Mail to Individual Income Tax Name and Address Change Revenue Louisiana 2016-2026

Understanding the Louisiana Individual Income Tax Name and Address Change

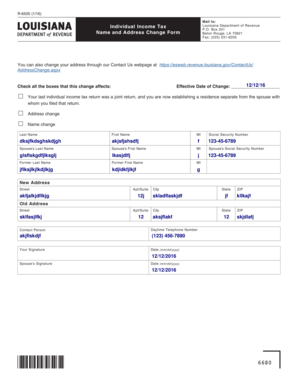

The Louisiana Individual Income Tax Name and Address Change form is a crucial document for taxpayers who need to update their personal information with the Louisiana Department of Revenue. This form ensures that all correspondence and tax-related notifications are sent to the correct address, which is essential for maintaining accurate tax records. It is important to complete this form promptly to avoid any issues with tax filings or communications.

Steps to Complete the Louisiana Individual Income Tax Name and Address Change

Completing the Louisiana Individual Income Tax Name and Address Change form involves several straightforward steps:

- Obtain the form from the Louisiana Department of Revenue website or through their office.

- Fill in your current name and address as they appear on your tax records.

- Provide your new name and address, ensuring that all information is accurate and clearly written.

- Sign and date the form to certify that the information provided is true.

- Submit the completed form to the appropriate address as indicated on the form instructions.

Required Documents for the Louisiana Individual Income Tax Name and Address Change

When submitting the Louisiana Individual Income Tax Name and Address Change form, it is important to include any necessary documentation that supports your request. This may include:

- A copy of your government-issued ID that reflects your new name, if applicable.

- Any legal documents that verify a name change, such as a marriage certificate or court order.

- Proof of residency at your new address, such as a utility bill or lease agreement.

Filing Deadlines for the Louisiana Individual Income Tax Name and Address Change

Timely submission of the Louisiana Individual Income Tax Name and Address Change form is essential. Generally, it is advisable to submit this form as soon as you change your name or address. This ensures that your tax records are updated before the next tax filing season. Be aware of any specific deadlines that may apply, especially if you are filing your taxes close to the due date.

Legal Use of the Louisiana Individual Income Tax Name and Address Change

The Louisiana Individual Income Tax Name and Address Change form is legally recognized by the state as an official document for updating taxpayer information. Properly completing and submitting this form helps ensure compliance with state tax regulations and prevents potential penalties for misinformation. It is essential to keep a copy of the submitted form for your records.

Who Issues the Louisiana Individual Income Tax Name and Address Change Form

The Louisiana Department of Revenue is responsible for issuing the Individual Income Tax Name and Address Change form. This state agency oversees tax collection and compliance in Louisiana, ensuring that all taxpayers have access to the necessary forms and resources for managing their tax obligations effectively.

Quick guide on how to complete mail to individual income tax name and address change revenue louisiana

Complete Mail To Individual Income Tax Name And Address Change Revenue Louisiana effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, enabling you to locate the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Manage Mail To Individual Income Tax Name And Address Change Revenue Louisiana on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Mail To Individual Income Tax Name And Address Change Revenue Louisiana with ease

- Locate Mail To Individual Income Tax Name And Address Change Revenue Louisiana and click Get Form to initiate.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mail To Individual Income Tax Name And Address Change Revenue Louisiana and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mail to individual income tax name and address change revenue louisiana

Create this form in 5 minutes!

How to create an eSignature for the mail to individual income tax name and address change revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of louisiana individual income tax for businesses?

Understanding louisiana individual income tax is crucial for businesses operating in the state. It affects how you manage payroll and employee compensation. Properly handling these taxes can help avoid penalties and ensure compliance with state regulations.

-

How can airSlate SignNow help with louisiana individual income tax documentation?

airSlate SignNow simplifies the process of managing documents related to louisiana individual income tax. With our eSignature solution, you can easily send, sign, and store tax-related documents securely. This streamlines your workflow and ensures that all necessary paperwork is completed efficiently.

-

What features does airSlate SignNow offer for managing louisiana individual income tax forms?

Our platform offers features like customizable templates, automated workflows, and secure storage for louisiana individual income tax forms. These tools help you create and manage tax documents with ease, ensuring that you meet all state requirements without hassle.

-

Is airSlate SignNow cost-effective for handling louisiana individual income tax?

Yes, airSlate SignNow provides a cost-effective solution for managing louisiana individual income tax documentation. Our pricing plans are designed to fit various business sizes and needs, allowing you to save on administrative costs while ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with accounting software for louisiana individual income tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your louisiana individual income tax filings. This integration helps streamline your financial processes and ensures that all tax-related documents are readily accessible.

-

What are the benefits of using airSlate SignNow for louisiana individual income tax?

Using airSlate SignNow for louisiana individual income tax offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage tax documents digitally, which minimizes the risk of errors and ensures timely submissions.

-

How does airSlate SignNow ensure the security of louisiana individual income tax documents?

airSlate SignNow prioritizes the security of your louisiana individual income tax documents with advanced encryption and secure cloud storage. We comply with industry standards to protect sensitive information, giving you peace of mind while managing your tax-related paperwork.

Get more for Mail To Individual Income Tax Name And Address Change Revenue Louisiana

Find out other Mail To Individual Income Tax Name And Address Change Revenue Louisiana

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free