Fair Credit Reporting Act FCRA University of Missouri St Louis Umsl Form

Understanding the Fair Credit Reporting Act (FCRA) at the University of Missouri St. Louis (UMSL)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how consumer reporting agencies collect, disseminate, and use consumer information. At the University of Missouri St. Louis, understanding the FCRA is essential for students and staff who may be involved in credit reporting processes. This act ensures that individuals have the right to access their credit reports, dispute inaccuracies, and understand how their information is used in decisions related to credit, employment, and insurance.

Steps to Complete the Fair Credit Reporting Act (FCRA) Process

Completing the FCRA process involves several key steps to ensure compliance and protection of consumer rights. First, individuals should obtain their credit reports from authorized agencies to review the information. Next, if any discrepancies are found, they must file a dispute with the reporting agency. It is crucial to provide documentation supporting the claim. Finally, follow up to ensure that the corrections have been made and that the updated report reflects accurate information.

Legal Use of the Fair Credit Reporting Act (FCRA) at UMSL

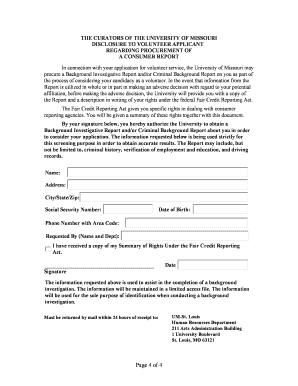

The FCRA outlines specific legal uses for consumer reports, particularly in employment and lending decisions. At UMSL, staff and faculty must adhere to these regulations when evaluating applicants or conducting background checks. It is important to obtain written consent from individuals before accessing their credit information and to inform them of their rights under the FCRA. Non-compliance can lead to legal repercussions and penalties.

Key Elements of the Fair Credit Reporting Act (FCRA)

Several key elements define the Fair Credit Reporting Act. These include the right to access one’s credit report, the ability to dispute inaccuracies, and the requirement for consumer reporting agencies to investigate disputes. Additionally, the FCRA mandates that consumers be notified when their credit information is used adversely, such as in loan denials or employment rejections. Understanding these elements is vital for both consumers and entities that utilize credit reports.

Examples of Using the Fair Credit Reporting Act (FCRA)

Practical examples of the FCRA in action include situations where a student applies for a credit card or a job. In these cases, the financial institution or employer must obtain the applicant's consent to access their credit report. If an application is denied based on the credit report, the individual must receive a notice explaining the reason. This transparency is a fundamental aspect of the FCRA, ensuring that consumers are informed and can take action if necessary.

Eligibility Criteria for FCRA Protections

Eligibility for protections under the Fair Credit Reporting Act applies to all consumers in the United States. This includes students, employees, and anyone whose credit information is accessed by third parties. To benefit from these protections, individuals should be aware of their rights and the processes involved in accessing and disputing their credit information. Understanding eligibility helps ensure that consumers can effectively navigate the credit reporting landscape.

Quick guide on how to complete fair credit reporting act fcra university of missouri st louis umsl

Effortlessly Handle [SKS] on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with features that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious searches for forms, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fair credit reporting act fcra university of missouri st louis umsl

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fair Credit Reporting Act FCRA and how does it relate to the University Of Missouri St Louis Umsl?

The Fair Credit Reporting Act FCRA is a federal law that regulates the collection, dissemination, and use of consumer information, including credit information. At the University Of Missouri St Louis Umsl, understanding FCRA compliance is crucial for institutions handling student and employee data. This ensures that all parties involved are aware of their rights and responsibilities regarding credit reporting.

-

How can airSlate SignNow help with FCRA compliance at the University Of Missouri St Louis Umsl?

airSlate SignNow provides a secure platform for sending and eSigning documents, which can help the University Of Missouri St Louis Umsl maintain compliance with the Fair Credit Reporting Act FCRA. By using our solution, institutions can ensure that sensitive information is handled properly and that all necessary disclosures are made to consumers. This minimizes the risk of non-compliance and enhances data security.

-

What features does airSlate SignNow offer that support FCRA compliance?

airSlate SignNow offers features such as secure document storage, audit trails, and customizable templates that support compliance with the Fair Credit Reporting Act FCRA. These features ensure that all transactions are documented and traceable, which is essential for maintaining compliance at the University Of Missouri St Louis Umsl. Additionally, our platform allows for easy access to important documents whenever needed.

-

Is airSlate SignNow a cost-effective solution for the University Of Missouri St Louis Umsl?

Yes, airSlate SignNow is designed to be a cost-effective solution for institutions like the University Of Missouri St Louis Umsl. Our pricing plans are flexible and cater to various needs, ensuring that you only pay for what you use. This affordability allows universities to allocate resources more efficiently while still ensuring compliance with the Fair Credit Reporting Act FCRA.

-

What are the benefits of using airSlate SignNow for document management related to FCRA?

Using airSlate SignNow for document management related to the Fair Credit Reporting Act FCRA offers numerous benefits, including enhanced security, improved efficiency, and streamlined workflows. The platform allows the University Of Missouri St Louis Umsl to manage sensitive documents securely while ensuring that all necessary compliance measures are met. This leads to faster processing times and reduced administrative burdens.

-

Can airSlate SignNow integrate with other systems used at the University Of Missouri St Louis Umsl?

Absolutely! airSlate SignNow can integrate seamlessly with various systems used at the University Of Missouri St Louis Umsl, enhancing overall efficiency. This integration capability allows for better data management and ensures that compliance with the Fair Credit Reporting Act FCRA is maintained across all platforms. Our API and pre-built integrations make it easy to connect with existing software.

-

How does airSlate SignNow ensure the security of documents related to FCRA?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect documents related to the Fair Credit Reporting Act FCRA. This ensures that sensitive information handled by the University Of Missouri St Louis Umsl is safeguarded against unauthorized access. Our commitment to security helps institutions maintain compliance and build trust with their stakeholders.

Get more for Fair Credit Reporting Act FCRA University Of Missouri St Louis Umsl

Find out other Fair Credit Reporting Act FCRA University Of Missouri St Louis Umsl

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free