Massachusetts Department of Revenue Schedule 2K 1 2024-2026

What is the Massachusetts Department Of Revenue Schedule 2K 1

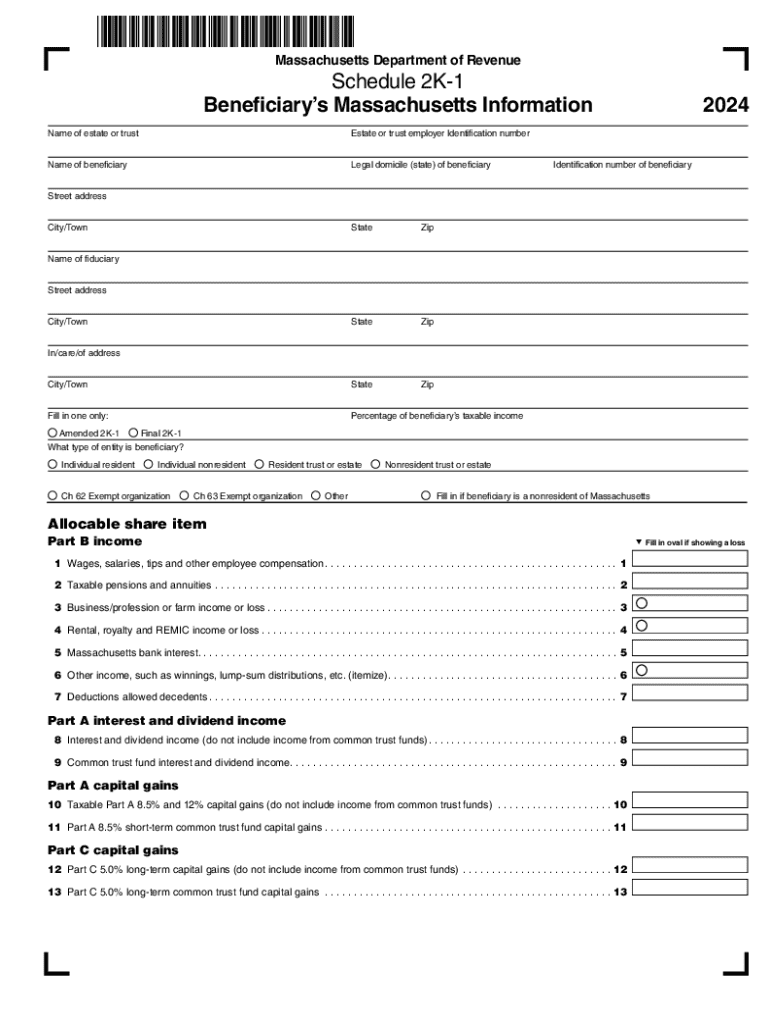

The Massachusetts Department Of Revenue Schedule 2K 1 is a tax form used for reporting income, deductions, and credits from partnerships and S corporations. This form is essential for individuals who receive income from these entities, as it helps ensure accurate reporting of income on personal tax returns. It provides detailed information about the taxpayer's share of the entity's income, losses, and other tax-related items, which are crucial for calculating state tax liabilities.

How to use the Massachusetts Department Of Revenue Schedule 2K 1

Using the Massachusetts Department Of Revenue Schedule 2K 1 involves several steps. First, taxpayers must receive the form from the partnership or S corporation in which they have an interest. Once received, individuals should carefully review the information provided, including their share of income and deductions. This data must then be accurately reported on the Massachusetts personal income tax return. It is important to ensure that the amounts match the figures reported by the entity to avoid discrepancies.

Steps to complete the Massachusetts Department Of Revenue Schedule 2K 1

Completing the Massachusetts Department Of Revenue Schedule 2K 1 requires attention to detail. Here are the steps to follow:

- Obtain the form from the partnership or S corporation.

- Review the information for accuracy, including your share of income, deductions, and credits.

- Fill out the form with the required details, ensuring all figures are correct.

- Attach the completed Schedule 2K 1 to your Massachusetts personal income tax return.

- Keep a copy for your records in case of future inquiries or audits.

Key elements of the Massachusetts Department Of Revenue Schedule 2K 1

The key elements of the Massachusetts Department Of Revenue Schedule 2K 1 include various sections that outline income, deductions, and credits. These elements typically consist of:

- Income Reporting: Details on the income earned from the entity.

- Deductions: Information on allowable deductions that can be claimed.

- Credits: Any tax credits that the taxpayer may be eligible for based on their share of the entity.

- Entity Information: The name and identification number of the partnership or S corporation.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance. For the Massachusetts Department Of Revenue Schedule 2K 1, the form must be filed along with the personal income tax return. The typical deadline for filing individual tax returns in Massachusetts is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply to their specific situation.

Penalties for Non-Compliance

Failing to file the Massachusetts Department Of Revenue Schedule 2K 1 or inaccuracies in reporting can lead to penalties. Taxpayers may face fines for late filing or for providing incorrect information. Additionally, interest may accrue on any unpaid taxes. It is essential to ensure that the form is completed accurately and submitted on time to avoid these potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue schedule 2k 1

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue schedule 2k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts Department Of Revenue Schedule 2K 1?

The Massachusetts Department Of Revenue Schedule 2K 1 is a tax form used by partnerships and S corporations to report income, deductions, and credits to the state. It provides essential information for partners and shareholders to accurately file their personal tax returns. Understanding this form is crucial for compliance with Massachusetts tax regulations.

-

How can airSlate SignNow help with the Massachusetts Department Of Revenue Schedule 2K 1?

airSlate SignNow simplifies the process of preparing and signing the Massachusetts Department Of Revenue Schedule 2K 1 by providing an intuitive platform for document management. Users can easily upload, edit, and eSign their tax documents, ensuring accuracy and compliance. This streamlines the workflow and reduces the time spent on tax preparation.

-

What are the pricing options for airSlate SignNow when dealing with the Massachusetts Department Of Revenue Schedule 2K 1?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring assistance with the Massachusetts Department Of Revenue Schedule 2K 1. Plans are designed to be cost-effective, allowing businesses to choose a package that fits their budget while accessing essential features for document management and eSigning.

-

Are there any specific features in airSlate SignNow for handling the Massachusetts Department Of Revenue Schedule 2K 1?

Yes, airSlate SignNow includes features specifically designed to assist with the Massachusetts Department Of Revenue Schedule 2K 1, such as customizable templates, automated workflows, and secure eSigning. These features enhance efficiency and ensure that all necessary information is accurately captured and submitted on time.

-

What benefits does airSlate SignNow provide for businesses dealing with the Massachusetts Department Of Revenue Schedule 2K 1?

Using airSlate SignNow for the Massachusetts Department Of Revenue Schedule 2K 1 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can save time by automating document workflows and ensuring that all signatures are collected electronically, which also minimizes the risk of errors.

-

Can airSlate SignNow integrate with other software for managing the Massachusetts Department Of Revenue Schedule 2K 1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Massachusetts Department Of Revenue Schedule 2K 1. This integration allows users to import data directly from their accounting systems, reducing manual entry and ensuring accuracy in tax reporting.

-

Is airSlate SignNow secure for handling sensitive information related to the Massachusetts Department Of Revenue Schedule 2K 1?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive information related to the Massachusetts Department Of Revenue Schedule 2K 1. The platform employs advanced encryption and security protocols to protect user data, ensuring that all documents are stored and transmitted securely.

Get more for Massachusetts Department Of Revenue Schedule 2K 1

- Collaborative assessment log form

- Healthy homes checklist form

- Ontario works income statement form

- Subp 025 fillable editable and saveable california judicial council forms

- Superior access insurance services inc form

- Protection class 8b 9 10 questionnaire utz ques 1 4 14 form

- Soc 2279 ihss form

- American legion certificate maker form

Find out other Massachusetts Department Of Revenue Schedule 2K 1

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document