Check Here If You Are Requesting W 2s Only 2020-2026

Understanding the Maryland State Tax Transcript

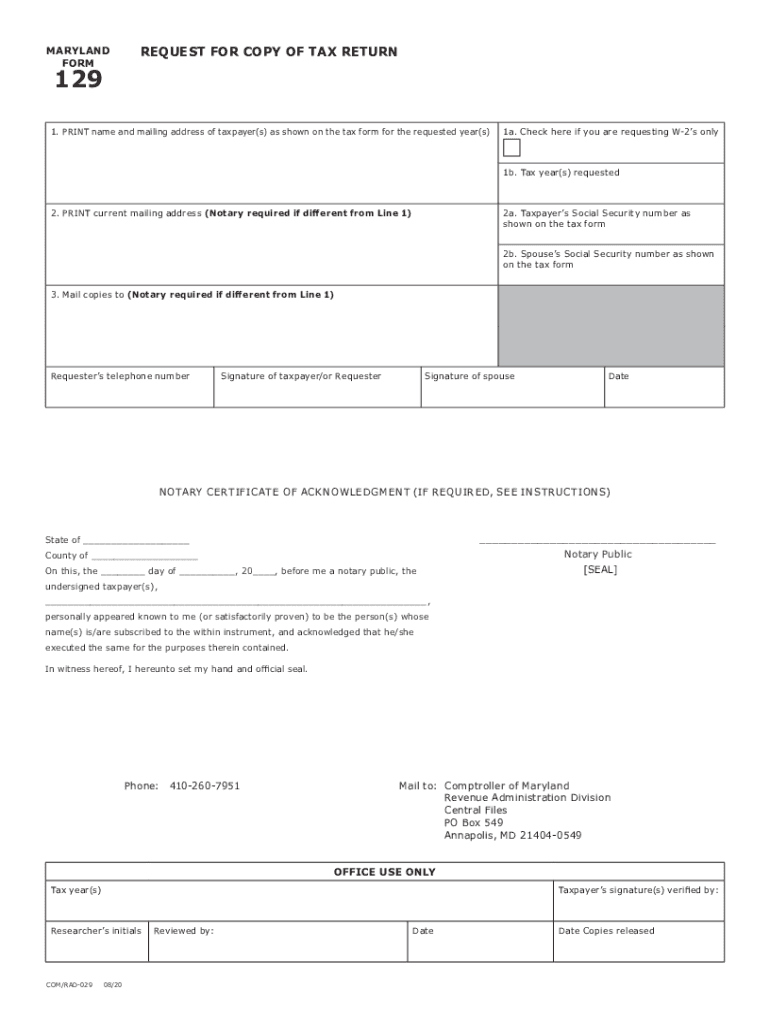

The Maryland state tax transcript is an official document that summarizes your tax return information for a specific tax year. This transcript includes details such as your filing status, adjusted gross income, and any tax payments made. It is often required for various purposes, including loan applications, financial aid, and verifying income. Knowing how to obtain and use this document is essential for residents and businesses in Maryland.

Steps to Request Your Maryland Tax Transcript

To request your Maryland tax transcript, follow these steps:

- Complete the Maryland tax transcript request form, commonly known as the Maryland tax transcript request form.

- Provide accurate personal information, including your name, address, and Social Security number.

- Specify the tax year for which you need the transcript.

- Submit the completed form via mail or electronically, depending on the options available.

Legal Uses of the Maryland Tax Transcript

The Maryland tax transcript serves multiple legal purposes. It is often used to verify income for loan applications, support financial aid requests, and provide proof of tax compliance during audits. Additionally, it may be required for certain legal proceedings or to resolve disputes with the Maryland Comptroller's office. Ensuring that your transcript is accurate and up to date can help facilitate these processes.

Required Documents for Requesting a Tax Transcript

When requesting your Maryland tax transcript, you may need to provide specific documents to verify your identity. These documents can include:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of residency, such as a utility bill or bank statement.

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

Form Submission Methods for Maryland Tax Transcript

You can submit your Maryland tax transcript request through various methods. The options typically include:

- Online submission through the Maryland Comptroller's website.

- Mailing the completed request form to the appropriate office.

- In-person submission at designated tax offices.

Filing Deadlines for Maryland Tax Transcripts

It is important to be aware of filing deadlines when requesting your Maryland tax transcript. Generally, you should allow sufficient time for processing, especially if you need the transcript for a specific deadline, such as a loan application. The Maryland Comptroller's office typically processes requests within a few weeks, but it is advisable to request your transcript well in advance of any deadlines to avoid delays.

Quick guide on how to complete check here if you are requesting w 2s only

Prepare Check Here If You Are Requesting W 2s Only seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Check Here If You Are Requesting W 2s Only on any device using airSlate SignNow Android or iOS applications and simplify any document-focused process today.

How to modify and eSign Check Here If You Are Requesting W 2s Only effortlessly

- Obtain Check Here If You Are Requesting W 2s Only and click Get Form to get started.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would prefer to share your form, either via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Check Here If You Are Requesting W 2s Only to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct check here if you are requesting w 2s only

Create this form in 5 minutes!

How to create an eSignature for the check here if you are requesting w 2s only

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is md 129 1 in airSlate SignNow?

md 129 1 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This product allows businesses to streamline their document workflows efficiently and securely, ensuring compliance with industry standards.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the features and usage levels required, but it remains cost-effective overall. Customers can explore different pricing tiers designed to accommodate small businesses to large enterprises, all while leveraging the benefits of md 129 1.

-

What are the key features of md 129 1?

md 129 1 offers robust features such as real-time document tracking, customizable templates, and advanced security options for eSigning. These features aim to enhance productivity and ensure that all signers have a seamless experience throughout the process.

-

How can md 129 1 benefit my business?

By using md 129 1 in airSlate SignNow, businesses can signNowly expedite their document handling processes. This results in quicker turnaround times, reduced paper usage, and enhanced customer satisfaction due to a streamlined workflow.

-

Is there a free trial for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows potential customers to explore the features of md 129 1 without any commitment. This trial period is designed to help businesses assess the solution’s functionality and determine its fit for their document management needs.

-

What integrations does airSlate SignNow support?

airSlate SignNow supports numerous integrations with popular business tools such as Google Drive, Salesforce, and Dropbox. These integrations allow users to easily incorporate md 129 1 into their existing workflows and enhance overall efficiency.

-

Is md 129 1 compliant with industry standards?

Yes, md 129 1 in airSlate SignNow is compliant with various industry standards, including GDPR and eIDAS regulations. This compliance ensures that businesses can trust airSlate SignNow for secure document transmission and eSigning.

Get more for Check Here If You Are Requesting W 2s Only

- Self employed contract form

- Minister agreement self employed independent contractor form

- Personal independent contractor form

- Self employed referee or umpire employment contract form

- Architect agreement form

- Independent contractor contract form

- Self employed instrument repair technician services contract form

- Commercial services contract form

Find out other Check Here If You Are Requesting W 2s Only

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template