YearEnd Accounts Checklist This is for Canadian Us 2023-2026

Understanding the Business Year End Accounts Checklist

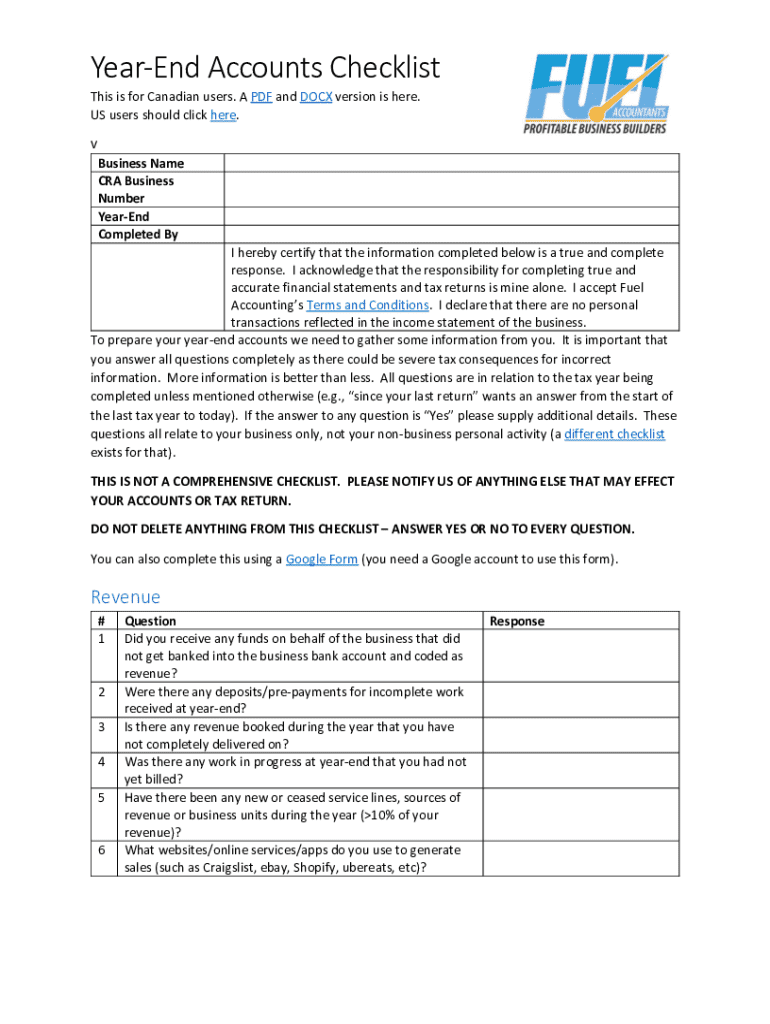

The business year end accounts checklist serves as a crucial tool for organizations to ensure they meet all financial reporting requirements at the end of their fiscal year. This checklist typically includes a comprehensive list of tasks and documents necessary for preparing accurate financial statements, including balance sheets, income statements, and cash flow statements. By following this checklist, businesses can streamline their accounting processes, reduce errors, and ensure compliance with regulatory standards.

Key Elements of the Business Year End Accounts Checklist

Essential components of the business year end accounts checklist often encompass several key areas:

- Financial Statements: Prepare and review the balance sheet, income statement, and cash flow statement.

- Account Reconciliation: Ensure all accounts are reconciled, including bank statements and ledger accounts.

- Tax Preparation: Gather necessary documents for tax filings, including W-2s, 1099s, and other relevant tax forms.

- Inventory Assessment: Conduct a physical inventory count and adjust records accordingly.

- Depreciation and Amortization: Calculate and record depreciation and amortization for fixed assets.

Steps to Complete the Business Year End Accounts Checklist

Completing the business year end accounts checklist involves several methodical steps to ensure accuracy and compliance:

- Gather all financial documents, including invoices, receipts, and bank statements.

- Reconcile all accounts to ensure that the financial records match bank statements.

- Prepare financial statements, ensuring they reflect the true financial position of the business.

- Review tax obligations and prepare necessary tax forms for submission.

- Finalize and store all documentation for future reference and audits.

IRS Guidelines for Year End Accounts

The Internal Revenue Service (IRS) provides specific guidelines that businesses must follow when preparing their year end accounts. These guidelines include requirements for recordkeeping, the format of financial statements, and deadlines for tax filings. It is essential for businesses to stay informed about any changes in IRS regulations to ensure compliance and avoid potential penalties.

Filing Deadlines and Important Dates

Understanding filing deadlines is critical for businesses. Key dates typically include:

- January 31: Deadline for issuing W-2 forms to employees.

- March 15: Deadline for partnerships and S corporations to file returns.

- April 15: Deadline for C corporations and individual tax returns.

Staying aware of these deadlines helps businesses avoid late fees and ensures timely compliance with tax obligations.

Required Documents for Year End Accounts

To complete the business year end accounts checklist, several documents are typically required:

- Financial statements: balance sheet, income statement, and cash flow statement.

- Tax forms: W-2s, 1099s, and any other relevant tax documentation.

- Bank statements for account reconciliation.

- Invoices and receipts for all transactions throughout the year.

- Inventory records and asset depreciation schedules.

Having these documents organized and readily available can significantly ease the year-end accounting process.

Quick guide on how to complete yearend accounts checklist this is for canadian us

Complete YearEnd Accounts Checklist This Is For Canadian Us seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle YearEnd Accounts Checklist This Is For Canadian Us on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-driven task today.

How to modify and eSign YearEnd Accounts Checklist This Is For Canadian Us with ease

- Obtain YearEnd Accounts Checklist This Is For Canadian Us and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of the documents or redact sensitive information with resources that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign YearEnd Accounts Checklist This Is For Canadian Us and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct yearend accounts checklist this is for canadian us

Create this form in 5 minutes!

How to create an eSignature for the yearend accounts checklist this is for canadian us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business year end accounts checklist?

A business year end accounts checklist is a comprehensive guide that helps businesses ensure all financial documents and reports are prepared accurately before the fiscal year closes. It typically includes tasks such as reconciling accounts, preparing financial statements, and ensuring compliance with tax regulations. Utilizing a checklist can streamline the year-end process and reduce the risk of errors.

-

How can airSlate SignNow assist with my business year end accounts checklist?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to your business year end accounts checklist. With its user-friendly interface, you can easily send, receive, and store important financial documents securely. This ensures that all necessary paperwork is completed on time, helping you stay organized during the year-end process.

-

What features does airSlate SignNow offer for managing financial documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your business year end accounts checklist. These tools allow you to create and send documents quickly, monitor their status, and ensure that all signatures are collected efficiently. This streamlines your workflow and enhances productivity.

-

Is airSlate SignNow cost-effective for small businesses handling year-end accounts?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing their year-end accounts. With flexible pricing plans, you can choose a package that fits your budget while still accessing essential features for your business year end accounts checklist. This affordability makes it an attractive option for those looking to optimize their financial processes.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easy to incorporate into your existing workflow. This compatibility allows you to streamline your business year end accounts checklist by connecting your financial documents directly with your accounting tools, ensuring a seamless process from document creation to eSigning.

-

What are the benefits of using airSlate SignNow for year-end financial tasks?

Using airSlate SignNow for your year-end financial tasks offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing your business year end accounts checklist, you can save time on document management and minimize the risk of losing important files. Additionally, the platform's security features ensure that your sensitive financial information is protected.

-

How does airSlate SignNow ensure the security of my financial documents?

airSlate SignNow prioritizes the security of your financial documents by employing advanced encryption and secure cloud storage. This ensures that all documents related to your business year end accounts checklist are protected from unauthorized access. Regular security audits and compliance with industry standards further enhance the safety of your sensitive information.

Get more for YearEnd Accounts Checklist This Is For Canadian Us

Find out other YearEnd Accounts Checklist This Is For Canadian Us

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney