New York State E File Signature Authorization for Tax Year for Forms it 204 and it 204 LL 2022

What is the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

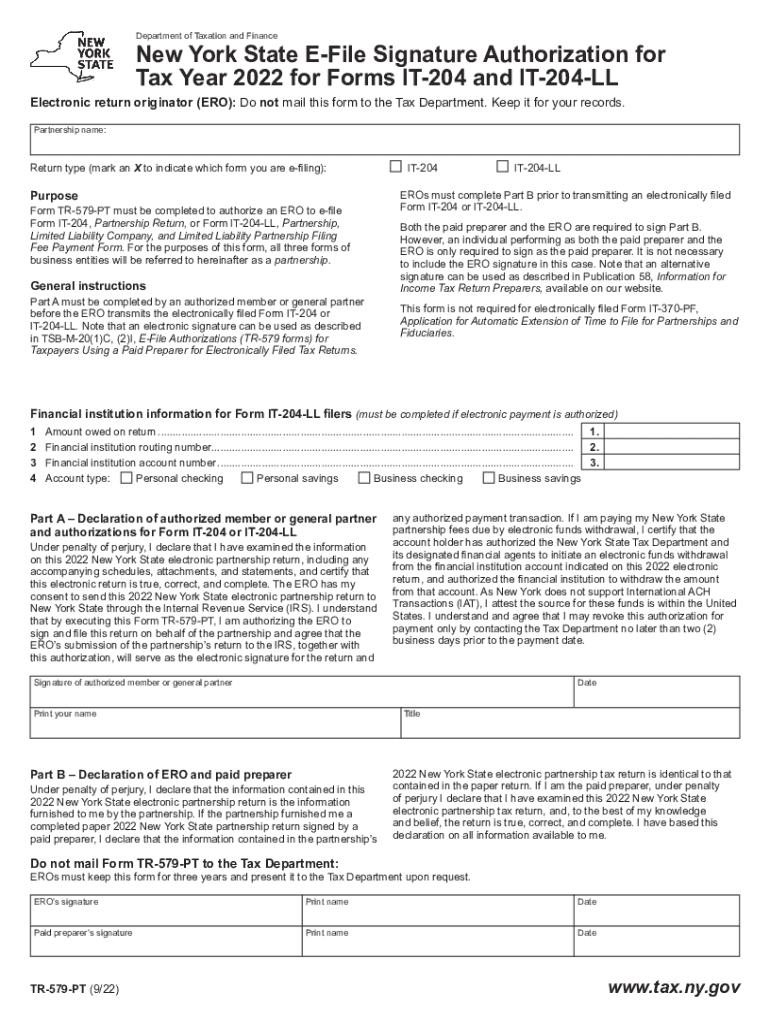

The New York State E File Signature Authorization is a crucial document for taxpayers who need to electronically file their tax returns using Forms IT-204 and IT-204 LL. This authorization allows taxpayers to provide their signature electronically, ensuring that their tax returns are submitted securely and efficiently. The form is specifically designed for partnerships and limited liability companies (LLCs) that are filing their New York State tax returns. By using this authorization, taxpayers can streamline their filing process and comply with state regulations regarding electronic submissions.

How to use the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

To use the New York State E File Signature Authorization, taxpayers must first complete the necessary sections of Forms IT-204 or IT-204 LL. Once the forms are filled out, the taxpayer or an authorized representative must sign the E File Signature Authorization. This signature can be provided electronically, which simplifies the submission process. After signing, the form should be submitted alongside the tax return to ensure that the electronic filing is valid and accepted by the New York State Department of Taxation and Finance.

Steps to complete the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

Completing the E File Signature Authorization involves several steps:

- Obtain Forms IT-204 or IT-204 LL from the New York State Department of Taxation and Finance website.

- Fill out the required information on the tax forms accurately.

- Access the E File Signature Authorization form, which is typically included with the tax forms.

- Provide the necessary signatures, ensuring that all required parties sign the authorization.

- Submit the completed forms electronically, along with the E File Signature Authorization, to the appropriate tax authority.

Key elements of the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

Several key elements must be included in the New York State E File Signature Authorization for it to be valid. These elements include:

- The taxpayer's name and identification number.

- The name and identification number of the authorized representative, if applicable.

- The specific tax year for which the authorization is being granted.

- The signatures of all parties involved, confirming their consent to file electronically.

- The date of the signatures, which is essential for record-keeping and compliance.

Eligibility Criteria for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

Eligibility for using the New York State E File Signature Authorization is primarily determined by the type of entity filing the tax return. Partnerships and LLCs that are required to file Forms IT-204 or IT-204 LL can utilize this authorization. Additionally, all parties involved in the filing must consent to the electronic signature process, ensuring that the authorization reflects the agreement of all necessary stakeholders. Taxpayers should also ensure they comply with any specific state regulations regarding electronic filing.

Filing Deadlines / Important Dates for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

Filing deadlines for the New York State E File Signature Authorization coincide with the deadlines for submitting Forms IT-204 and IT-204 LL. Generally, these forms are due on the fifteenth day of the fourth month following the close of the tax year. For partnerships and LLCs operating on a calendar year, the deadline is typically April 15. Taxpayers should be aware of these dates to ensure timely submission and avoid penalties for late filing.

Quick guide on how to complete new york state e file signature authorization for tax year for forms it 204 and it 204 ll 695248725

Complete New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL seamlessly on any device

Managing documents online has gained traction among enterprises and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

How to edit and eSign New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL effortlessly

- Find New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Forget about lost or forgotten documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state e file signature authorization for tax year for forms it 204 and it 204 ll 695248725

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax year for forms it 204 and it 204 ll 695248725

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL?

The New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL is a document that allows taxpayers to electronically sign and submit their tax forms. This authorization simplifies the filing process, ensuring that your forms are submitted securely and efficiently.

-

How does airSlate SignNow facilitate the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL?

airSlate SignNow provides a user-friendly platform that enables you to easily eSign the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. With our solution, you can quickly prepare, send, and manage your tax documents without the hassle of printing or mailing.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individuals and enterprises. Our pricing is competitive, ensuring that you can efficiently manage your New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL without breaking the bank.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to streamline the process of handling the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. These tools enhance productivity and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, making it easier to manage your New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. This integration allows for a more efficient workflow and reduces the chances of errors during the filing process.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for your New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL offers numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. Our platform ensures that your documents are signed and submitted quickly, allowing you to focus on other important tasks.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive information, including encryption and secure access controls. When you use our platform for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL, you can trust that your data is safe and secure.

Get more for New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- Notice to beneficiaries of being named in will montana form

- Estate planning questionnaire and worksheets montana form

- Document locator and personal information package including burial information form montana

- Demand to produce copy of will from heir to executor or person in possession of will montana form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497316719 form

- Bill of sale of automobile and odometer statement north carolina form

- Bill of sale for automobile or vehicle including odometer statement and promissory note north carolina form

- Promissory note in connection with sale of vehicle or automobile north carolina form

Find out other New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease