

Timeliness is crucial when dealing with the Form Mo c. It is important to be aware of any filing deadlines associated with the form. Missing these deadlines can result in penalties or delays in processing. Always check for specific dates relevant to your situation to ensure compliance.

Form Submission Methods

The Form Mo c can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate office.

- In-person submission at a local office or agency.

Choosing the right submission method can impact processing times and overall efficiency.

Create this form in 5 minutes or less

Find and fill out the correct form mo c

Create this form in 5 minutes!

How to create an eSignature for the form mo c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo c and how does it relate to airSlate SignNow?

Mo c refers to the mobile capabilities of airSlate SignNow, allowing users to manage their documents on the go. With mo c, you can easily send and eSign documents from your mobile device, ensuring that you never miss an opportunity to finalize important agreements.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and designed to fit various business needs. With different plans available, you can choose the one that best suits your requirements, ensuring that you get the most value for your investment in mo c solutions.

-

What features does airSlate SignNow offer?

AirSlate SignNow offers a range of features including document templates, real-time collaboration, and advanced security measures. These features enhance the mo c experience, making it easier for users to manage their documents efficiently and securely.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with various applications such as Google Drive, Salesforce, and more. This flexibility allows you to streamline your workflow and enhance the mo c experience by connecting your favorite tools.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The mo c capabilities ensure that you can sign documents anytime, anywhere, making it a convenient choice for busy professionals.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security with features like encryption and secure storage. This ensures that your sensitive documents are protected, giving you peace of mind while using the mo c functionalities.

-

How does airSlate SignNow improve document workflow?

AirSlate SignNow streamlines document workflows by allowing users to create, send, and sign documents all in one platform. The mo c features enhance this process by enabling users to manage their documents efficiently from any device.

Get more for Form Mo c

Find out other Form Mo c

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure