Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year 2023

Understanding the Form CT 33 NL for Non-Life Insurance Corporations

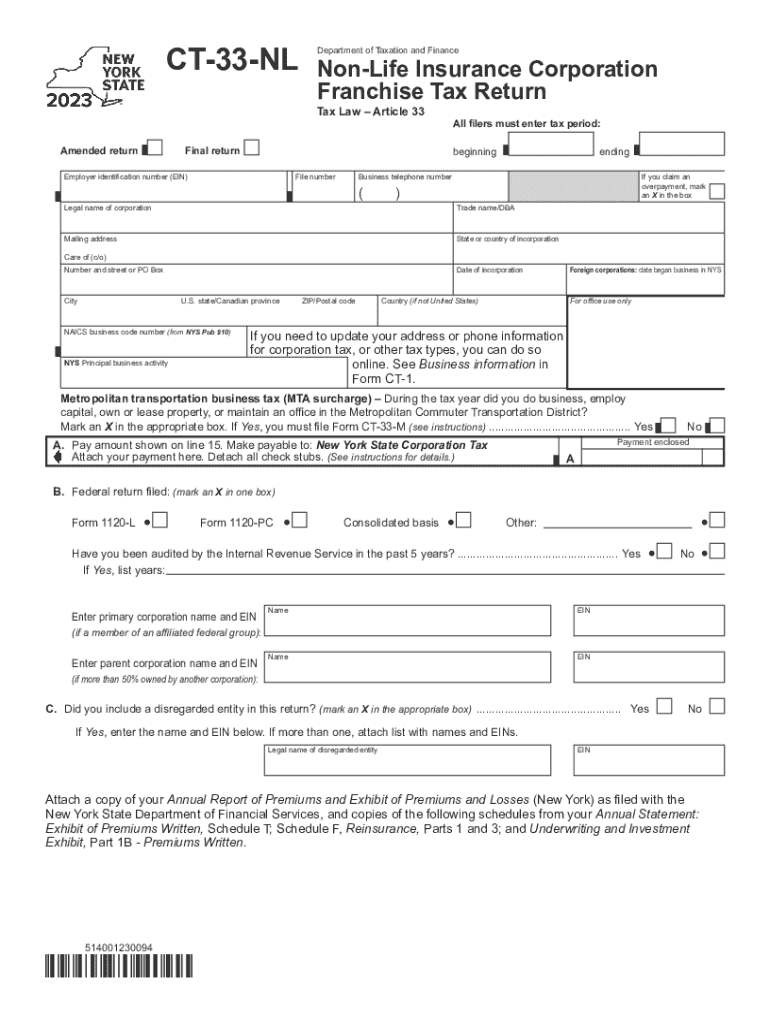

The Form CT 33 NL is specifically designed for non-life insurance corporations to report their franchise tax obligations in New York. This form is essential for ensuring compliance with state tax laws and is required for any non-life insurance company operating within the state. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and avoiding penalties.

Steps to Complete the Form CT 33 NL

Completing the Form CT 33 NL involves several key steps. First, gather all necessary financial documents, including income statements and balance sheets, as these will provide the data needed for accurate reporting. Next, fill out the form by entering the required information, such as gross premiums written and any applicable deductions. It is important to double-check all entries for accuracy before submission. Finally, ensure that the form is signed and dated by an authorized representative of the corporation.

Obtaining the Form CT 33 NL

The Form CT 33 NL can be obtained directly from the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out manually, or it may be available through tax preparation software that supports New York state forms. Ensure you have the most current version of the form to comply with the latest tax regulations.

Filing Deadlines for the Form CT 33 NL

Timely filing of the Form CT 33 NL is critical to avoid penalties. The due date for filing this form typically aligns with the corporation's fiscal year-end. Corporations must file the form by the fifteenth day of the third month following the end of their tax year. It is advisable to mark this date on your calendar and prepare the form in advance to ensure compliance.

Legal Use of the Form CT 33 NL

The Form CT 33 NL serves a legal purpose in the context of state taxation for non-life insurance corporations. Filing this form is not only a requirement but also a means of ensuring that the corporation meets its tax obligations under New York law. Failure to file or inaccuracies in the form can result in legal repercussions, including fines and penalties.

Key Elements of the Form CT 33 NL

Key elements of the Form CT 33 NL include sections for reporting gross premiums, deductions, and the calculation of the franchise tax owed. Additionally, the form requires the corporation's identification information, including its name, address, and tax identification number. Understanding these elements is essential for accurate completion and compliance with state tax laws.

Quick guide on how to complete form ct 33 nl non life insurance corporation franchise tax return tax year

Complete Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year without hassle

- Locate Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year and click Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 33 nl non life insurance corporation franchise tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 33 nl non life insurance corporation franchise tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny ct 33 nl and how does it relate to airSlate SignNow?

The ny ct 33 nl is a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows users to easily send, eSign, and store these documents securely. By utilizing airSlate SignNow, businesses can streamline their workflow and ensure compliance with New York and Connecticut regulations.

-

How much does airSlate SignNow cost for handling ny ct 33 nl documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. For handling ny ct 33 nl documents, our plans include features that enhance document management and eSigning capabilities. You can choose a plan that fits your budget and needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for ny ct 33 nl document management?

airSlate SignNow provides a range of features specifically designed for managing ny ct 33 nl documents. These include customizable templates, secure eSigning, and real-time tracking of document status. Our user-friendly interface makes it easy to navigate and manage your documents efficiently.

-

Can I integrate airSlate SignNow with other tools for managing ny ct 33 nl?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms to enhance your document management process. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure that handling ny ct 33 nl documents is streamlined and efficient.

-

What are the benefits of using airSlate SignNow for ny ct 33 nl?

Using airSlate SignNow for ny ct 33 nl documents provides numerous benefits, including increased efficiency and reduced turnaround time. Our platform simplifies the eSigning process, allowing you to focus on your core business activities. Additionally, it enhances security and compliance, ensuring your documents are protected.

-

Is airSlate SignNow compliant with regulations for ny ct 33 nl?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations for handling ny ct 33 nl documents. Our platform adheres to industry standards for security and data protection, giving you peace of mind when managing sensitive information.

-

How can I get started with airSlate SignNow for ny ct 33 nl?

Getting started with airSlate SignNow for ny ct 33 nl is simple. You can sign up for a free trial on our website to explore the features and capabilities. Once you're ready, choose a pricing plan that suits your needs and start managing your documents with ease.

Get more for Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year

- Form 8006 usps

- Wellstar new patient forms

- Calculating tax on beer omb no 1513 0083 form

- Tdlr form

- Rpd 41329 sustainable building tax credit claim form tax newmexico

- Account upgrade form

- Priority processing request form

- Article 19 a motor carrier accident and conviction notification program application 535906788 form

Find out other Form CT 33 NL Non Life Insurance Corporation Franchise Tax Return Tax Year

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement