Form MO C Missouri Dividends Deduction Schedule 2020

What is the Form MO C Missouri Dividends Deduction Schedule

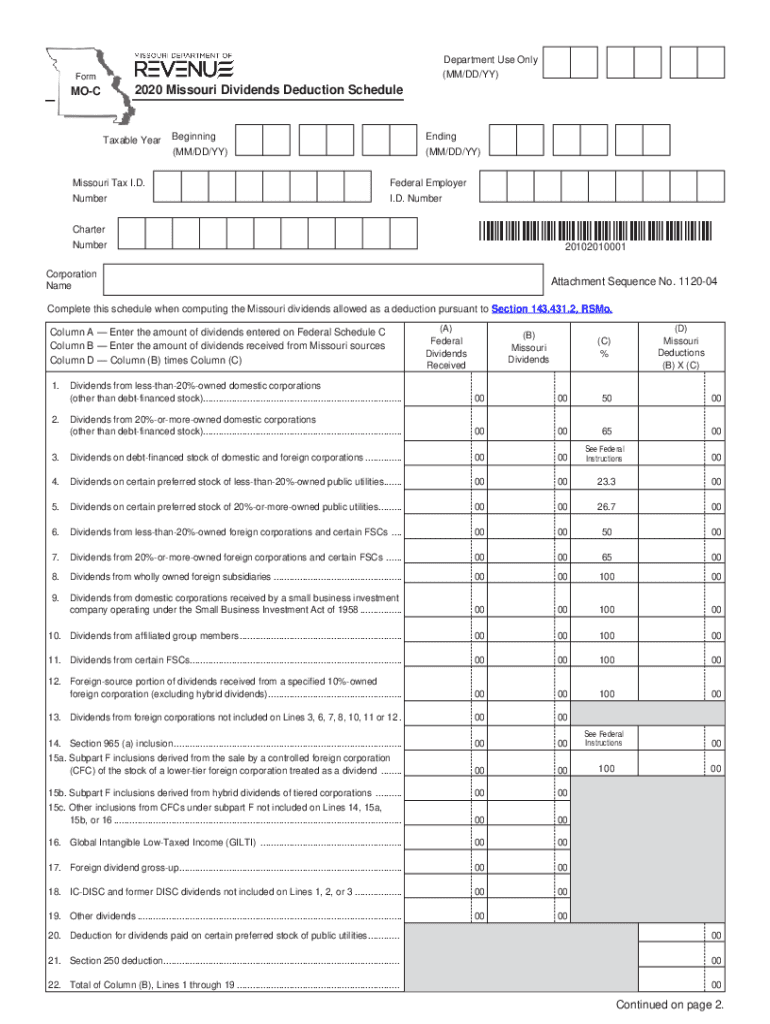

The Form MO C, known as the Missouri Dividends Deduction Schedule, is a tax form utilized by corporations in Missouri to claim a deduction for dividends received from other corporations. This form is essential for businesses that want to reduce their taxable income by accounting for dividends that are not subject to state tax. The form ensures that taxpayers can accurately report their dividend income while taking advantage of state tax benefits, thereby promoting fair taxation practices.

How to use the Form MO C Missouri Dividends Deduction Schedule

To use the Form MO C, taxpayers must first gather all necessary financial information regarding dividends received from other corporations. This includes the names of the corporations, the amounts of dividends received, and any relevant documentation supporting the claims. Once the information is compiled, the taxpayer fills out the form by entering the required details in the designated fields. It is crucial to ensure accuracy, as errors may lead to delays or penalties. After completing the form, it should be submitted alongside the corporate tax return to the Missouri Department of Revenue.

Steps to complete the Form MO C Missouri Dividends Deduction Schedule

Completing the Form MO C involves several key steps:

- Gather all relevant dividend information from financial records.

- Obtain the latest version of the Form MO C from the Missouri Department of Revenue.

- Fill in the taxpayer information, including the corporation's name and identification number.

- List each dividend received, specifying the amount and the corporation from which it was received.

- Calculate the total dividends eligible for deduction.

- Review the completed form for accuracy and completeness.

- Attach the Form MO C to the corporate tax return and submit it to the appropriate tax authority.

Key elements of the Form MO C Missouri Dividends Deduction Schedule

The Form MO C includes several key elements that are important for accurate completion:

- Taxpayer Information: This section requires the corporation's name, address, and identification number.

- Dividend Details: Taxpayers must list each dividend received, including the source corporation and the amount.

- Total Deduction Calculation: This section summarizes the total dividends eligible for deduction.

- Signature: The form must be signed by an authorized representative of the corporation to validate the submission.

Eligibility Criteria for the Form MO C Missouri Dividends Deduction Schedule

To be eligible to use the Form MO C, corporations must meet specific criteria. The dividends claimed must be received from other corporations that are subject to Missouri income tax. Additionally, the dividends must not have been previously deducted from the corporation's income. Corporations must also maintain proper documentation to support their claims, ensuring compliance with state tax regulations.

Form Submission Methods for the Form MO C Missouri Dividends Deduction Schedule

The Form MO C can be submitted through various methods, allowing flexibility for taxpayers. Corporations may choose to file the form electronically via the Missouri Department of Revenue's online portal, which can expedite processing times. Alternatively, the form can be printed and mailed to the appropriate address provided by the Department of Revenue. In-person submissions are also possible at designated tax offices. It is advisable to keep copies of all submitted documents for record-keeping purposes.

Quick guide on how to complete form mo c missouri dividends deduction schedule

Effortlessly Complete Form MO C Missouri Dividends Deduction Schedule on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Form MO C Missouri Dividends Deduction Schedule on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Method to Edit and eSign Form MO C Missouri Dividends Deduction Schedule with Ease

- Obtain Form MO C Missouri Dividends Deduction Schedule and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form MO C Missouri Dividends Deduction Schedule to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo c missouri dividends deduction schedule

Create this form in 5 minutes!

How to create an eSignature for the form mo c missouri dividends deduction schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form MO C Missouri Dividends Deduction Schedule?

The Form MO C Missouri Dividends Deduction Schedule is a tax form used by businesses in Missouri to report dividends received and claim deductions. This form helps ensure that businesses accurately calculate their taxable income by accounting for eligible dividends. Understanding this form is crucial for compliance and maximizing tax benefits.

-

How can airSlate SignNow assist with the Form MO C Missouri Dividends Deduction Schedule?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Form MO C Missouri Dividends Deduction Schedule. With its user-friendly interface, you can easily manage your documents and ensure they are signed and submitted on time. This streamlines the process, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the Form MO C Missouri Dividends Deduction Schedule?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while providing access to features necessary for managing the Form MO C Missouri Dividends Deduction Schedule. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing tax documents like the Form MO C Missouri Dividends Deduction Schedule?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Form MO C Missouri Dividends Deduction Schedule. These features enhance efficiency and ensure that your documents are handled securely and professionally. Additionally, you can collaborate with your team in real-time.

-

Are there any integrations available with airSlate SignNow for the Form MO C Missouri Dividends Deduction Schedule?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Form MO C Missouri Dividends Deduction Schedule. These integrations allow for automatic data transfer and reduce the need for manual entry, enhancing accuracy and saving time. Explore our integration options to find the best fit for your workflow.

-

What are the benefits of using airSlate SignNow for the Form MO C Missouri Dividends Deduction Schedule?

Using airSlate SignNow for the Form MO C Missouri Dividends Deduction Schedule offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to manage your documents digitally, which minimizes the risk of loss and ensures compliance with tax regulations. Additionally, the ease of use helps you focus on your business rather than paperwork.

-

Is airSlate SignNow secure for handling the Form MO C Missouri Dividends Deduction Schedule?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption methods to protect your documents, including the Form MO C Missouri Dividends Deduction Schedule. Our platform is designed to keep your sensitive information safe while allowing you to eSign and share documents securely. You can trust us to handle your tax documents with the utmost care.

Get more for Form MO C Missouri Dividends Deduction Schedule

Find out other Form MO C Missouri Dividends Deduction Schedule

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document