Lee County Business Tax Application 2010

What is the Lee County Business Tax Application

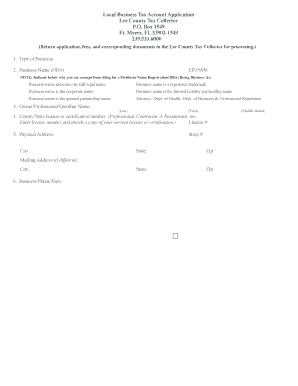

The Lee County Business Tax Application is a formal request that businesses must submit to obtain a local business tax receipt. This application is essential for operating legally within Lee County, Florida. It ensures that businesses comply with local regulations and contribute to the local economy. The application collects important information about the business, including its structure, ownership, and operational details, which are necessary for tax assessment and compliance purposes.

Steps to complete the Lee County Business Tax Application

Completing the Lee County Business Tax Application involves several key steps:

- Gather necessary information about your business, including the business name, address, and ownership details.

- Determine the appropriate business category, as different categories may have varying fees and requirements.

- Fill out the application form accurately, ensuring all required fields are completed.

- Prepare any supporting documents that may be required, such as proof of identity or business registration.

- Submit the application either online, by mail, or in person, depending on your preference and the options available.

Required Documents

When applying for the Lee County Business Tax Application, certain documents are typically required to support your application. These may include:

- A copy of your business registration or incorporation documents.

- Proof of identification, such as a driver's license or state ID.

- Any relevant licenses or permits specific to your business type.

- Documentation of your business location, such as a lease agreement or property deed.

Form Submission Methods

The Lee County Business Tax Application can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online: Many applicants choose to submit their applications electronically through the Lee County official website.

- By Mail: You can print the application, complete it, and send it to the designated address.

- In-Person: Applicants may also visit the local business tax office to submit their application directly.

Eligibility Criteria

To qualify for the Lee County Business Tax Application, businesses must meet specific eligibility criteria. These criteria generally include:

- The business must be legally registered in the state of Florida.

- The applicant must provide accurate and truthful information on the application.

- The business must comply with all local zoning and operational regulations.

- All required documentation must be submitted along with the application.

Application Process & Approval Time

The application process for the Lee County Business Tax Application typically involves several stages. After submission, the application will be reviewed by local authorities. The approval time can vary based on factors such as the completeness of the application and the current workload of the office. Generally, applicants can expect a response within a few weeks. It is advisable to follow up if you do not receive communication within the expected timeframe.

Quick guide on how to complete lee county business tax application

Complete Lee County Business Tax Application effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly without any delays. Manage Lee County Business Tax Application on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign Lee County Business Tax Application effortlessly

- Find Lee County Business Tax Application and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, either via email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require you to print new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Lee County Business Tax Application to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lee county business tax application

Create this form in 5 minutes!

How to create an eSignature for the lee county business tax application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the lee county business tax application process?

The lee county business tax application process involves submitting the required forms and documentation to the local tax office. You can complete this process online or in person, ensuring you meet all local regulations. Using airSlate SignNow can streamline this process by allowing you to eSign and send documents quickly.

-

How much does the lee county business tax application cost?

The cost of the lee county business tax application varies based on your business type and location. Typically, there are fees associated with the application and annual renewals. Utilizing airSlate SignNow can help you manage these costs effectively by providing a cost-efficient solution for document management.

-

What features does airSlate SignNow offer for the lee county business tax application?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage, which are essential for the lee county business tax application. These features simplify the application process, allowing you to prepare and submit documents with ease. Additionally, you can track the status of your applications in real-time.

-

How can airSlate SignNow benefit my lee county business tax application?

Using airSlate SignNow for your lee county business tax application can save you time and reduce paperwork. The platform allows for quick eSigning and document sharing, ensuring that your application is processed faster. This efficiency can lead to quicker approvals and help you focus on growing your business.

-

Is airSlate SignNow compliant with lee county business tax application requirements?

Yes, airSlate SignNow is designed to comply with various legal and regulatory requirements, including those for the lee county business tax application. The platform ensures that all eSigned documents are legally binding and secure. This compliance gives you peace of mind when submitting your application.

-

Can I integrate airSlate SignNow with other tools for my lee county business tax application?

Absolutely! airSlate SignNow offers integrations with various business tools that can enhance your lee county business tax application process. Whether you use CRM systems, project management tools, or accounting software, these integrations can streamline your workflow and improve efficiency.

-

What support does airSlate SignNow provide for the lee county business tax application?

airSlate SignNow provides comprehensive support for users navigating the lee county business tax application. You can access tutorials, FAQs, and customer support to assist you with any questions or issues. This support ensures that you can effectively use the platform to manage your application.

Get more for Lee County Business Tax Application

Find out other Lee County Business Tax Application

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online