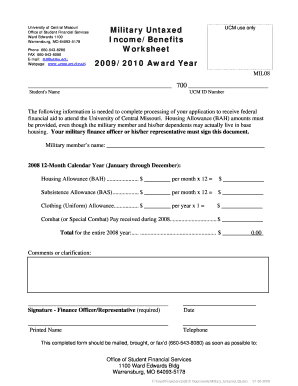

Military Untaxed IncomeBenefits Worksheet Award Year Form

What is the Military Untaxed Income Benefits Worksheet Award Year

The Military Untaxed Income Benefits Worksheet Award Year is a specific document used primarily by military personnel and their families to report untaxed income for financial aid purposes. This worksheet helps in determining eligibility for various federal student aid programs. It focuses on income sources that are not subject to federal taxation, ensuring that applicants accurately represent their financial situations when applying for assistance. Understanding this form is crucial for military families seeking educational support.

How to use the Military Untaxed Income Benefits Worksheet Award Year

Using the Military Untaxed Income Benefits Worksheet Award Year involves several steps. First, gather all relevant financial documents, including any records of untaxed income such as basic housing allowances, combat pay, or veteran benefits. Next, fill out the worksheet by accurately reporting these income sources in the designated sections. It is essential to follow the instructions carefully to ensure that all information is correct and complete. Once filled out, this worksheet should be submitted alongside other financial aid documents to the appropriate educational institution or financial aid office.

Steps to complete the Military Untaxed Income Benefits Worksheet Award Year

Completing the Military Untaxed Income Benefits Worksheet Award Year requires a systematic approach:

- Step one: Collect all necessary financial documents, including tax returns and records of untaxed income.

- Step two: Review the instructions provided with the worksheet to understand the required information.

- Step three: Fill out the form accurately, ensuring that all untaxed income is reported in the correct sections.

- Step four: Double-check the information for accuracy and completeness.

- Step five: Submit the completed worksheet along with other required financial aid documents.

Key elements of the Military Untaxed Income Benefits Worksheet Award Year

The Military Untaxed Income Benefits Worksheet Award Year includes several key elements that are vital for accurate reporting. These elements typically consist of sections for identifying the applicant, detailing specific untaxed income sources, and providing any additional information required by the financial aid office. Common untaxed income sources include military housing allowances, veteran benefits, and certain types of disability payments. Understanding these elements ensures that applicants can provide a comprehensive view of their financial situation.

Eligibility Criteria

Eligibility for using the Military Untaxed Income Benefits Worksheet Award Year generally includes military personnel, veterans, and their dependents who are applying for federal student aid. To qualify, applicants must demonstrate that they have untaxed income that needs to be reported for financial aid purposes. This worksheet is particularly relevant for those who may not have traditional income sources due to their military service. Meeting these criteria is essential for ensuring that the financial aid application is processed correctly.

Required Documents

When preparing to complete the Military Untaxed Income Benefits Worksheet Award Year, several documents are typically required. Applicants should gather:

- Most recent tax returns, if applicable.

- Documentation of untaxed income sources, such as military pay stubs or benefit statements.

- Any additional financial aid forms required by the educational institution.

Having these documents ready will streamline the process and help ensure that all information provided is accurate.

Quick guide on how to complete military untaxed incomebenefits worksheet award year

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files promptly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and eSign [SKS] without any stress

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Military Untaxed IncomeBenefits Worksheet Award Year

Create this form in 5 minutes!

How to create an eSignature for the military untaxed incomebenefits worksheet award year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Military Untaxed IncomeBenefits Worksheet Award Year?

The Military Untaxed IncomeBenefits Worksheet Award Year is a crucial document that helps military families accurately report untaxed income for financial aid purposes. This worksheet ensures that all relevant income sources are considered, allowing for a more accurate assessment of financial need.

-

How can airSlate SignNow assist with the Military Untaxed IncomeBenefits Worksheet Award Year?

airSlate SignNow provides an efficient platform for completing and eSigning the Military Untaxed IncomeBenefits Worksheet Award Year. Our user-friendly interface simplifies the process, ensuring that military families can easily fill out and submit their documents without hassle.

-

Is there a cost associated with using airSlate SignNow for the Military Untaxed IncomeBenefits Worksheet Award Year?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solutions ensure that military families can access the tools necessary for completing the Military Untaxed IncomeBenefits Worksheet Award Year without breaking the bank.

-

What features does airSlate SignNow offer for the Military Untaxed IncomeBenefits Worksheet Award Year?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features streamline the process of completing the Military Untaxed IncomeBenefits Worksheet Award Year, making it easier for users to manage their documents efficiently.

-

Can I integrate airSlate SignNow with other tools for the Military Untaxed IncomeBenefits Worksheet Award Year?

Absolutely! airSlate SignNow offers integrations with various applications, allowing users to connect their workflow seamlessly. This means you can easily incorporate the Military Untaxed IncomeBenefits Worksheet Award Year into your existing systems for enhanced productivity.

-

What are the benefits of using airSlate SignNow for military families?

Using airSlate SignNow provides military families with a secure and efficient way to manage their documents, including the Military Untaxed IncomeBenefits Worksheet Award Year. Our platform enhances accessibility and ensures that families can focus on what matters most while we handle the paperwork.

-

How secure is airSlate SignNow when handling the Military Untaxed IncomeBenefits Worksheet Award Year?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to protect sensitive information, ensuring that your Military Untaxed IncomeBenefits Worksheet Award Year and other documents are safe from unauthorized access.

Get more for Military Untaxed IncomeBenefits Worksheet Award Year

Find out other Military Untaxed IncomeBenefits Worksheet Award Year

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure