New York State E File Signature Authorization for Tax Year for Forms it 204 and it 204 LL 2018

What is the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

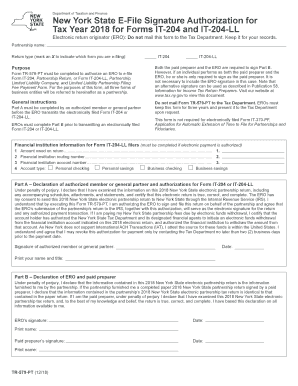

The New York State E File Signature Authorization for Tax Year for Forms IT-204 and IT-204 LL is a crucial document that allows taxpayers to electronically sign their tax returns. This authorization is specifically designed for partnerships and limited liability companies (LLCs) filing their New York State tax returns. By using this form, taxpayers can ensure that their electronic submissions are valid and comply with state regulations, streamlining the filing process.

How to use the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

To effectively use the New York State E File Signature Authorization, taxpayers must complete the form accurately. This involves providing necessary information such as the taxpayer's name, identification number, and the specific tax year. Once the form is filled out, it must be signed by the authorized individual, which can include partners or members of the LLC. After signing, the form should be submitted along with the electronic tax return to ensure proper processing.

Steps to complete the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

Completing the New York State E File Signature Authorization involves several key steps:

- Obtain the form from the New York State Department of Taxation and Finance website.

- Fill in the taxpayer's details, including name and identification number.

- Specify the tax year for which the authorization is being granted.

- Have the authorized individual sign the document.

- Submit the completed form alongside the electronic tax return.

Legal use of the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

This authorization is legally binding and recognized by the New York State Department of Taxation and Finance. It allows taxpayers to file their returns electronically while maintaining compliance with state laws. The form ensures that the signature on the electronic submission is valid, which is essential for the acceptance of the tax return. Failure to use this authorization when required may result in delays or rejections of the tax filings.

Key elements of the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

Key elements of this authorization include:

- Taxpayer identification details, including name and identification number.

- Signature of the authorized individual.

- Tax year for which the authorization applies.

- Confirmation of the electronic filing method.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of the filing deadlines associated with the New York State E File Signature Authorization. Typically, the deadline for submitting tax returns falls on April fifteenth of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any extensions they may apply for, which can provide additional time for filing.

Quick guide on how to complete new york state e file signature authorization for tax year for forms it 204 and it 204 ll

Complete New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without delays. Manage New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL effortlessly

- Find New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL and click on Get Form to start.

- Use the tools we provide to finish your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state e file signature authorization for tax year for forms it 204 and it 204 ll

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax year for forms it 204 and it 204 ll

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL?

The New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL is a document that allows taxpayers to electronically sign their tax forms. This authorization simplifies the filing process and ensures compliance with state regulations. By using airSlate SignNow, you can easily manage and submit these forms securely.

-

How does airSlate SignNow facilitate the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL?

airSlate SignNow provides a user-friendly platform that allows you to electronically sign the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. Our solution streamlines the signing process, making it quick and efficient. You can complete your tax filings without the hassle of printing and mailing documents.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to features specifically designed for managing the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. Our cost-effective solution ensures you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. These tools enhance your document management experience, ensuring that you can easily access and manage your tax forms efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software, enhancing your workflow for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL. This integration allows you to streamline your processes and ensure that all your documents are in one place, making tax season less stressful.

-

What are the benefits of using airSlate SignNow for tax filings?

Using airSlate SignNow for the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL offers numerous benefits, including time savings, enhanced security, and improved compliance. Our platform ensures that your documents are signed and submitted quickly, reducing the risk of errors and delays in your tax filings.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive information related to the New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL is protected. We utilize advanced encryption and security protocols to safeguard your data throughout the signing process.

Get more for New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- Marriage license application ny form

- Request form for prior authorizations centerlight health centerlighthealthcare

- Medicaid transportation form 2015 pdf

- Nyu langone hospitals nyu langone orthopedic hospital security request formacademic observers

- Dss workplace violence prevention policy committee for form

- You and your health records new york state department of form

- Certificate of qualification questionnaire form

- Value of medical history in ophthalmology a study of ncbi form

Find out other New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple