Rensselaer EZ Snapshot Additional Client Form Rpi

What is the Rensselaer EZ Snapshot Additional Client Form Rpi

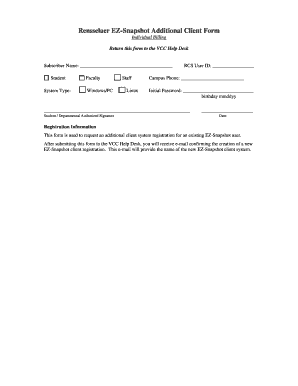

The Rensselaer EZ Snapshot Additional Client Form Rpi is a specialized document designed to gather essential information from clients in a streamlined manner. This form is particularly useful for organizations and individuals who need to collect specific data efficiently, ensuring that all necessary details are captured for further processing. It serves as an extension of the standard EZ Snapshot form, allowing for additional client-specific information that may be required for various administrative purposes.

How to use the Rensselaer EZ Snapshot Additional Client Form Rpi

Using the Rensselaer EZ Snapshot Additional Client Form Rpi involves several straightforward steps. First, ensure you have access to the form, either in digital format or printed. Next, fill out all required fields, providing accurate and up-to-date information. Once completed, review the form for any errors or missing information. Finally, submit the form as per the guidelines provided, whether through digital submission or by mailing it to the appropriate office.

Steps to complete the Rensselaer EZ Snapshot Additional Client Form Rpi

To complete the Rensselaer EZ Snapshot Additional Client Form Rpi effectively, follow these steps:

- Gather necessary information, including personal details and any relevant documentation.

- Access the form and begin filling it out, ensuring that you provide all requested information.

- Double-check your entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the specified submission method, either online or via mail.

Key elements of the Rensselaer EZ Snapshot Additional Client Form Rpi

The Rensselaer EZ Snapshot Additional Client Form Rpi includes several key elements that are crucial for its effective use:

- Client Information: Basic details such as name, address, and contact information.

- Additional Data Fields: Sections for any extra information that may be needed beyond the standard form.

- Signature Section: A space for the client to sign, confirming the accuracy of the provided information.

- Submission Instructions: Clear guidelines on how to submit the form, including deadlines and acceptable methods.

Legal use of the Rensselaer EZ Snapshot Additional Client Form Rpi

The Rensselaer EZ Snapshot Additional Client Form Rpi is designed for legal compliance in data collection. It is important to ensure that the information gathered adheres to relevant privacy laws and regulations. Users should be aware of their obligations regarding data protection and confidentiality, ensuring that client information is handled securely and responsibly throughout the process.

Form Submission Methods

Submitting the Rensselaer EZ Snapshot Additional Client Form Rpi can be done through various methods, depending on the preferences of the organization or individual requesting the form. Common submission methods include:

- Online Submission: Many organizations allow clients to submit the form electronically through secure portals.

- Mail: Clients can print the completed form and send it via postal service to the designated address.

- In-Person: Some may prefer to deliver the form directly to an office location for immediate processing.

Quick guide on how to complete rensselaer ez snapshot additional client form rpi

Accomplish [SKS] effortlessly on any gadget

Digital document management has gained traction with organizations and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to generate, modify, and eSign your documents quickly without interruptions. Control [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to alter and eSign [SKS] seamlessly

- Locate [SKS] and then click Get Form to commence.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Rensselaer EZ Snapshot Additional Client Form Rpi

Create this form in 5 minutes!

How to create an eSignature for the rensselaer ez snapshot additional client form rpi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rensselaer EZ Snapshot Additional Client Form Rpi?

The Rensselaer EZ Snapshot Additional Client Form Rpi is a streamlined document designed to simplify the client onboarding process. It allows users to collect essential information efficiently, ensuring a smooth experience for both clients and businesses. This form is integrated with airSlate SignNow for easy eSigning and document management.

-

How much does the Rensselaer EZ Snapshot Additional Client Form Rpi cost?

Pricing for the Rensselaer EZ Snapshot Additional Client Form Rpi varies based on the specific features and volume of usage. airSlate SignNow offers competitive pricing plans that cater to different business needs, ensuring you get the best value for your investment. For detailed pricing information, please visit our pricing page.

-

What features does the Rensselaer EZ Snapshot Additional Client Form Rpi offer?

The Rensselaer EZ Snapshot Additional Client Form Rpi includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features are designed to enhance efficiency and reduce the time spent on document management. Additionally, it integrates seamlessly with other tools to streamline your processes.

-

How can the Rensselaer EZ Snapshot Additional Client Form Rpi benefit my business?

Using the Rensselaer EZ Snapshot Additional Client Form Rpi can signNowly improve your client onboarding experience. It reduces paperwork, minimizes errors, and speeds up the process of collecting necessary information. This ultimately leads to higher client satisfaction and retention rates.

-

Is the Rensselaer EZ Snapshot Additional Client Form Rpi easy to use?

Yes, the Rensselaer EZ Snapshot Additional Client Form Rpi is designed with user-friendliness in mind. The intuitive interface allows users to create, send, and manage forms effortlessly. Even those with minimal technical skills can navigate the platform with ease.

-

Can I integrate the Rensselaer EZ Snapshot Additional Client Form Rpi with other software?

Absolutely! The Rensselaer EZ Snapshot Additional Client Form Rpi can be integrated with various software applications, enhancing your workflow. airSlate SignNow supports integrations with popular tools like CRM systems, project management software, and more, allowing for a seamless experience.

-

What security measures are in place for the Rensselaer EZ Snapshot Additional Client Form Rpi?

The Rensselaer EZ Snapshot Additional Client Form Rpi prioritizes security with advanced encryption and compliance with industry standards. airSlate SignNow ensures that all documents are securely stored and transmitted, protecting sensitive client information. You can trust that your data is safe with us.

Get more for Rensselaer EZ Snapshot Additional Client Form Rpi

- Handel worksheet form

- Domicile determination form eligibility for in state

- Hilton new application form

- Admissionsmsuedudocsaffidavitofsupportinternational applicants only affidavit of support for form

- Personal data form

- Tnccedusitesdefaultconsortium agreement section 1 student acknowledgement form

- 1 forms divided by the department to which they should be

- Utmb medical records form

Find out other Rensselaer EZ Snapshot Additional Client Form Rpi

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors