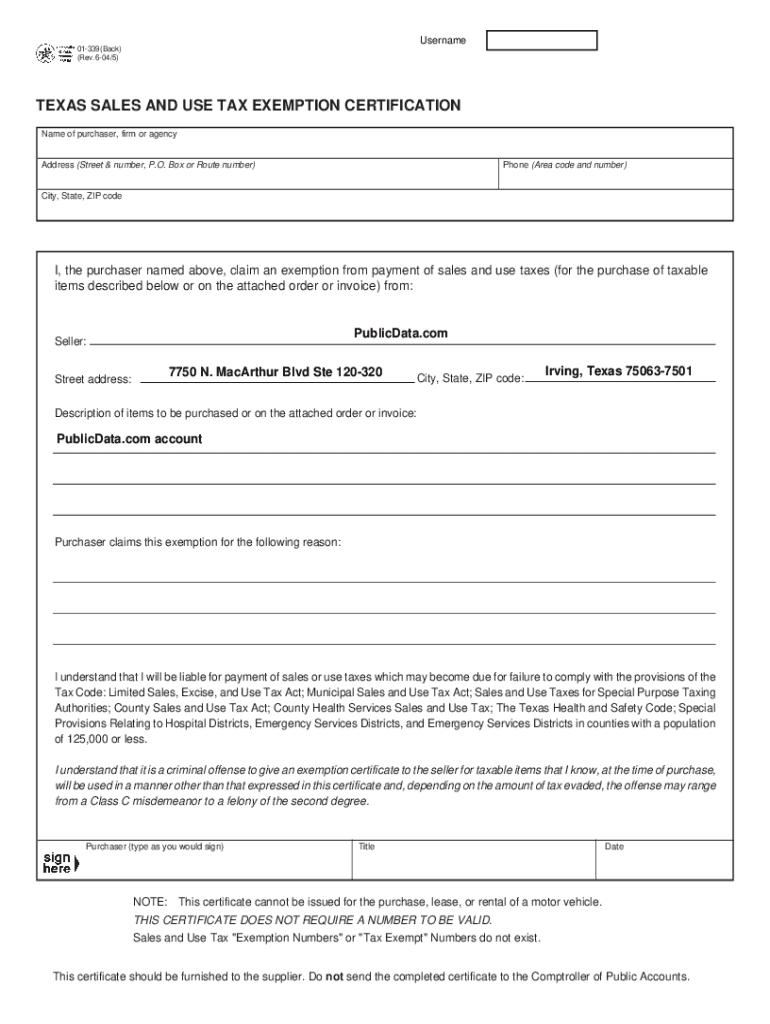

Texas Sales and Use Tax Exemption Certification PublicData Com Form

What is the Texas Sales And Use Tax Exemption Certification?

The Texas Sales And Use Tax Exemption Certification is a legal document that allows qualifying entities to purchase items without paying sales tax. This certification is essential for organizations that are exempt from sales tax under Texas law, such as non-profit organizations, government entities, and certain educational institutions. By presenting this certification to vendors, eligible purchasers can avoid the additional costs associated with sales tax, thereby promoting economic efficiency and supporting their operational budgets.

How to Obtain the Texas Sales And Use Tax Exemption Certification

To obtain the Texas Sales And Use Tax Exemption Certification, eligible entities must complete the application process through the Texas Comptroller of Public Accounts. This process typically involves filling out the appropriate forms, providing necessary documentation that proves eligibility, and submitting the application for review. It is important to ensure that all information is accurate and complete to avoid delays in processing. Once approved, the certification can be used for tax-exempt purchases.

Steps to Complete the Texas Sales And Use Tax Exemption Certification

Completing the Texas Sales And Use Tax Exemption Certification involves several steps:

- Determine eligibility based on the type of organization or entity.

- Gather required documentation, including proof of tax-exempt status.

- Fill out the Texas Sales And Use Tax Exemption Certification form accurately.

- Submit the completed form along with any supporting documents to the Texas Comptroller.

- Await confirmation of approval, which will allow for tax-exempt purchases.

Key Elements of the Texas Sales And Use Tax Exemption Certification

The Texas Sales And Use Tax Exemption Certification includes several key elements that must be understood by users:

- Entity Information: This includes the name, address, and type of organization applying for the exemption.

- Exemption Reason: Applicants must specify the reason for tax exemption, such as being a non-profit or educational entity.

- Signature: The form must be signed by an authorized representative of the organization, confirming the accuracy of the information provided.

Legal Use of the Texas Sales And Use Tax Exemption Certification

The legal use of the Texas Sales And Use Tax Exemption Certification is strictly defined by state law. Only entities that qualify under Texas tax regulations may utilize this certification for tax-exempt purchases. Misuse of the certification, such as presenting it for non-qualifying purchases, can result in penalties, including fines and the revocation of tax-exempt status. It is crucial for organizations to understand the legal implications and ensure compliance with all relevant laws.

Eligibility Criteria for the Texas Sales And Use Tax Exemption Certification

Eligibility for the Texas Sales And Use Tax Exemption Certification is determined by specific criteria set forth by the Texas Comptroller. Generally, eligible entities include:

- Non-profit organizations that operate for charitable, religious, or educational purposes.

- Government agencies at the federal, state, or local level.

- Certain educational institutions recognized by the state.

Entities must provide documentation that verifies their status to qualify for the exemption.

Quick guide on how to complete texas sales and use tax exemption certification publicdata com

Complete Texas Sales And Use Tax Exemption Certification PublicData com effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Texas Sales And Use Tax Exemption Certification PublicData com on any device with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and electronically sign Texas Sales And Use Tax Exemption Certification PublicData com without stress

- Obtain Texas Sales And Use Tax Exemption Certification PublicData com and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that reason.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from your chosen device. Edit and electronically sign Texas Sales And Use Tax Exemption Certification PublicData com while ensuring seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas sales and use tax exemption certification publicdata com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas Sales And Use Tax Exemption Certification PublicData com?

The Texas Sales And Use Tax Exemption Certification PublicData com is a document that allows eligible businesses to purchase items without paying sales tax. This certification is essential for companies looking to save on costs while complying with state tax regulations. By utilizing this certification, businesses can streamline their purchasing processes and enhance their financial efficiency.

-

How can airSlate SignNow help with the Texas Sales And Use Tax Exemption Certification PublicData com?

airSlate SignNow provides a seamless platform for businesses to manage and eSign their Texas Sales And Use Tax Exemption Certification PublicData com documents. Our user-friendly interface ensures that you can quickly prepare, send, and receive signed documents, saving you time and reducing paperwork. This efficiency allows you to focus on your core business activities.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the management of documents like the Texas Sales And Use Tax Exemption Certification PublicData com. You can choose a plan that fits your budget while ensuring you have access to essential tools for document management.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features designed to enhance document management, including eSigning, templates, and automated workflows. These features are particularly useful for handling the Texas Sales And Use Tax Exemption Certification PublicData com, allowing for quick and efficient processing. Our platform also supports collaboration, making it easy for teams to work together on important documents.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including the Texas Sales And Use Tax Exemption Certification PublicData com, are protected. We utilize advanced encryption and secure storage solutions to safeguard your data. You can trust that your sensitive information is handled with the utmost care and security.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow efficiency. Whether you need to connect with CRM systems, accounting software, or other tools, our platform can easily integrate to support the management of documents like the Texas Sales And Use Tax Exemption Certification PublicData com.

-

What are the benefits of using airSlate SignNow for tax exemption certifications?

Using airSlate SignNow for your Texas Sales And Use Tax Exemption Certification PublicData com provides numerous benefits, including time savings, reduced paperwork, and improved accuracy. Our platform simplifies the eSigning process, allowing for quick approvals and compliance with tax regulations. This efficiency can lead to signNow cost savings for your business.

Get more for Texas Sales And Use Tax Exemption Certification PublicData com

Find out other Texas Sales And Use Tax Exemption Certification PublicData com

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation