Form 129 Maryland Taxes Comptroller of Maryland 2018

What is the Form 129 Maryland Taxes Comptroller Of Maryland

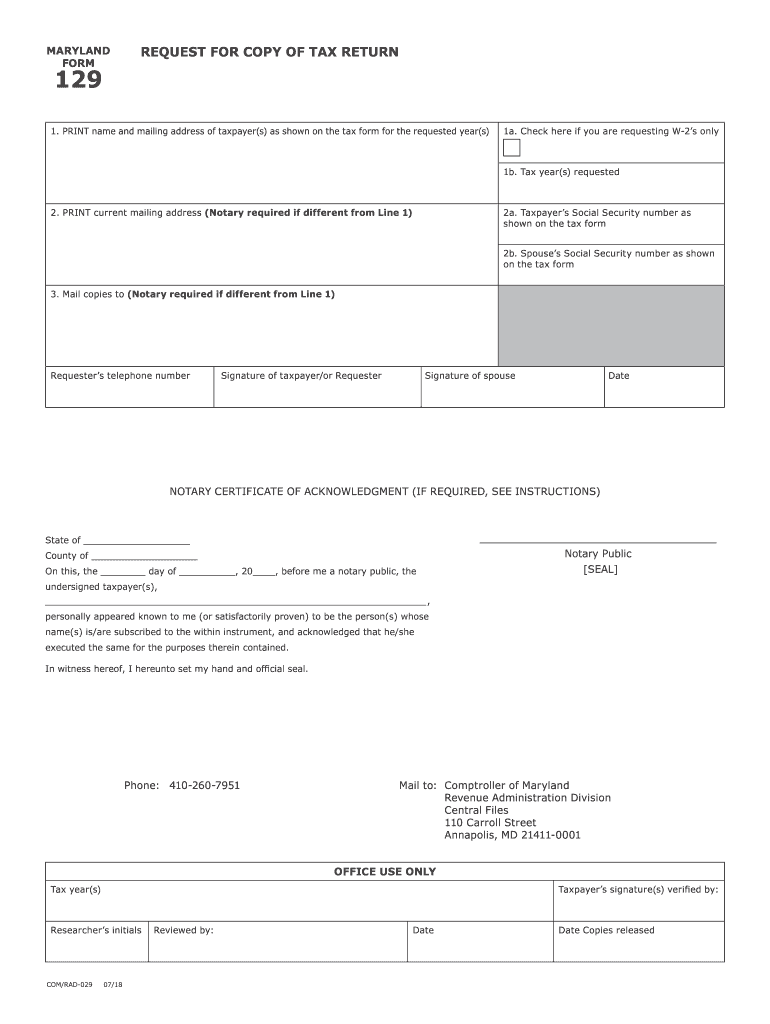

The Form 129 is a specific document issued by the Comptroller of Maryland, designed for taxpayers to request their Maryland state tax transcripts. This form is essential for individuals who need to verify their tax records for various purposes, such as applying for loans, financial aid, or other official transactions that require proof of income or tax compliance. The form allows taxpayers to obtain a detailed overview of their tax filings and payment history, ensuring that they have accurate and up-to-date information.

How to use the Form 129 Maryland Taxes Comptroller Of Maryland

Using the Form 129 involves a straightforward process. Taxpayers must complete the form by providing their personal information, including their name, Social Security number, and the tax year for which they are requesting the transcript. Once the form is filled out, it can be submitted either online or via mail to the Comptroller's office. It is important to ensure that all information is accurate to avoid delays in processing. The form can be used for various purposes, including verifying income for loan applications or confirming tax compliance for state or federal requirements.

Steps to complete the Form 129 Maryland Taxes Comptroller Of Maryland

Completing the Form 129 requires careful attention to detail. Here are the steps involved:

- Download the Form 129 from the official Maryland Comptroller website or request a physical copy.

- Fill in your personal information, including your full name, address, and Social Security number.

- Indicate the specific tax year for which you need the transcript.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the form either electronically through the Comptroller's online portal or mail it to the designated address.

Legal use of the Form 129 Maryland Taxes Comptroller Of Maryland

The Form 129 is legally recognized as a valid request for tax transcripts in Maryland. It complies with state regulations and is accepted by various institutions, including banks and educational organizations, as proof of income or tax compliance. Taxpayers should be aware that submitting false information on this form can lead to legal consequences, including penalties or audits. Therefore, it is crucial to ensure that all information provided is accurate and truthful.

Key elements of the Form 129 Maryland Taxes Comptroller Of Maryland

Key elements of the Form 129 include:

- Personal Information: Full name, address, and Social Security number of the taxpayer.

- Tax Year: The specific year for which the transcript is being requested.

- Signature: The taxpayer's signature is required to authorize the release of the tax transcript.

- Submission Method: Options for submitting the form, either online or by mail.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 129. The most efficient method is online submission through the Maryland Comptroller's website, where users can fill out and submit the form electronically. Alternatively, taxpayers may choose to print the form and send it via mail to the appropriate office. In some cases, individuals may also visit the Comptroller's office in person to submit the form and receive assistance if needed. Regardless of the method chosen, it is essential to keep a copy of the submitted form for personal records.

Quick guide on how to complete how can i get a copy of my wage and tax statements form w 2

Your assistance manual on how to prepare your Form 129 Maryland Taxes Comptroller Of Maryland

If you’re interested in finding out how to generate and submit your Form 129 Maryland Taxes Comptroller Of Maryland, here are a few brief guidelines on how to simplify tax processing.

To begin, you simply need to register your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to modify, generate, and finalize your income tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revert to edit responses as necessary. Optimize your tax administration with cutting-edge PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Form 129 Maryland Taxes Comptroller Of Maryland in just minutes:

- Set up your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Form 129 Maryland Taxes Comptroller Of Maryland in our editor.

- Complete the necessary fillable fields with your details (textual information, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if applicable).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Be aware that filing paper forms can lead to return errors and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct how can i get a copy of my wage and tax statements form w 2

FAQs

-

How can I get a copy of my wage and tax statements (Form W-2)?

Ask your employer (or former employer). They were obligated to provide it to you by now. If they haven’t, perhaps they do not have your current address.If they know where to find you but are refusing to provide you your W-2, they are breaking the law. You should report them to the IRS as they may not be paying the taxes they have withheld from your wages which would be stealing from you (as well as the government). Report them immediately. You might even get a reward for turning them in.

-

Where can I get a copy of my W-2 Form from prior tax years?

You should contact your prior employers for a copy(ies) of your prior year W-2’s. They should maintain records in their Accounting office or HR.Here is some information regarding the Statute of Limitations since you are referring to filing previous year returns: How long should I keep records?Period of Limitations that apply to income tax returnsKeep records for 3 years if situations (4), (5), and (6) below do not apply to you.Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return.Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.Keep records indefinitely if you do not file a return.Keep records indefinitely if you file a fraudulent return.Keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later.

-

How do I get a copy of my 1098 tax form from 2014?

There are several different kinds of forms designated as 1098.The base Form 1098 is a mortgage interest statement, provided to you by your mortgage holder. Many institutions have these available online; check with them.Form 1098-T is a statement provided by an institution of higher learning to a student showing the tuition paid and how much (if any) was offset by a scholarship. The institution should be able to provide you the information that was on the form.Form 1098-E is a statement provided to a recipient of a student loan by a lender showing how much interest was paid by that recipient. Again, the lender will often make these available online.There are a couple of other flavors of Form 1098, but those are far less common. While you can get the info from the IRS, it will probably be easier to get it from the source. Note that in most cases you don't actually have to have the form to claim the benefit, it just simplifies the process of matching up your return for the IRS when the information you enter matches what's on the form.

-

How can I get a copy of my 1983 tax return Form 1040?

Unless you kept a copy yourself or used a tax professional who is also a major packrat, there's no way to get one.The IRS starts purging income tax returns at 7 years and by 10 years it's impossible to get copies or transcripts.

-

I didn't file for my tax return for 2016 and I don't have the W2 form. How can I get a copy of a previous W2 from IRS when I never filed for a return?

You can go to the link below. Alternatively, your local post office may still have these.http://findformsonline.com/crmv1...

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the how can i get a copy of my wage and tax statements form w 2

How to create an eSignature for the How Can I Get A Copy Of My Wage And Tax Statements Form W 2 online

How to make an electronic signature for the How Can I Get A Copy Of My Wage And Tax Statements Form W 2 in Google Chrome

How to make an electronic signature for signing the How Can I Get A Copy Of My Wage And Tax Statements Form W 2 in Gmail

How to create an electronic signature for the How Can I Get A Copy Of My Wage And Tax Statements Form W 2 right from your smartphone

How to make an eSignature for the How Can I Get A Copy Of My Wage And Tax Statements Form W 2 on iOS

How to make an electronic signature for the How Can I Get A Copy Of My Wage And Tax Statements Form W 2 on Android

People also ask

-

What are Maryland state tax transcripts?

Maryland state tax transcripts are official documents that provide a summary of your tax history, including your filed tax returns and any payments made. They are crucial for verifying income and filing accurate tax returns.

-

How can I obtain my Maryland state tax transcripts?

You can obtain your Maryland state tax transcripts through the Maryland Comptroller's Office either online, by mail, or in person. Make sure to have your personal information ready for efficient processing.

-

What is the cost associated with getting Maryland state tax transcripts?

Typically, obtaining Maryland state tax transcripts is free. However, there may be fees for expedited services or copies of previous tax returns, so it's best to check with the Maryland Comptroller's website for the most current information.

-

How quickly can I receive my Maryland state tax transcripts?

The processing time for Maryland state tax transcripts can vary based on the request method. Online requests may be processed within minutes, while mailed requests can take several days to weeks.

-

Can airSlate SignNow help with the electronic signing of Maryland state tax transcripts?

Yes, airSlate SignNow allows you to securely eSign your Maryland state tax transcripts electronically, making the process seamless and efficient. You’ll save time and maintain legal compliance with electronic signatures.

-

What benefits does airSlate SignNow provide for managing Maryland state tax transcripts?

Using airSlate SignNow for Maryland state tax transcripts streamlines the document management process, allowing you to quickly send, sign, and store your transcripts online. The platform is intuitive, ensuring ease of use for everyone involved.

-

Does airSlate SignNow integrate with other tools for managing tax documents?

Absolutely! airSlate SignNow offers integrations with various productivity and accounting tools, enhancing your workflow for managing Maryland state tax transcripts. This integration allows you to import and export documents effortlessly.

Get more for Form 129 Maryland Taxes Comptroller Of Maryland

- Viking forge form

- Bof 4544a report of operations of law or intra familial firearm transaction bof 4544a report of operations of law or intra form

- Resume brainstorming worksheet form

- How to log on to ladder logic on automax rockwell form

- Fulton county dispossessory form

- Ficha de acreedor ejemplo form

- Medication treatment authorization form

- Human foosball flyer form

Find out other Form 129 Maryland Taxes Comptroller Of Maryland

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple