Newark Quarter Payroll Tax Statement Form 2017

What is the Newark Quarter Payroll Tax Statement Form

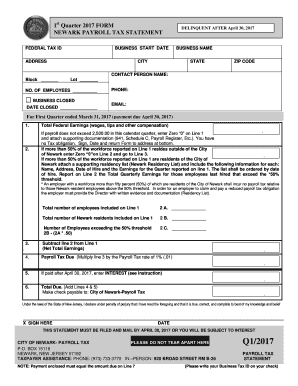

The Newark Quarter Payroll Tax Statement Form is a tax document used by employers in Newark to report payroll taxes for a specific quarter. This form captures essential information regarding employee wages, tax withholdings, and contributions made to local tax authorities. It is crucial for ensuring compliance with local tax regulations and for maintaining accurate payroll records.

How to use the Newark Quarter Payroll Tax Statement Form

To use the Newark Quarter Payroll Tax Statement Form effectively, employers should first gather all necessary payroll information for the quarter. This includes total wages paid, taxes withheld, and any other relevant deductions. Once all data is compiled, the form can be filled out electronically or on paper. After completing the form, it must be submitted to the appropriate local tax authority by the specified deadline to avoid penalties.

Steps to complete the Newark Quarter Payroll Tax Statement Form

Completing the Newark Quarter Payroll Tax Statement Form involves several key steps:

- Gather payroll records for the quarter, including employee wages and tax withholdings.

- Access the form through official channels or tax preparation software.

- Fill in the required fields accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the designated tax authority.

Legal use of the Newark Quarter Payroll Tax Statement Form

The Newark Quarter Payroll Tax Statement Form is legally required for all employers operating within Newark. Proper completion and timely submission of this form are essential for compliance with local tax laws. Failure to submit the form can result in penalties, fines, or additional scrutiny from tax authorities. Employers should ensure that they understand the legal implications of the information reported on this form.

Filing Deadlines / Important Dates

Filing deadlines for the Newark Quarter Payroll Tax Statement Form are typically set by local tax authorities. Employers should be aware of these dates to ensure timely submission. Generally, the form must be filed within a specific timeframe after the end of each quarter. Missing these deadlines can lead to penalties, so it is important to mark these dates on the calendar and prepare the documentation in advance.

Form Submission Methods (Online / Mail / In-Person)

The Newark Quarter Payroll Tax Statement Form can be submitted through various methods, depending on the preferences of the employer and the requirements of the local tax authority. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices during business hours.

Who Issues the Form

The Newark Quarter Payroll Tax Statement Form is issued by the local tax authority in Newark. This authority is responsible for overseeing tax collection and ensuring compliance with local tax laws. Employers should refer to the official website or contact the tax office for the most current version of the form and any specific instructions related to its completion and submission.

Quick guide on how to complete 2010 newark quarter payroll tax statement 2017 form

Your assistance manual on how to prepare your Newark Quarter Payroll Tax Statement Form

If you're wondering how to generate and submit your Newark Quarter Payroll Tax Statement Form, here are some brief instructions on how to simplify tax submission.

To begin, you just need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that allows you to modify, create, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to make changes where necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Newark Quarter Payroll Tax Statement Form in just a few minutes:

- Register your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Newark Quarter Payroll Tax Statement Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to insert your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, deliver it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting in paper format can lead to return errors and delay refunds. Naturally, before e-filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2010 newark quarter payroll tax statement 2017 form

FAQs

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the 2010 newark quarter payroll tax statement 2017 form

How to generate an electronic signature for your 2010 Newark Quarter Payroll Tax Statement 2017 Form online

How to create an electronic signature for the 2010 Newark Quarter Payroll Tax Statement 2017 Form in Chrome

How to generate an eSignature for signing the 2010 Newark Quarter Payroll Tax Statement 2017 Form in Gmail

How to make an electronic signature for the 2010 Newark Quarter Payroll Tax Statement 2017 Form from your mobile device

How to create an electronic signature for the 2010 Newark Quarter Payroll Tax Statement 2017 Form on iOS

How to make an electronic signature for the 2010 Newark Quarter Payroll Tax Statement 2017 Form on Android OS

People also ask

-

What is the Newark Quarter Payroll Tax Statement Form?

The Newark Quarter Payroll Tax Statement Form is a document that employers use to report payroll taxes withheld from employees' wages for a specific quarter. This form ensures compliance with local tax regulations and helps streamline the payroll reporting process.

-

How can I access the Newark Quarter Payroll Tax Statement Form using airSlate SignNow?

You can easily access the Newark Quarter Payroll Tax Statement Form through airSlate SignNow’s user-friendly interface. Simply log into your account, navigate to the forms section, and search for the Newark Quarter Payroll Tax Statement Form to download or fill it out electronically.

-

Is there a cost associated with using the Newark Quarter Payroll Tax Statement Form on airSlate SignNow?

While airSlate SignNow offers various pricing plans, access to the Newark Quarter Payroll Tax Statement Form is included in the subscription. This cost-effective solution allows businesses to manage all their document signing needs, including payroll tax forms, without additional fees.

-

What features does airSlate SignNow offer for the Newark Quarter Payroll Tax Statement Form?

airSlate SignNow provides several features for the Newark Quarter Payroll Tax Statement Form, including e-signature capabilities, secure document storage, and easy sharing options. These features help streamline the completion and submission process, ensuring that your payroll tax statements are handled efficiently.

-

How does airSlate SignNow ensure the security of the Newark Quarter Payroll Tax Statement Form?

Security is a top priority for airSlate SignNow. The Newark Quarter Payroll Tax Statement Form is protected by advanced encryption protocols, ensuring that your sensitive payroll information remains confidential and secure during the signing and storage processes.

-

Can I integrate airSlate SignNow with other software to manage the Newark Quarter Payroll Tax Statement Form?

Yes, airSlate SignNow offers seamless integrations with popular accounting and payroll software. This allows you to easily manage the Newark Quarter Payroll Tax Statement Form alongside your existing systems, enhancing your overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for the Newark Quarter Payroll Tax Statement Form?

Using airSlate SignNow for the Newark Quarter Payroll Tax Statement Form simplifies the tax reporting process, saves time, and reduces paperwork. The platform's electronic signing feature accelerates approval times and ensures that your forms are submitted on time, helping you maintain compliance with tax regulations.

Get more for Newark Quarter Payroll Tax Statement Form

- Quest diagnostics authorization form 51388567

- Diorama rubric 488239234 form

- Confusing prepositions exercises form

- Substitution of counsel utah state courts utcourts form

- Instructions for form ct 5 tax ny gov

- Powder puff football permission slip form

- City fence permit application form

- Location release form location release template

Find out other Newark Quarter Payroll Tax Statement Form

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed