Newark Payroll Tax 2018

What is the Newark Payroll Tax

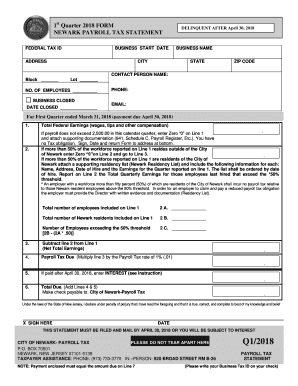

The Newark payroll tax is a municipal tax levied on businesses operating within the city of Newark, New Jersey. This tax is primarily aimed at employers and is based on the wages paid to their employees. The funds collected through this tax are used to support various city services and infrastructure projects. Understanding this tax is essential for both employers and employees to ensure compliance and proper reporting.

Steps to Complete the Newark Payroll Tax

Completing the Newark payroll tax statement involves several key steps:

- Gather employee wage information: Collect data on all wages paid during the relevant quarter.

- Access the appropriate form: Obtain the Newark payroll tax statement for the second quarter of 2018.

- Fill out the form: Enter the required information accurately, ensuring all fields are completed.

- Review for accuracy: Double-check all entries for correctness to avoid errors.

- Sign the form electronically: Utilize a secure eSignature solution to sign the document.

- Submit the form: Send the completed form to the appropriate city department, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Newark payroll tax are crucial for compliance. Typically, the payroll tax statement for the second quarter must be filed by a specific date, often falling in July. It is important to stay informed about these dates to avoid late fees or penalties. Keeping a calendar of tax deadlines can help ensure timely submissions.

Required Documents

To complete the Newark payroll tax statement, certain documents are necessary:

- Employee wage records for the quarter.

- Previous payroll tax statements for reference.

- Identification information for the business, such as the Employer Identification Number (EIN).

- Any additional documentation requested by the city of Newark.

Legal Use of the Newark Payroll Tax

The Newark payroll tax must be used in accordance with local laws and regulations. Employers are legally obligated to withhold this tax from employee wages and remit it to the city. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid amounts. It is essential for businesses to understand their legal responsibilities regarding this tax.

Form Submission Methods (Online / Mail / In-Person)

The Newark payroll tax statement can be submitted through various methods, providing flexibility for employers. Options typically include:

- Online submission through the city’s designated portal.

- Mailing the completed form to the appropriate city office.

- In-person submission at designated city locations.

Employers should choose the submission method that best fits their operational needs while ensuring compliance with deadlines.

Quick guide on how to complete 2010 newark quarter payroll tax statement 2018 2019 form

Your assistance manual for preparing your Newark Payroll Tax

If you’re curious about how to generate and submit your Newark Payroll Tax, here are some brief instructions to simplify the tax processing experience.

To start, you need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to alter, generate, and finalize your tax forms effortlessly. With its editor, you can navigate between text, checkboxes, and eSignatures, and return to modify details as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and intuitive sharing features.

Follow these steps to complete your Newark Payroll Tax in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax document; explore multiple versions and schedules.

- Click Get form to open your Newark Payroll Tax in our editor.

- Enter the necessary fillable fields with your information (text, numbers, checkboxes).

- Employ the Sign Tool to insert your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically submit your taxes with airSlate SignNow. Please keep in mind that paper filing can lead to return mistakes and delays in refunds. Importantly, before e-filing your taxes, check the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2010 newark quarter payroll tax statement 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 newark quarter payroll tax statement 2018 2019 form

How to generate an electronic signature for your 2010 Newark Quarter Payroll Tax Statement 2018 2019 Form online

How to make an electronic signature for the 2010 Newark Quarter Payroll Tax Statement 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the 2010 Newark Quarter Payroll Tax Statement 2018 2019 Form in Gmail

How to create an eSignature for the 2010 Newark Quarter Payroll Tax Statement 2018 2019 Form right from your mobile device

How to make an eSignature for the 2010 Newark Quarter Payroll Tax Statement 2018 2019 Form on iOS

How to create an eSignature for the 2010 Newark Quarter Payroll Tax Statement 2018 2019 Form on Android OS

People also ask

-

What are Newark payroll tax statement 2quarter 2018 forms?

The Newark payroll tax statement 2quarter 2018 forms are official documents required by the city of Newark for reporting payroll taxes. These forms provide essential information about employee wages and tax withholding for the specified quarter. Businesses must complete and submit these forms to ensure compliance with local tax regulations.

-

How can I access Newark payroll tax statement 2quarter 2018 forms online?

You can easily access the Newark payroll tax statement 2quarter 2018 forms online through various government and tax-related websites. Additionally, airSlate SignNow offers a user-friendly platform that allows you to eSign and send these forms directly from your device, ensuring a seamless experience.

-

What features does airSlate SignNow offer for managing Newark payroll tax statement 2quarter 2018 forms?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time tracking, making it ideal for managing Newark payroll tax statement 2quarter 2018 forms. These features streamline the process of filling out and submitting necessary paperwork, saving your business time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Newark payroll tax statement 2quarter 2018 forms?

Yes, there is a cost associated with using airSlate SignNow, but the pricing is competitive and cost-effective. Plans vary based on features and usage, ensuring that businesses of all sizes can find a solution that fits their budget while managing Newark payroll tax statement 2quarter 2018 forms efficiently.

-

Can I integrate airSlate SignNow with other software for processing Newark payroll tax statement 2quarter 2018 forms?

Absolutely! airSlate SignNow supports various integrations with popular business applications, making it easy to process Newark payroll tax statement 2quarter 2018 forms alongside your existing tools. This enhances your workflow and helps in maintaining organization in your financial documentation.

-

What are the benefits of using airSlate SignNow for Newark payroll tax statement 2quarter 2018 forms?

Using airSlate SignNow for Newark payroll tax statement 2quarter 2018 forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform simplifies the document management process, ensuring that your payroll tax forms are completed accurately and submitted on time.

-

How secure is airSlate SignNow when handling Newark payroll tax statement 2quarter 2018 forms?

airSlate SignNow takes security seriously and employs robust encryption and compliance measures to safeguard sensitive information in Newark payroll tax statement 2quarter 2018 forms. You can trust that your documents are protected throughout the entire eSigning process, allowing you to focus on your business.

Get more for Newark Payroll Tax

- Download mba 805 form

- App 031 attached declaration court of appeal editable and saveable california judicial council forms

- Www healthearizonaplus gov form

- Liver failare form

- Aurora il parking card prepaid form

- 1113 0 initial police reports form

- Fillable online request for termination of utility service polk form

- Assignment contract template form

Find out other Newark Payroll Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors