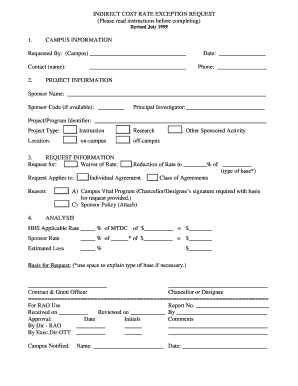

INDIRECT COST RATE EXCEPTION REQUEST Form

What is the Indirect Cost Rate Exception Request

The Indirect Cost Rate Exception Request is a formal document used by organizations to seek approval for an exception to the standard indirect cost rate. This request is typically necessary for entities that receive federal funding and need to justify a higher or different rate than what is typically allowed. Understanding the purpose of this request is crucial for compliance with federal regulations and for ensuring that organizations can recover appropriate costs associated with their projects.

Steps to Complete the Indirect Cost Rate Exception Request

Completing the Indirect Cost Rate Exception Request involves several key steps:

- Gather necessary documentation that supports your request, including financial statements and cost allocation plans.

- Clearly identify the reason for the exception, detailing the unique circumstances that justify the need for a different rate.

- Fill out the request form accurately, ensuring that all required fields are completed and that the information is consistent with your supporting documents.

- Review the completed form for accuracy and completeness before submission.

- Submit the request to the appropriate federal agency or funding source, adhering to any specific submission guidelines they may have.

Required Documents

When submitting the Indirect Cost Rate Exception Request, specific documents are typically required to support your case. These may include:

- Current financial statements, including balance sheets and income statements.

- A detailed cost allocation plan that outlines how indirect costs are distributed.

- Justification letters or memos explaining the need for the exception.

- Previous indirect cost rate agreements, if applicable.

Eligibility Criteria

To be eligible for an Indirect Cost Rate Exception, organizations generally must meet certain criteria. These may include:

- Being a recipient of federal funds or grants.

- Demonstrating that the standard indirect cost rate does not adequately cover the organization's expenses.

- Providing a clear rationale for the requested exception, supported by financial data.

Filing Deadlines / Important Dates

It is essential to be aware of any filing deadlines associated with the Indirect Cost Rate Exception Request. These deadlines can vary depending on the federal agency or funding source involved. Typically, organizations should submit their requests well in advance of the funding period to ensure timely processing. Keeping track of these dates helps avoid delays in funding and project implementation.

Form Submission Methods

The Indirect Cost Rate Exception Request can usually be submitted through various methods, depending on the guidelines provided by the funding agency. Common submission methods include:

- Online submission through the agency's designated portal.

- Mailing a hard copy of the request to the appropriate office.

- In-person submission, if applicable, during designated office hours.

Quick guide on how to complete indirect cost rate exception request

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained signNow popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling easy access to the necessary forms and secure online storage. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and streamline your document-related workflow today.

The Easiest Method to Edit and eSign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the frustrations of lost or misplaced documents, cumbersome form searches, and errors that require reprinting new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you choose. Edit and eSign [SKS] to ensure seamless communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to INDIRECT COST RATE EXCEPTION REQUEST

Create this form in 5 minutes!

How to create an eSignature for the indirect cost rate exception request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an INDIRECT COST RATE EXCEPTION REQUEST?

An INDIRECT COST RATE EXCEPTION REQUEST is a formal request made by organizations to seek approval for a different indirect cost rate than the standard rate. This process is essential for ensuring that your organization can accurately allocate costs and maximize funding opportunities. Understanding how to properly submit this request can signNowly impact your financial management.

-

How can airSlate SignNow assist with the INDIRECT COST RATE EXCEPTION REQUEST process?

airSlate SignNow streamlines the INDIRECT COST RATE EXCEPTION REQUEST process by providing an easy-to-use platform for document management and eSigning. With our solution, you can quickly prepare, send, and track your requests, ensuring that all necessary documentation is completed efficiently. This helps reduce delays and enhances compliance with funding requirements.

-

What features does airSlate SignNow offer for managing INDIRECT COST RATE EXCEPTION REQUESTs?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for your INDIRECT COST RATE EXCEPTION REQUESTs. These tools simplify the submission process and ensure that all stakeholders are informed and engaged. Additionally, our platform supports secure document storage, making it easy to access your requests whenever needed.

-

Is there a cost associated with using airSlate SignNow for INDIRECT COST RATE EXCEPTION REQUESTs?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different organizations. Our cost-effective solution ensures that you can manage your INDIRECT COST RATE EXCEPTION REQUESTs without breaking the bank. We provide transparent pricing with no hidden fees, allowing you to choose the plan that best fits your budget.

-

Can I integrate airSlate SignNow with other tools for my INDIRECT COST RATE EXCEPTION REQUESTs?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow for INDIRECT COST RATE EXCEPTION REQUESTs. Whether you use project management tools, accounting software, or CRM systems, our integrations help streamline your processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for INDIRECT COST RATE EXCEPTION REQUESTs?

Using airSlate SignNow for your INDIRECT COST RATE EXCEPTION REQUESTs provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for faster approvals and better tracking of your requests, ultimately saving you time and resources. Additionally, the user-friendly interface ensures that all team members can easily navigate the process.

-

How secure is airSlate SignNow when handling INDIRECT COST RATE EXCEPTION REQUESTs?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your INDIRECT COST RATE EXCEPTION REQUESTs and sensitive information. Our platform complies with industry standards, ensuring that your documents are safe and secure throughout the entire process.

Get more for INDIRECT COST RATE EXCEPTION REQUEST

Find out other INDIRECT COST RATE EXCEPTION REQUEST

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure