BD2037b Tax File Number Registration Department of Veterans Bb 2020-2026

Understanding the BD2037b Tax File Number Registration

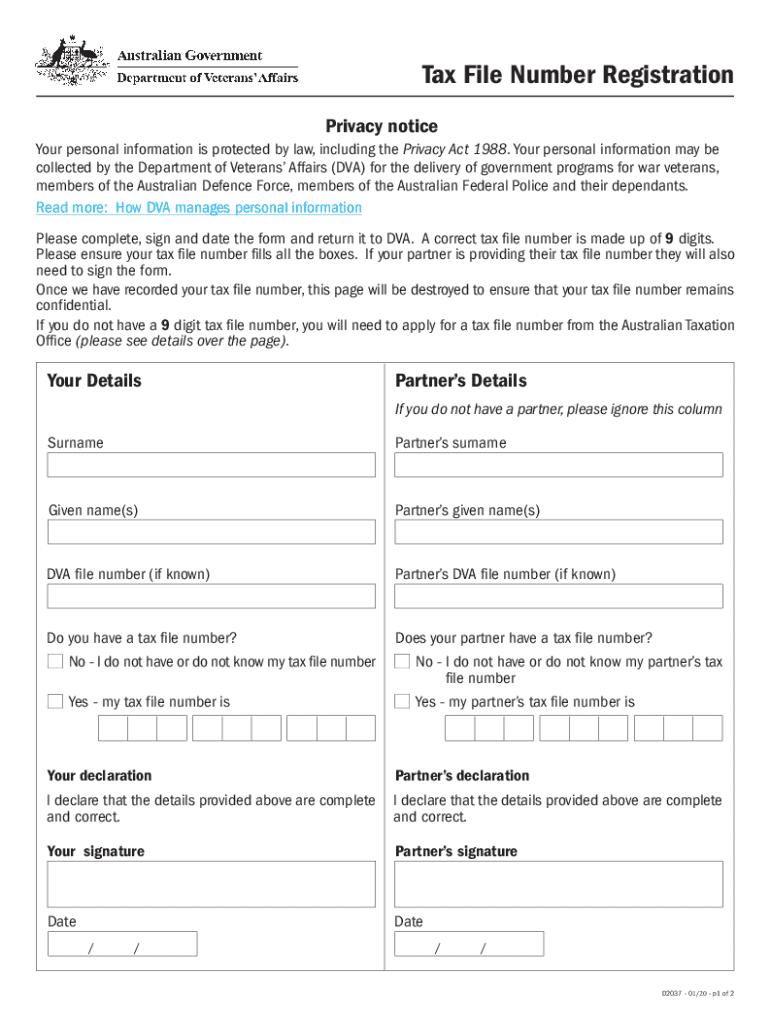

The BD2037b Tax File Number Registration is a crucial document for individuals and businesses in the United States who need to comply with tax regulations. This form is primarily used to register for a tax file number, which is essential for filing taxes accurately and on time. The tax file number serves as a unique identifier for taxpayers, helping the Internal Revenue Service (IRS) track tax obligations and payments.

Steps to Complete the BD2037b Tax File Number Registration

Completing the BD2037b Tax File Number Registration involves several key steps:

- Gather necessary information, including personal identification and business details if applicable.

- Access the BD2037b form through the official IRS website or authorized platforms.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information provided for any errors or omissions.

- Submit the completed form online, by mail, or in person, depending on your preference.

Required Documents for BD2037b Tax File Number Registration

To successfully register for a tax file number using the BD2037b form, you will need to provide certain documents. These typically include:

- Government-issued identification (e.g., driver's license or passport).

- Social Security number or Employer Identification Number (EIN) if applicable.

- Proof of residency or business address.

IRS Guidelines for Filing the BD2037b Tax File Number Registration

The IRS has established guidelines that must be followed when filing the BD2037b form. These include:

- Ensuring that all information is accurate and up-to-date.

- Filing by the designated deadlines to avoid penalties.

- Keeping copies of submitted forms for your records.

Penalties for Non-Compliance with BD2037b Registration

Failure to complete the BD2037b Tax File Number Registration can result in various penalties. These may include:

- Fines imposed by the IRS for late registration.

- Inability to file taxes correctly, leading to further complications.

- Potential audits or increased scrutiny from tax authorities.

Eligibility Criteria for BD2037b Tax File Number Registration

Eligibility for the BD2037b Tax File Number Registration varies based on several factors, including:

- Individual status (e.g., resident, non-resident).

- Type of business entity (e.g., sole proprietorship, corporation).

- Compliance with state-specific regulations.

Quick guide on how to complete bd2037b tax file number registration department of veterans bb

Complete BD2037b Tax File Number Registration Department Of Veterans Bb effortlessly on any device

Web-based document management has gained signNow traction among companies and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage BD2037b Tax File Number Registration Department Of Veterans Bb on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-driven process today.

How to modify and eSign BD2037b Tax File Number Registration Department Of Veterans Bb with ease

- Obtain BD2037b Tax File Number Registration Department Of Veterans Bb and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that function.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Choose your preferred method for sending your form—via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choice. Edit and eSign BD2037b Tax File Number Registration Department Of Veterans Bb to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bd2037b tax file number registration department of veterans bb

Create this form in 5 minutes!

How to create an eSignature for the bd2037b tax file number registration department of veterans bb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to file tax number registration online using airSlate SignNow?

To file tax number registration online with airSlate SignNow, simply create an account, upload your documents, and use our eSignature feature to sign them electronically. Our platform guides you through each step, ensuring a smooth and efficient process. You can complete your registration from anywhere, saving you time and effort.

-

How much does it cost to file tax number registration online with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to all features necessary for filing tax number registration online. Check our pricing page for detailed information on plans and any available discounts.

-

What features does airSlate SignNow offer for filing tax number registration online?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to streamline the process of filing tax number registration online. Additionally, you can collaborate with team members in real-time, ensuring that all necessary documents are completed accurately and efficiently.

-

Is airSlate SignNow secure for filing tax number registration online?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption methods to protect your data and ensure that your documents are safe while filing tax number registration online. Our platform is compliant with industry standards, giving you peace of mind during the entire process.

-

Can I integrate airSlate SignNow with other software for filing tax number registration online?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and enhance your efficiency when filing tax number registration online, making it easier to manage all your documents in one place.

-

What are the benefits of using airSlate SignNow for filing tax number registration online?

Using airSlate SignNow for filing tax number registration online provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly interface simplifies the process, allowing you to focus on your business while we handle the documentation. Plus, our cost-effective solution helps you save money on administrative tasks.

-

How can I get support while filing tax number registration online with airSlate SignNow?

airSlate SignNow offers comprehensive customer support to assist you while filing tax number registration online. You can access our help center for FAQs, tutorials, and guides, or signNow out to our support team via chat or email for personalized assistance. We're here to ensure your experience is smooth and successful.

Get more for BD2037b Tax File Number Registration Department Of Veterans Bb

Find out other BD2037b Tax File Number Registration Department Of Veterans Bb

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer