NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF 2023-2026

Understanding the NJHMFA Low Income Tax Credit Tenant Income Self-Certification

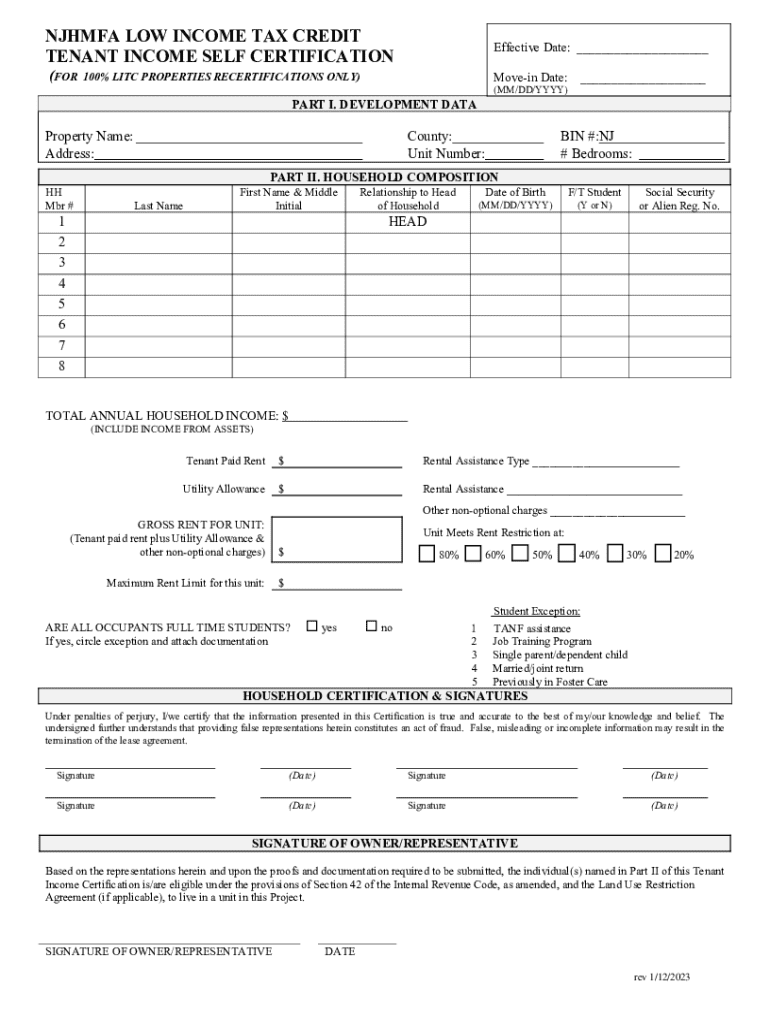

The NJHMFA Low Income Tax Credit Tenant Income Self-Certification is a crucial document for tenants in New Jersey seeking to qualify for various housing programs. This form allows tenants to self-report their income, which is essential for determining eligibility for low-income housing tax credits. It is designed to streamline the process for tenants, ensuring that those who meet the income requirements can receive the necessary benefits without extensive documentation. Understanding this form is vital for both tenants and landlords to navigate the complexities of housing assistance.

Steps to Complete the NJHMFA Low Income Tax Credit Tenant Income Self-Certification

Completing the NJHMFA Low Income Tax Credit Tenant Income Self-Certification involves several key steps:

- Gather necessary financial documents, such as pay stubs, tax returns, and any other income verification.

- Fill out the self-certification form accurately, ensuring all income sources are reported.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate housing authority or landlord as directed.

Following these steps helps ensure that the application process goes smoothly and that tenants can access the benefits they need.

Eligibility Criteria for the NJHMFA Low Income Tax Credit Tenant Income Self-Certification

Eligibility for the NJHMFA Low Income Tax Credit Tenant Income Self-Certification is primarily based on income levels. Tenants must meet specific income thresholds, which are determined by the area median income (AMI) for New Jersey. Additionally, factors such as family size and the type of housing may affect eligibility. It is essential for tenants to review these criteria carefully to ensure they qualify before submitting their self-certification.

Required Documents for the NJHMFA Low Income Tax Credit Tenant Income Self-Certification

When completing the NJHMFA Low Income Tax Credit Tenant Income Self-Certification, tenants must provide several key documents to support their income claims:

- Recent pay stubs or proof of income from employment.

- Tax returns from the previous year, including W-2 forms.

- Documentation of any additional income sources, such as social security, unemployment benefits, or child support.

Having these documents ready can facilitate a smoother certification process and help avoid delays in receiving assistance.

Legal Use of the NJHMFA Low Income Tax Credit Tenant Income Self-Certification

The NJHMFA Low Income Tax Credit Tenant Income Self-Certification is legally recognized as a valid method for tenants to report their income for housing assistance programs. Tenants must understand that providing false information on this form can result in penalties, including loss of benefits or legal action. It is crucial to ensure that all information reported is accurate and truthful to comply with legal requirements.

Form Submission Methods for the NJHMFA Low Income Tax Credit Tenant Income Self-Certification

Tenants can submit the NJHMFA Low Income Tax Credit Tenant Income Self-Certification through various methods, depending on the requirements of their housing authority or landlord. Common submission methods include:

- Online submission through designated housing authority portals.

- Mailing the completed form to the appropriate office.

- In-person submission at local housing authority offices.

Choosing the correct submission method is important to ensure that the form is received and processed in a timely manner.

Quick guide on how to complete njhmfa low income tax credit tenant income self

Easily prepare NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF on any gadget

The management of digital documents has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents rapidly without delays. Handle NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and electronically sign NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF effortlessly

- Locate NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your edits.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct njhmfa low income tax credit tenant income self

Create this form in 5 minutes!

How to create an eSignature for the njhmfa low income tax credit tenant income self

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to new jersey tenant income?

airSlate SignNow is a digital document management solution that allows users to send and eSign documents efficiently. For those dealing with new jersey tenant income, it simplifies the process of signing rental agreements and income verification forms, ensuring a smooth transaction.

-

How can airSlate SignNow help landlords verify new jersey tenant income?

With airSlate SignNow, landlords can easily create and send income verification forms to tenants. This streamlines the process of confirming new jersey tenant income, allowing for quicker approvals and reducing the time spent on paperwork.

-

What features does airSlate SignNow offer for managing new jersey tenant income documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking. These tools are particularly beneficial for managing new jersey tenant income documents, ensuring that all necessary paperwork is completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for managing new jersey tenant income?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and landlords. By reducing the time and resources spent on managing new jersey tenant income documentation, users can save money while ensuring compliance and efficiency.

-

Can airSlate SignNow integrate with other tools for managing new jersey tenant income?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including property management software. This integration allows users to manage new jersey tenant income more effectively by connecting all relevant tools in one platform.

-

What are the benefits of using airSlate SignNow for new jersey tenant income documentation?

Using airSlate SignNow for new jersey tenant income documentation offers numerous benefits, including enhanced security, faster processing times, and improved organization. These advantages help landlords and tenants alike to navigate the rental process with ease.

-

How secure is airSlate SignNow for handling new jersey tenant income information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information. This ensures that all new jersey tenant income data is handled securely, giving users peace of mind during the signing process.

Get more for NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF

Find out other NJHMFA LOW INCOME TAX CREDIT TENANT INCOME SELF

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT