New York State E File Signature Authorization for Tax Year for Forms it 204 and it 204 LL 2024-2026

Understanding the New York E File Signature Authorization for Tax Forms IT-204 and IT-204 LL

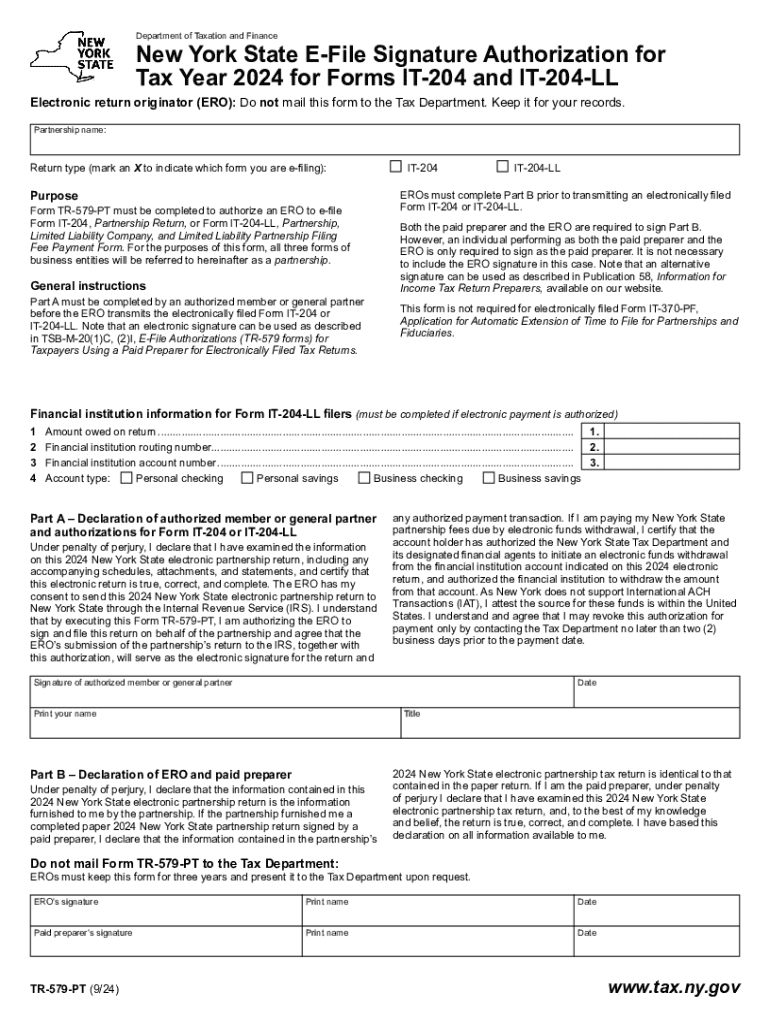

The New York E File Signature Authorization is a crucial document for taxpayers filing their income tax returns using forms IT-204 and IT-204 LL. This authorization allows taxpayers to e-file their returns electronically while ensuring that their signatures are valid and legally recognized. The form is particularly important for partnerships and other entities that need to submit their tax returns electronically. By completing this authorization, taxpayers can streamline their filing process and ensure compliance with state regulations.

Steps to Complete the New York E File Signature Authorization

Completing the New York E File Signature Authorization involves several straightforward steps:

- Obtain the form from the New York State Department of Taxation and Finance website or through your tax software.

- Fill in the required information, including your name, address, and the tax year for which you are filing.

- Provide the necessary signatures, which may include both the taxpayer and the tax preparer, if applicable.

- Review the completed form for accuracy to avoid any delays in processing.

- Submit the form electronically along with your e-filed tax return or as instructed by your tax software.

Legal Use of the New York E File Signature Authorization

The New York E File Signature Authorization is legally binding and serves as a substitute for a handwritten signature when filing electronically. It complies with the Internal Revenue Service (IRS) guidelines for electronic signatures, making it a secure method for taxpayers to authorize their returns. By using this authorization, taxpayers affirm that the information provided is accurate and complete, thus avoiding potential penalties for misrepresentation or fraud.

Key Elements of the New York E File Signature Authorization

Several key elements are essential to understand when dealing with the New York E File Signature Authorization:

- Taxpayer Information: This includes the name, address, and taxpayer identification number.

- Signatures: The form requires signatures from both the taxpayer and any authorized tax preparer.

- Tax Year: Clearly indicate the tax year for which the authorization is being submitted.

- Submission Method: Specify whether the form will be submitted electronically or via mail.

Obtaining the New York E File Signature Authorization

To obtain the New York E File Signature Authorization, taxpayers can visit the New York State Department of Taxation and Finance website or access it through compatible tax preparation software. The form is typically available for download in PDF format, allowing for easy printing and completion. It is important to ensure that you are using the correct version of the form for the specific tax year you are filing.

Examples of Using the New York E File Signature Authorization

Taxpayers can utilize the New York E File Signature Authorization in various scenarios, including:

- Filing partnership tax returns using Form IT-204.

- Submitting tax returns for limited liability companies (LLCs) using Form IT-204 LL.

- Working with tax professionals who file on behalf of the taxpayer, ensuring compliance with e-filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct new york state e file signature authorization for tax year for forms it 204 and it 204 ll 769896786

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax year for forms it 204 and it 204 ll 769896786

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is New York e file signature authorization?

New York e file signature authorization allows users to electronically sign documents for filing with state agencies. This process streamlines the submission of important documents, ensuring compliance with New York regulations. By using airSlate SignNow, businesses can easily manage their e-signatures and enhance their workflow efficiency.

-

How does airSlate SignNow support New York e file signature authorization?

airSlate SignNow provides a user-friendly platform that simplifies the New York e file signature authorization process. Users can create, send, and sign documents electronically, ensuring that all signatures are legally binding. Our solution is designed to meet the specific requirements of New York state regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for New York e file signature authorization. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can access essential e-signature features without breaking the bank. You can choose a plan that best fits your document signing volume and requirements.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow includes a range of features tailored for New York e file signature authorization, such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the signing experience and ensure that all documents are handled efficiently. Additionally, users can integrate with other tools to streamline their workflows.

-

Are there any benefits to using airSlate SignNow for New York e file signature authorization?

Using airSlate SignNow for New York e file signature authorization offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Businesses can save time and resources by eliminating the need for physical signatures and paperwork. This digital approach also helps in maintaining compliance with state regulations.

-

Can airSlate SignNow integrate with other software for New York e file signature authorization?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing the New York e file signature authorization process. This integration allows users to connect their existing tools, such as CRM systems and document management platforms, to streamline their workflows. By integrating with airSlate SignNow, businesses can improve their overall efficiency.

-

Is airSlate SignNow secure for New York e file signature authorization?

Absolutely! airSlate SignNow prioritizes security, ensuring that all New York e file signature authorization processes are protected. Our platform employs advanced encryption and complies with industry standards to safeguard sensitive information. Users can confidently sign and send documents, knowing their data is secure.

Get more for New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- Warranty deed from individual to husband and wife wisconsin form

- Wisconsin transfer deed form

- Quitclaim deed from corporation to husband and wife wisconsin form

- Warranty deed from corporation to husband and wife wisconsin form

- Quitclaim deed from corporation to individual wisconsin form

- Warranty deed from corporation to individual wisconsin form

- Quitclaim deed from corporation to llc wisconsin form

- Quitclaim deed from corporation to corporation wisconsin form

Find out other New York State E File Signature Authorization For Tax Year For Forms IT 204 And IT 204 LL

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT