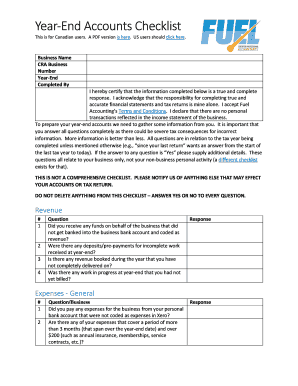

Year End Accounts Checklist 2017

Understanding the Year End Accounts Checklist

The Year End Accounts Checklist serves as a comprehensive guide for businesses to ensure they have completed all necessary financial documentation and reporting for the year. This checklist is crucial for maintaining compliance with accounting standards and tax regulations. It typically includes items such as verifying income statements, balance sheets, and cash flow statements, ensuring that all financial records are accurate and up to date.

Steps to Complete the Year End Accounts Checklist

Completing the Year End Accounts Checklist involves several systematic steps:

- Gather all financial documents, including invoices, receipts, and bank statements.

- Review and reconcile accounts to ensure accuracy in financial reporting.

- Prepare the income statement, balance sheet, and cash flow statement.

- Ensure that all tax obligations are met, including payroll taxes and estimated tax payments.

- Compile any necessary disclosures required for financial statements.

- Review the checklist for completeness before finalizing the accounts.

Required Documents for the Year End Accounts Checklist

To effectively complete the Year End Accounts Checklist, specific documents are necessary:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Cash flow statements tracking cash inflows and outflows.

- Bank statements for reconciliation purposes.

- Invoices and receipts for all transactions throughout the year.

- Any relevant tax documents, including W-2s, 1099s, and prior year tax returns.

Legal Use of the Year End Accounts Checklist

The Year End Accounts Checklist is designed to help businesses comply with legal and regulatory requirements. It ensures that all financial statements are prepared according to Generally Accepted Accounting Principles (GAAP) and are ready for submission to the Internal Revenue Service (IRS) if required. Proper use of the checklist can help avoid penalties related to financial misreporting or non-compliance with tax laws.

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential for businesses completing their Year End Accounts Checklist. Key dates typically include:

- January 31: Deadline for issuing W-2s and 1099s to employees and contractors.

- March 15: Deadline for filing corporate tax returns for S corporations.

- April 15: Deadline for filing individual tax returns and C corporation tax returns.

- Various state-specific deadlines that may apply based on local regulations.

Examples of Using the Year End Accounts Checklist

Businesses can utilize the Year End Accounts Checklist in various scenarios:

- A small business owner preparing for tax season by ensuring all financial records are in order.

- A corporation conducting an internal audit to verify financial accuracy before year-end reporting.

- A nonprofit organization ensuring compliance with funding requirements and financial accountability.

Quick guide on how to complete year end accounts checklist

Effortlessly prepare Year End Accounts Checklist on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents swiftly without any holdups. Manage Year End Accounts Checklist on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

Easily edit and eSign Year End Accounts Checklist without hassle

- Find Year End Accounts Checklist and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Year End Accounts Checklist to ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct year end accounts checklist

Create this form in 5 minutes!

How to create an eSignature for the year end accounts checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Year End Accounts Checklist?

A Year End Accounts Checklist is a comprehensive guide that helps businesses ensure all financial documents are in order before closing the fiscal year. It includes essential tasks such as reconciling accounts, preparing financial statements, and ensuring compliance with regulations. Utilizing a Year End Accounts Checklist can streamline your accounting process and reduce errors.

-

How can airSlate SignNow assist with my Year End Accounts Checklist?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to your Year End Accounts Checklist. With features like document templates and secure storage, you can easily organize and access all necessary paperwork. This simplifies the process and ensures that your checklist is completed accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Each plan includes features that can enhance your Year End Accounts Checklist process, such as unlimited eSignatures and document storage. You can choose a plan that best fits your budget and needs, ensuring you get the most value for your investment.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features designed to enhance document management, such as customizable templates, automated workflows, and real-time tracking. These features can signNowly improve the efficiency of your Year End Accounts Checklist by allowing you to manage documents seamlessly. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to incorporate your Year End Accounts Checklist into your existing workflow. This allows for seamless data transfer and ensures that all financial documents are aligned with your accounting system. Integrating these tools can enhance productivity and accuracy in your financial processes.

-

What are the benefits of using airSlate SignNow for my Year End Accounts Checklist?

Using airSlate SignNow for your Year End Accounts Checklist provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which can save valuable time during the year-end closing process. Additionally, the user-friendly interface ensures that all team members can easily navigate the system.

-

Is airSlate SignNow suitable for small businesses managing Year End Accounts?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Its features can help streamline the Year End Accounts Checklist process, making it easier for small teams to manage their financial documents efficiently. The platform's affordability and ease of use make it an ideal choice for small business owners.

Get more for Year End Accounts Checklist

Find out other Year End Accounts Checklist

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now