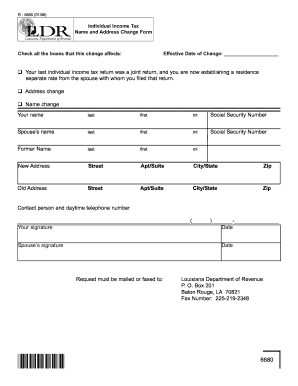

R 6505 0106 Individual Income Tax Name and Address Change Form Check All the Boxes that This Change Affects Effective Date of Ch 2006

Understanding the R-6 Individual Income Tax Name and Address Change Form

The R-6 Individual Income Tax Name and Address Change Form is essential for taxpayers who need to update their personal information with the IRS. This form is particularly relevant if you have changed your name due to marriage, divorce, or any other reason, or if you have moved to a new address. Keeping your information current is crucial to ensure that you receive important tax documents and communications from the IRS.

How to Use the R-6 Individual Income Tax Name and Address Change Form

Using the R-6 form is straightforward. Begin by downloading the form from the IRS website or obtaining a physical copy from a local IRS office. Fill in your current name, address, and the new name or address as applicable. Ensure that you check all the boxes that this change affects, as this will help the IRS process your request accurately. Once completed, submit the form according to the instructions provided, either online or via mail.

Steps to Complete the R-6 Individual Income Tax Name and Address Change Form

To complete the R-6 form, follow these steps:

- Download the form from the IRS website or request a copy from the IRS office.

- Fill in your personal details, including your current name and address.

- Indicate the new name and/or address you wish to update.

- Check all relevant boxes that indicate which changes apply to your situation.

- Review the form for accuracy before submission.

- Submit the form via the specified method, either online or by mailing it to the appropriate IRS address.

Key Elements of the R-6 Individual Income Tax Name and Address Change Form

The key elements of the R-6 form include:

- Personal Information: Your current name and address, along with the new information.

- Effective Date of Change: The date when the name or address change takes effect.

- Joint Return Information: If your last return was a joint return, you must indicate this on the form.

- Signature: Your signature is required to validate the changes.

Required Documents for the R-6 Individual Income Tax Name and Address Change Form

When submitting the R-6 form, you may need to provide supporting documents to verify your identity and the changes being made. Commonly required documents include:

- A copy of your marriage certificate or divorce decree if changing your name.

- Proof of residency, such as a utility bill or lease agreement, if changing your address.

- A government-issued ID that reflects your current name.

Filing Deadlines for the R-6 Individual Income Tax Name and Address Change Form

It is important to be aware of filing deadlines when submitting the R-6 form. Generally, you should file this form as soon as you change your name or address to avoid any disruptions in communication from the IRS. If you are filing your tax return, ensure that the IRS has your updated information by the time you submit your return to prevent any delays in processing your tax documents.

Quick guide on how to complete r 6505 0106 individual income tax name and address change form check all the boxes that this change affects effective date of

Complete R 6505 0106 Individual Income Tax Name And Address Change Form Check All The Boxes That This Change Affects Effective Date Of Ch effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly and without issues. Manage R 6505 0106 Individual Income Tax Name And Address Change Form Check All The Boxes That This Change Affects Effective Date Of Ch on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign R 6505 0106 Individual Income Tax Name And Address Change Form Check All The Boxes That This Change Affects Effective Date Of Ch with ease

- Find R 6505 0106 Individual Income Tax Name And Address Change Form Check All The Boxes That This Change Affects Effective Date Of Ch and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and select the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether through email, text message (SMS), an invite link, or downloading it to your computer.

Put an end to lost or disorganized files, exhausting form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your selection. Alter and eSign R 6505 0106 Individual Income Tax Name And Address Change Form Check All The Boxes That This Change Affects Effective Date Of Ch while ensuring excellent communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 6505 0106 individual income tax name and address change form check all the boxes that this change affects effective date of

Create this form in 5 minutes!

How to create an eSignature for the r 6505 0106 individual income tax name and address change form check all the boxes that this change affects effective date of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the R 6505 0106 Individual Income Tax Name And Address Change Form?

The R 6505 0106 Individual Income Tax Name And Address Change Form is a document used to notify tax authorities of changes to your name or address. This form is essential for ensuring that your tax records are up-to-date, especially if your last individual income tax return was a joint return and you are now establishing a residence.

-

How do I complete the R 6505 0106 Individual Income Tax Name And Address Change Form?

To complete the R 6505 0106 Individual Income Tax Name And Address Change Form, you need to fill out your personal information, check all the boxes that this change affects, and provide the effective date of change. Make sure to review your last individual income tax return to ensure accuracy.

-

What are the benefits of using airSlate SignNow for the R 6505 0106 form?

Using airSlate SignNow for the R 6505 0106 Individual Income Tax Name And Address Change Form allows you to eSign documents quickly and securely. Our platform is user-friendly and cost-effective, making it easy to manage your tax documents without hassle.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our plans are designed to be cost-effective, ensuring that you can efficiently manage the R 6505 0106 Individual Income Tax Name And Address Change Form without breaking the bank.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow. This means you can easily manage the R 6505 0106 Individual Income Tax Name And Address Change Form alongside your other business tools.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as eSigning, document templates, and real-time tracking. These features enhance your ability to manage the R 6505 0106 Individual Income Tax Name And Address Change Form efficiently and ensure that all changes are documented properly.

-

How secure is my information when using airSlate SignNow?

Your information is highly secure when using airSlate SignNow. We implement advanced security measures to protect your data, especially when handling sensitive documents like the R 6505 0106 Individual Income Tax Name And Address Change Form.

Get more for R 6505 0106 Individual Income Tax Name And Address Change Form Check All The Boxes That This Change Affects Effective Date Of Ch

- Affidavit of landlord form texas

- Values and spending survey form

- Cover page for project form

- Pregnancy emergency room discharge form regions hospital

- Lic 9151 242582005 form

- Hilton hotel reservation form

- Form st 100 new york state and local quarterly sales and use tax return revised 924

- Instructions for form st 100 new york state and local quarterly sales and use tax return revised 924

Find out other R 6505 0106 Individual Income Tax Name And Address Change Form Check All The Boxes That This Change Affects Effective Date Of Ch

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form