Estate or Trust Employer Identification Number 2022

What is the Estate Or Trust Employer Identification Number

The Estate Or Trust Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify estates and trusts for tax purposes. This number is essential for filing tax returns and managing financial transactions related to the estate or trust. It functions similarly to a Social Security number for individuals, providing a means for the IRS to track tax obligations and compliance.

How to obtain the Estate Or Trust Employer Identification Number

To obtain an Estate Or Trust EIN, you can apply directly through the IRS. This can be done online, by mail, or by fax. The online application is the fastest method, allowing you to receive your EIN immediately upon completion. If you choose to apply by mail or fax, you will need to complete Form SS-4 and submit it to the appropriate IRS address. It is important to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Estate Or Trust Employer Identification Number

Completing the application for the Estate Or Trust EIN involves several key steps:

- Gather necessary information, including the legal name of the estate or trust, the responsible party's name and Social Security number, and the mailing address.

- Choose the appropriate application method: online, by mail, or by fax.

- If applying online, visit the IRS EIN application page and follow the prompts. If applying by mail or fax, fill out Form SS-4 accurately.

- Submit the application and wait for your EIN to be issued, which can take just a few minutes online or several weeks by mail.

Legal use of the Estate Or Trust Employer Identification Number

The Estate Or Trust EIN is legally required for various financial activities, including opening bank accounts, filing tax returns, and reporting income. It ensures that the estate or trust complies with federal tax regulations. Using the EIN helps to separate the estate or trust's financial activities from those of the individual beneficiaries, which is crucial for proper tax reporting and liability management.

Filing Deadlines / Important Dates

Filing deadlines for estates and trusts can vary based on the specific circumstances. Generally, Form 1041, the U.S. Income Tax Return for Estates and Trusts, is due on the fifteenth day of the fourth month following the end of the tax year. For estates, this typically means April 15 for calendar year filers. It is important to stay informed about these deadlines to avoid penalties and ensure compliance with IRS regulations.

Required Documents

When applying for an Estate Or Trust EIN or filing tax returns, several documents may be required. These typically include:

- Form SS-4 for EIN application.

- Form 1041 for income tax returns.

- Documentation of the estate's or trust's assets and liabilities.

- Any relevant legal documents, such as the trust agreement or will.

Penalties for Non-Compliance

Failure to obtain an Estate Or Trust EIN or to file required tax returns can result in significant penalties. The IRS may impose fines for late filings, and the estate or trust may be subject to interest on unpaid taxes. Additionally, not using the EIN for required transactions can lead to complications in managing the estate or trust, including legal repercussions for the responsible parties.

Quick guide on how to complete estate or trust employer identification number

Effortlessly Prepare Estate Or Trust Employer Identification Number on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without interruptions. Manage Estate Or Trust Employer Identification Number on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to Edit and Electronically Sign Estate Or Trust Employer Identification Number with Ease

- Find Estate Or Trust Employer Identification Number and click Get Form to begin.

- Utilize the tools we provide to complete your template.

- Emphasize relevant sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Estate Or Trust Employer Identification Number and ensure exceptional communication at each stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estate or trust employer identification number

Create this form in 5 minutes!

How to create an eSignature for the estate or trust employer identification number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

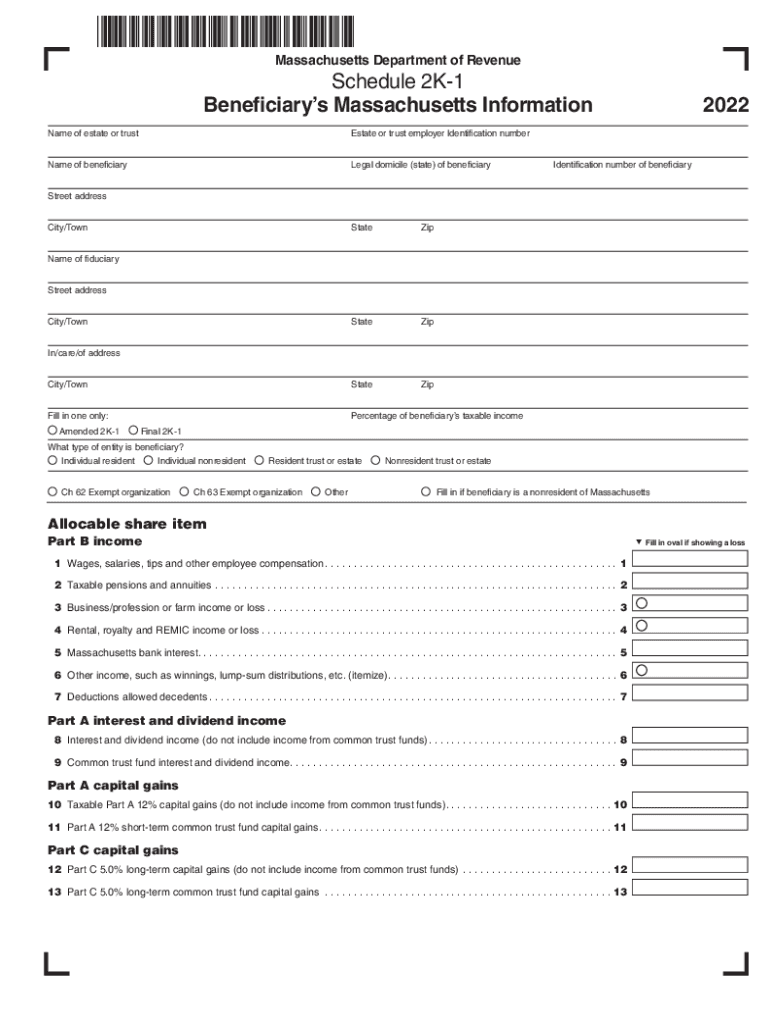

What are the Massachusetts Schedule 2K-1 instructions?

The Massachusetts Schedule 2K-1 instructions provide guidance on how to report income, deductions, and credits for partnerships and S corporations in Massachusetts. Understanding these instructions is crucial for accurate tax filing and compliance. By following the Massachusetts Schedule 2K-1 instructions, you can ensure that your tax returns are completed correctly.

-

How can airSlate SignNow help with Massachusetts Schedule 2K-1 forms?

airSlate SignNow simplifies the process of preparing and signing Massachusetts Schedule 2K-1 forms by providing an easy-to-use platform for document management. You can quickly create, send, and eSign your forms, ensuring that all necessary information is included. This streamlines your workflow and helps you stay compliant with Massachusetts Schedule 2K-1 instructions.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Massachusetts Schedule 2K-1. These features enhance efficiency and ensure that your documents are handled securely. With airSlate SignNow, you can focus on your business while we take care of your document needs.

-

Is airSlate SignNow cost-effective for small businesses handling Massachusetts Schedule 2K-1?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to manage Massachusetts Schedule 2K-1 forms. Our pricing plans are designed to fit various budgets, allowing you to access essential features without breaking the bank. This affordability makes it easier for small businesses to comply with Massachusetts Schedule 2K-1 instructions.

-

Can I integrate airSlate SignNow with other accounting software for Massachusetts Schedule 2K-1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Massachusetts Schedule 2K-1 forms. This integration allows for automatic data transfer, reducing the risk of errors and saving you time. By using airSlate SignNow, you can streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including Massachusetts Schedule 2K-1, offers numerous benefits such as enhanced security, ease of use, and improved collaboration. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the user-friendly interface allows for quick eSigning and sharing, making tax season less stressful.

-

How does airSlate SignNow ensure compliance with Massachusetts Schedule 2K-1 instructions?

airSlate SignNow is designed to help users comply with Massachusetts Schedule 2K-1 instructions by providing templates that adhere to state requirements. Our platform also offers guidance and support to ensure that all necessary information is included in your forms. This commitment to compliance helps you avoid potential issues with tax authorities.

Get more for Estate Or Trust Employer Identification Number

- Written consent for minor visitation prisonpro com form

- Bank plate 558330519 form

- Application for medicare provider number allied health form

- In grades k 12 grade who has completed the admissions requirements and who in the opinion of the college president or designee form

- Calvet veteran services state parks and recreation pass form

- Imm5257f pdf form

- Statement of remuneration paid 692870325 form

- Health improvement benefit approval form

Find out other Estate Or Trust Employer Identification Number

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF