MO C Missouri Dividends Deduction Schedule 2021

What is the MO C Missouri Dividends Deduction Schedule

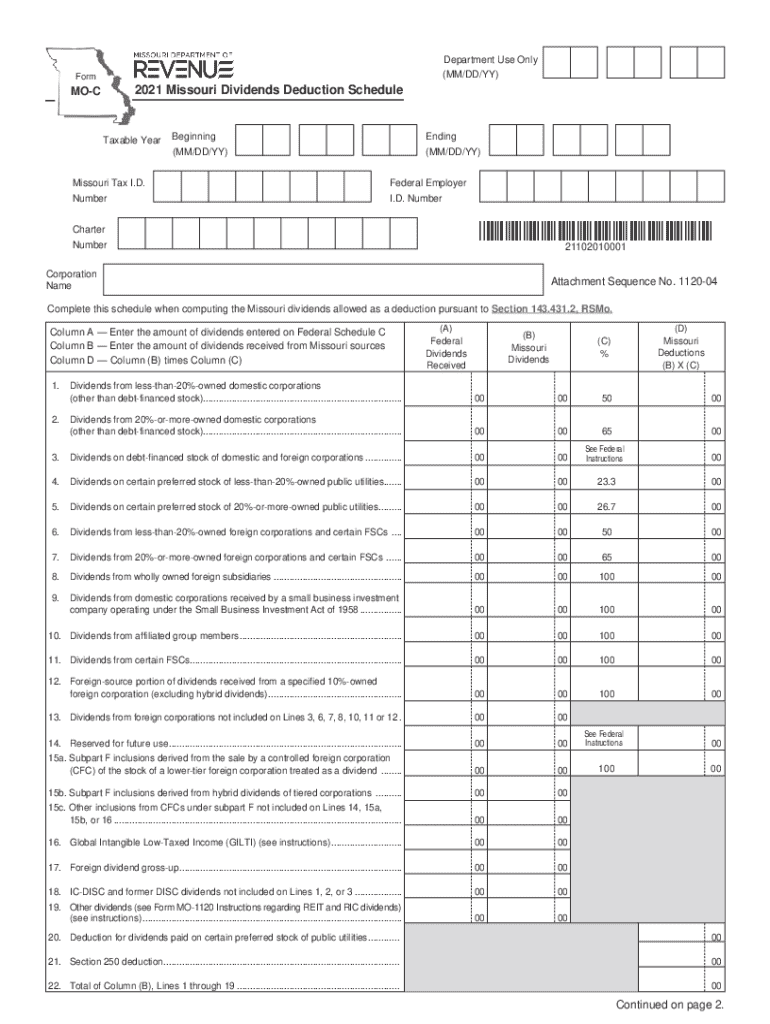

The MO C Missouri Dividends Deduction Schedule is a tax form used by residents of Missouri to claim deductions on dividends received from certain sources. This form is specifically designed for individuals and businesses that have earned dividends from Missouri-based corporations or other qualifying entities. By using this schedule, taxpayers can potentially reduce their taxable income, leading to lower state tax liabilities.

How to use the MO C Missouri Dividends Deduction Schedule

To effectively use the MO C Missouri Dividends Deduction Schedule, taxpayers must first gather all relevant financial documents that detail their dividend income. This includes statements from financial institutions and corporations. Once the necessary information is compiled, individuals can fill out the form by entering the total amount of dividends received and any applicable deductions. It is essential to ensure that all entries are accurate to avoid issues with the Missouri Department of Revenue.

Steps to complete the MO C Missouri Dividends Deduction Schedule

Completing the MO C Missouri Dividends Deduction Schedule involves several key steps:

- Gather all dividend income statements from the relevant tax year.

- Fill in your personal information, including name, address, and Social Security number.

- Report the total amount of dividends received on the designated line.

- Apply any eligible deductions according to the instructions provided with the form.

- Review the completed form for accuracy before submission.

Key elements of the MO C Missouri Dividends Deduction Schedule

The MO C Missouri Dividends Deduction Schedule includes several important elements that taxpayers need to be aware of:

- Taxpayer Information: Personal details such as name and Social Security number.

- Dividend Income: Total dividends received from qualifying sources.

- Deductions: Specific deductions that can be claimed based on the type of dividends.

- Signature: Required signature to validate the form upon submission.

Eligibility Criteria

To be eligible to use the MO C Missouri Dividends Deduction Schedule, taxpayers must meet certain criteria. They should be residents of Missouri and must have received dividends from qualifying Missouri corporations or entities. Additionally, the dividends must not be exempt from state taxation under Missouri law. It is advisable for taxpayers to review the specific eligibility requirements outlined by the Missouri Department of Revenue to ensure compliance.

Form Submission Methods

The MO C Missouri Dividends Deduction Schedule can be submitted in several ways. Taxpayers have the option to file the form online through the Missouri Department of Revenue's e-filing system, which provides a quick and efficient method. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submissions may also be possible at designated state offices. Each method has its own processing times, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete mo c missouri dividends deduction schedule 579392247

Effortlessly Complete MO C Missouri Dividends Deduction Schedule on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage MO C Missouri Dividends Deduction Schedule on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest method to edit and electronically sign MO C Missouri Dividends Deduction Schedule without much effort

- Obtain MO C Missouri Dividends Deduction Schedule and click on Get Form to begin.

- Make use of the tools available to finish your form.

- Emphasize important sections of your documents or obscure confidential information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature utilizing the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign MO C Missouri Dividends Deduction Schedule and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo c missouri dividends deduction schedule 579392247

Create this form in 5 minutes!

How to create an eSignature for the mo c missouri dividends deduction schedule 579392247

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO C Missouri Dividends Deduction Schedule?

The MO C Missouri Dividends Deduction Schedule is a form used by businesses in Missouri to report dividends received and claim deductions. This schedule helps ensure that businesses accurately calculate their taxable income by allowing them to deduct qualifying dividends. Understanding this schedule is crucial for compliance and optimizing tax liabilities.

-

How can airSlate SignNow assist with the MO C Missouri Dividends Deduction Schedule?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and send the MO C Missouri Dividends Deduction Schedule electronically. With our easy-to-use interface, you can streamline the document management process, ensuring that your tax forms are completed accurately and submitted on time. This saves you time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the MO C Missouri Dividends Deduction Schedule?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing documents, including the MO C Missouri Dividends Deduction Schedule. You can choose a plan that fits your budget and needs, ensuring you get the best value for your investment.

-

Are there any features specifically for handling the MO C Missouri Dividends Deduction Schedule?

Yes, airSlate SignNow includes features that simplify the handling of the MO C Missouri Dividends Deduction Schedule. These features include customizable templates, electronic signatures, and secure document storage. This ensures that your tax documents are not only compliant but also easily accessible whenever you need them.

-

What benefits does airSlate SignNow offer for managing tax documents like the MO C Missouri Dividends Deduction Schedule?

Using airSlate SignNow for managing tax documents like the MO C Missouri Dividends Deduction Schedule offers numerous benefits, including enhanced efficiency and reduced paperwork. Our platform allows for quick document turnaround and easy collaboration among team members. This ultimately leads to a more organized and stress-free tax preparation process.

-

Can airSlate SignNow integrate with accounting software for the MO C Missouri Dividends Deduction Schedule?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the MO C Missouri Dividends Deduction Schedule. This integration allows for automatic data transfer, reducing manual entry errors and ensuring that your financial records are always up-to-date and accurate.

-

Is airSlate SignNow secure for handling sensitive tax documents like the MO C Missouri Dividends Deduction Schedule?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents such as the MO C Missouri Dividends Deduction Schedule. We utilize advanced encryption and secure storage solutions to protect your data. You can trust that your information is safe while using our platform.

Get more for MO C Missouri Dividends Deduction Schedule

Find out other MO C Missouri Dividends Deduction Schedule

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure