Mi 1310 Form 2018-2026

What is the MI 1310 Form

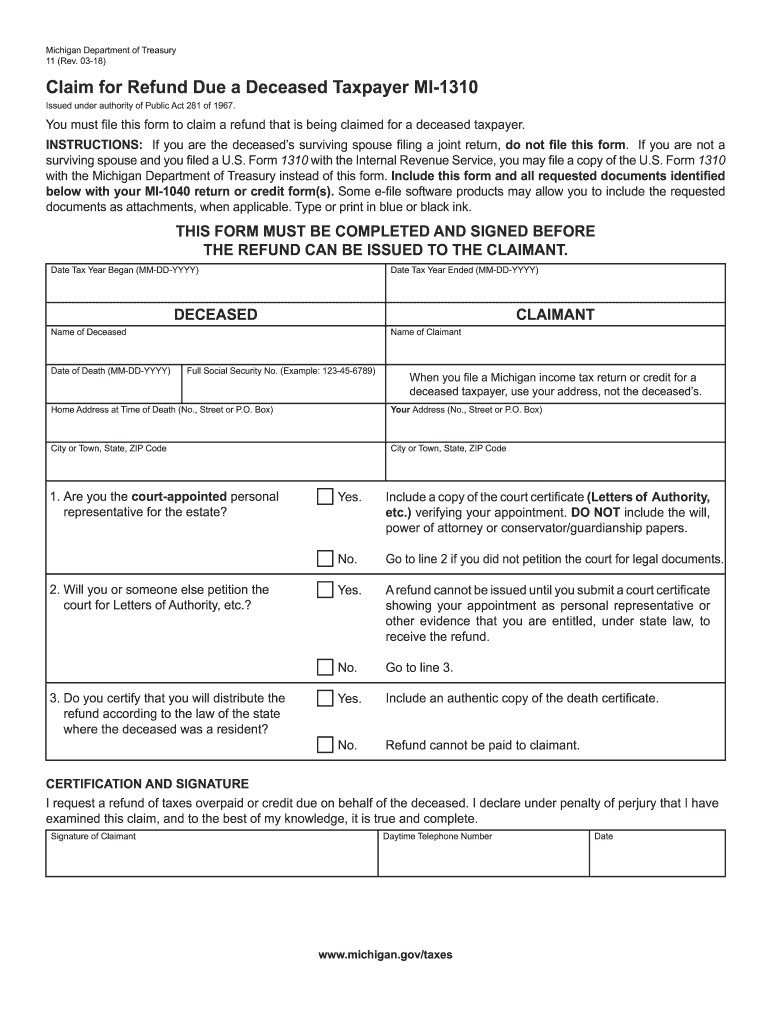

The MI 1310 Form, also known as the Claim for Refund Due a Deceased Taxpayer, is a tax form used in Michigan. This form allows the estate or personal representative of a deceased taxpayer to claim any tax refund that may be due. It is essential for ensuring that the rightful beneficiaries receive any funds owed to the deceased individual from the state. The MI 1310 Form is specifically designed to address situations where a taxpayer has passed away and there are outstanding refunds from previous tax filings.

How to Use the MI 1310 Form

Using the MI 1310 Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to the deceased taxpayer's financial records, including previous tax returns and any supporting documents that may validate the claim for refund. Next, fill out the MI 1310 Form carefully, providing all required information such as the deceased's name, Social Security number, and details about the refund being claimed. Once completed, the form must be signed by the personal representative or executor of the estate before submission.

Steps to Complete the MI 1310 Form

Completing the MI 1310 Form requires attention to detail. Follow these steps:

- Obtain the MI 1310 Form from the Michigan Department of Treasury website or other authorized sources.

- Fill in the deceased taxpayer's information, including name and Social Security number.

- Provide details about the refund being claimed, including the tax year and amount.

- Include your information as the personal representative or executor, including your name and contact details.

- Sign and date the form to certify that the information provided is accurate.

Required Documents

When submitting the MI 1310 Form, certain documents are required to support the claim. These may include:

- A copy of the deceased taxpayer's death certificate.

- Copies of relevant tax returns filed by the deceased.

- Any documentation that verifies the refund amount being claimed.

- Proof of your authority as the personal representative, such as a will or court appointment.

Form Submission Methods

The MI 1310 Form can be submitted in several ways to ensure proper processing. Options include:

- Online Submission: If available, you may submit the form electronically through the Michigan Department of Treasury's online portal.

- Mail: Print the completed form and send it to the appropriate address specified by the Michigan Department of Treasury.

- In-Person: You may also deliver the form in person at designated state offices.

Legal Use of the MI 1310 Form

The MI 1310 Form is legally recognized for claiming tax refunds due to deceased taxpayers in Michigan. It is important to ensure that the form is used in compliance with state laws and IRS regulations. Proper use of this form helps to protect the rights of the estate and ensures that any refunds are processed correctly. Failure to use the form appropriately may result in delays or denial of the claim.

Quick guide on how to complete mi 1310 instructions 2018 2019 form

Your assistance manual on how to prepare your Mi 1310 Form

If you’re curious about how to generate and transmit your Mi 1310 Form, here are some straightforward guidelines to facilitate tax submission.

To begin, you just need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax forms effortlessly. Using its editor, you can alternate between text, checkboxes, and eSignatures and revisit to amend any information as needed. Streamline your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Mi 1310 Form in a few minutes:

- Establish your account and start processing PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through editions and schedules.

- Press Get form to access your Mi 1310 Form in our editor.

- Populate the necessary fillable fields with your information (text, figures, checkmarks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if applicable).

- Review your document and correct any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and save it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that paper submissions can lead to increased errors and delays in reimbursements. It goes without saying, before e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct mi 1310 instructions 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How can I fill out the application form for the JMI (Jamia Millia Islamia) 2019?

Form for jamia school have been releaseYou can fill it from jamia siteJamia Millia Islamia And for collegeMost probably the form will out end of this month or next monthBut visit the jamia site regularly.Jamia Millia Islamiacheck whether the form is out or not for the course you want to apply.when notification is out then you have to create the account for entrance and for 2 entrance same account will be used you have to check in the account that the course you want to apply is there in listed or not ….if not then you have to create the different account for that course .If you have any doubts you can freely ask me .

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the mi 1310 instructions 2018 2019 form

How to make an electronic signature for the Mi 1310 Instructions 2018 2019 Form in the online mode

How to make an eSignature for your Mi 1310 Instructions 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the Mi 1310 Instructions 2018 2019 Form in Gmail

How to generate an electronic signature for the Mi 1310 Instructions 2018 2019 Form from your mobile device

How to make an electronic signature for the Mi 1310 Instructions 2018 2019 Form on iOS

How to create an eSignature for the Mi 1310 Instructions 2018 2019 Form on Android OS

People also ask

-

What is the Mi 1310 Form and how is it used?

The Mi 1310 Form is a crucial document used for various administrative purposes, including tax filings and compliance. It allows users to provide necessary information in a standardized format, ensuring accuracy and efficiency. With airSlate SignNow, you can easily eSign and send the Mi 1310 Form securely.

-

How can airSlate SignNow help with the Mi 1310 Form?

airSlate SignNow streamlines the process of completing and submitting the Mi 1310 Form by allowing users to eSign documents electronically. Our platform enhances collaboration and reduces turnaround time, making it easier to manage your paperwork efficiently. Plus, you can track the status of your Mi 1310 Form in real-time.

-

What are the pricing options for airSlate SignNow when using the Mi 1310 Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring you can efficiently manage the Mi 1310 Form without breaking the bank. Our plans include features like unlimited eSigning and document templates, making them cost-effective solutions for your needs. Visit our pricing page to find the plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other tools for handling the Mi 1310 Form?

Yes, airSlate SignNow easily integrates with various applications such as Google Drive, Salesforce, and Microsoft Office, allowing you to manage the Mi 1310 Form seamlessly. These integrations enhance your workflow by enabling you to send and eSign documents directly from your favorite tools. This ensures a smooth and efficient process for handling your forms.

-

Is airSlate SignNow secure for sending the Mi 1310 Form?

Absolutely! airSlate SignNow prioritizes your data security, employing advanced encryption methods to protect your documents, including the Mi 1310 Form. Our platform is compliant with major regulations, ensuring that your sensitive information remains confidential and secure during the signing process.

-

What features does airSlate SignNow offer for the Mi 1310 Form?

airSlate SignNow provides a range of features designed to enhance your experience with the Mi 1310 Form, including customizable templates, automated workflows, and real-time tracking. These features not only speed up the eSigning process but also ensure that you maintain full control over your documents. Additionally, our user-friendly interface makes it easy to navigate and manage your forms.

-

Can I access airSlate SignNow on mobile devices for the Mi 1310 Form?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage the Mi 1310 Form on-the-go. Whether you're in the office or out in the field, you can easily eSign and send documents directly from your smartphone or tablet. This flexibility ensures that you can keep your business moving forward, no matter where you are.

Get more for Mi 1310 Form

- Dhs 0008 a irrevocable funeral contract certification abbit biz abbit form

- Appendix a application form for enrolment as civic volunteer

- Spt tahunan pph orang pribadi 1770 s direktorat form

- St edward preschool 12 school year re enrollment form saintedwardspreschool

- Construction affidavit template form

- Artist feature contract template form

- Artist development contract template form

- Artist gallery contract template form

Find out other Mi 1310 Form

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free