Form 4682 Missouri Department of Revenue 2018

What is the Form 4682 Missouri Department Of Revenue

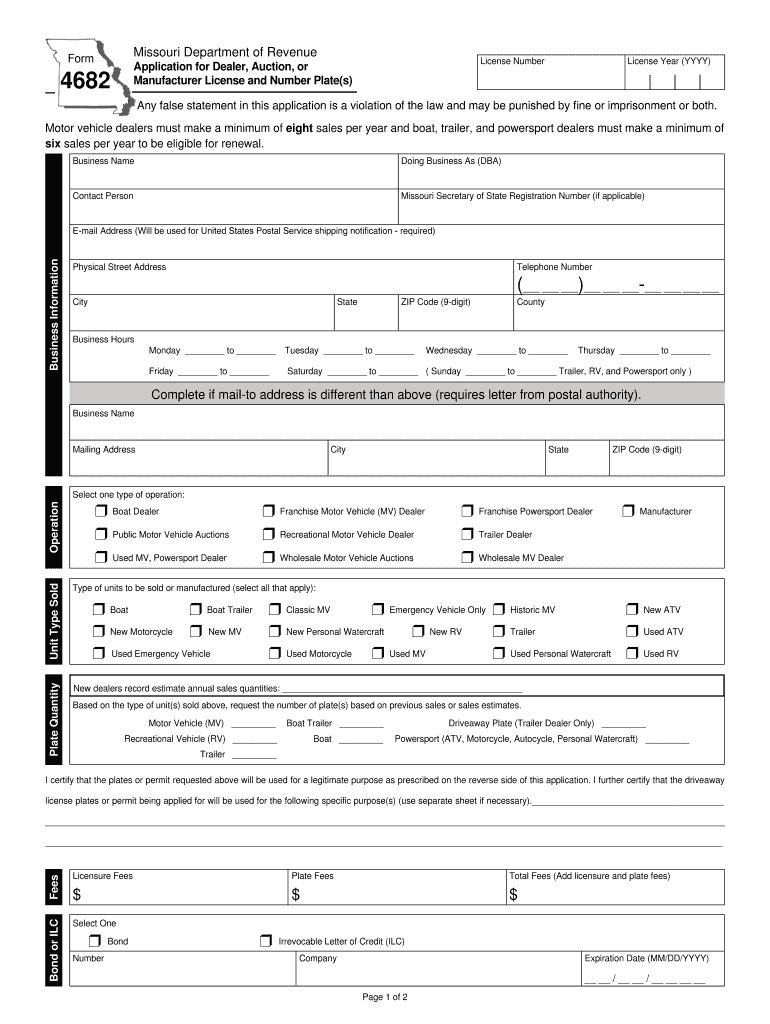

The Form 4682, issued by the Missouri Department of Revenue, is a specific tax document utilized primarily by vehicle dealers in the state. This form is essential for reporting certain transactions related to the sale of motor vehicles. It ensures compliance with state regulations and helps maintain accurate records of vehicle sales and purchases. Understanding the purpose and requirements of this form is crucial for dealers to operate legally and efficiently within Missouri's tax framework.

How to use the Form 4682 Missouri Department Of Revenue

Utilizing the Form 4682 involves several key steps. First, dealers must accurately fill out the form with relevant transaction details, including buyer and seller information, vehicle identification numbers, and sale prices. After completing the form, it must be submitted to the Missouri Department of Revenue, either electronically or via mail. Ensuring that all information is correct and complete is vital to avoid delays or penalties. Utilizing digital tools can streamline the process, making it easier to manage and submit the form.

Steps to complete the Form 4682 Missouri Department Of Revenue

Completing the Form 4682 requires attention to detail. Follow these steps for accuracy:

- Gather necessary information, including the details of the vehicle and the parties involved in the transaction.

- Access the Form 4682, available through the Missouri Department of Revenue's website or other authorized platforms.

- Fill in the required fields, ensuring all information is accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods, either online or by mailing it to the appropriate office.

Legal use of the Form 4682 Missouri Department Of Revenue

The legal use of Form 4682 is essential for compliance with Missouri tax laws. This form serves as a record of vehicle sales transactions, which are subject to state regulations. Dealers must ensure that the form is filled out correctly and submitted within the required timeframes to avoid potential legal repercussions. Proper use of this form not only aids in tax compliance but also protects dealers from penalties associated with improper reporting.

Key elements of the Form 4682 Missouri Department Of Revenue

Key elements of the Form 4682 include:

- Dealer Information: Details about the vehicle dealer, including name, address, and license number.

- Transaction Details: Information related to the sale, such as vehicle identification number (VIN), sale price, and buyer information.

- Signature: The form must be signed by the dealer to validate the information provided.

- Date of Transaction: The date when the sale occurred is crucial for record-keeping and compliance.

Form Submission Methods (Online / Mail / In-Person)

Form 4682 can be submitted through various methods, providing flexibility for dealers. The available submission options include:

- Online Submission: Dealers can complete and submit the form electronically via the Missouri Department of Revenue's online portal, which offers a streamlined process.

- Mail Submission: The completed form can be printed and mailed to the designated address provided by the Department of Revenue.

- In-Person Submission: Dealers may also choose to submit the form in person at local Department of Revenue offices, ensuring immediate processing and assistance if needed.

Quick guide on how to complete form 4682 application for dealer auction or manufacturer license and number plates

Your assistance manual on how to prepare your Form 4682 Missouri Department Of Revenue

If you’re wondering how to create and submit your Form 4682 Missouri Department Of Revenue, here are some straightforward instructions on how to simplify tax processing.

To begin, you only need to register your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that allows you to edit, create, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to amend details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the steps below to finalize your Form 4682 Missouri Department Of Revenue in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; sift through variants and schedules.

- Hit Get form to access your Form 4682 Missouri Department Of Revenue in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to apply your legally-binding eSignature (if needed).

- Review your document and amend any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, visit the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 4682 application for dealer auction or manufacturer license and number plates

Create this form in 5 minutes!

How to create an eSignature for the form 4682 application for dealer auction or manufacturer license and number plates

How to generate an electronic signature for your Form 4682 Application For Dealer Auction Or Manufacturer License And Number Plates online

How to create an electronic signature for your Form 4682 Application For Dealer Auction Or Manufacturer License And Number Plates in Chrome

How to generate an electronic signature for putting it on the Form 4682 Application For Dealer Auction Or Manufacturer License And Number Plates in Gmail

How to generate an eSignature for the Form 4682 Application For Dealer Auction Or Manufacturer License And Number Plates right from your smart phone

How to generate an electronic signature for the Form 4682 Application For Dealer Auction Or Manufacturer License And Number Plates on iOS

How to make an electronic signature for the Form 4682 Application For Dealer Auction Or Manufacturer License And Number Plates on Android OS

People also ask

-

What is Form 4682 from the Missouri Department of Revenue?

Form 4682 Missouri Department Of Revenue is a tax form used for reporting certain business-related expenses and income. This form is essential for businesses operating in Missouri to ensure compliance with state tax regulations. Understanding how to properly fill out Form 4682 can help you avoid penalties and ensure your business remains in good standing.

-

How can airSlate SignNow help with Form 4682 Missouri Department Of Revenue?

airSlate SignNow provides a seamless way to prepare, send, and eSign Form 4682 Missouri Department Of Revenue. With our platform, you can easily upload the form, add necessary signatures, and share it securely with relevant parties. This simplifies the process and ensures that your documents are legally binding and compliant.

-

Is airSlate SignNow affordable for small businesses needing Form 4682 Missouri Department Of Revenue?

Yes, airSlate SignNow offers competitive pricing plans that are ideal for small businesses. Our subscription options provide excellent value, especially when you consider the ability to eSign and manage important documents like Form 4682 Missouri Department Of Revenue efficiently. Choosing airSlate SignNow can save you both time and money.

-

What features does airSlate SignNow offer for filling out Form 4682 Missouri Department Of Revenue?

airSlate SignNow includes features such as document templates, customizable workflows, and secure eSigning, all of which enhance your experience with Form 4682 Missouri Department Of Revenue. These tools make it easy to prepare and manage your documents while ensuring compliance with state regulations. Plus, our user-friendly interface simplifies the entire process.

-

Can I integrate airSlate SignNow with other software for Form 4682 Missouri Department Of Revenue?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to streamline your workflow when dealing with Form 4682 Missouri Department Of Revenue. Whether you use CRM systems, cloud storage, or other business tools, our integrations enhance productivity and ensure your documents are always accessible.

-

Is it secure to use airSlate SignNow for Form 4682 Missouri Department Of Revenue?

Yes, security is a top priority at airSlate SignNow. We employ industry-standard encryption and compliance measures to protect your documents, including Form 4682 Missouri Department Of Revenue. You can trust that your sensitive information is safe while using our platform.

-

What benefits do I gain by using airSlate SignNow for Form 4682 Missouri Department Of Revenue?

Using airSlate SignNow for Form 4682 Missouri Department Of Revenue provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can easily send, sign, and manage your documents from anywhere, making it a convenient solution for busy professionals. Additionally, our platform helps ensure that your forms are completed accurately and promptly.

Get more for Form 4682 Missouri Department Of Revenue

- Tenancy agreement form

- Energie graz fernwarme ummeldung i abnehmernr i l i energie graz form

- Vehicle service contract cancellation request form

- Fmhscom adult questionaire form

- Texas sales and use tax exemption certification publicdata com form

- Dh4157 form

- Njhs induction ceremony script form

- Ary film contract template form

Find out other Form 4682 Missouri Department Of Revenue

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter