New Mexico Pit X Form 2023

What is the New Mexico Pit X Form

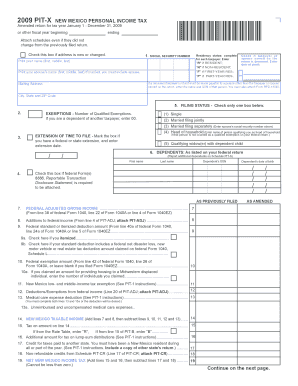

The New Mexico Pit X Form is a specific document used primarily for reporting and remitting taxes related to the extraction of natural resources in the state. This form is essential for businesses and individuals involved in activities such as mining, oil, and gas extraction. It provides the state with necessary information about the volume of resources extracted and the corresponding taxes owed. Proper completion and submission of this form ensure compliance with state regulations and help avoid potential penalties.

How to use the New Mexico Pit X Form

Using the New Mexico Pit X Form involves several steps to ensure accurate reporting. First, gather all relevant data regarding the resources extracted, including quantities and types. Next, fill out the form with this information, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline to the appropriate state agency, either electronically or via mail, depending on your preference.

Steps to complete the New Mexico Pit X Form

Completing the New Mexico Pit X Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all necessary data on resource extraction, including dates, quantities, and types of materials.

- Access the form through the official state website or obtain a physical copy from a state office.

- Fill in the required fields, ensuring all information is accurate and complete.

- Double-check the form for any errors or missing information.

- Submit the completed form by the deadline, choosing your preferred submission method.

Legal use of the New Mexico Pit X Form

The New Mexico Pit X Form serves a legal purpose in the state’s regulatory framework. It is used to ensure compliance with state tax laws regarding natural resource extraction. Accurate reporting through this form helps maintain transparency and accountability in resource management. Failure to use the form correctly can result in legal repercussions, including fines or other penalties, emphasizing the importance of adherence to state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Pit X Form are crucial for compliance. Typically, the form must be submitted quarterly, with specific due dates depending on the reporting period. It is important to stay informed about these dates to avoid late submissions, which can incur penalties. Keeping a calendar of important dates related to the form can help ensure timely filing and compliance with state requirements.

Required Documents

To complete the New Mexico Pit X Form, certain documents may be required. These typically include:

- Records of resource extraction activities, including quantities and types of materials.

- Previous tax returns related to resource extraction, if applicable.

- Any correspondence from state agencies regarding previous submissions or compliance issues.

Having these documents ready can streamline the completion process and ensure that all necessary information is reported accurately.

Quick guide on how to complete new mexico pit x form

Prepare New Mexico Pit X Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage New Mexico Pit X Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-centered activity today.

How to modify and electronically sign New Mexico Pit X Form effortlessly

- Locate New Mexico Pit X Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to store your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign New Mexico Pit X Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico pit x form

Create this form in 5 minutes!

How to create an eSignature for the new mexico pit x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Mexico Pit X Form?

The New Mexico Pit X Form is a specific document required for certain transactions in New Mexico, particularly related to oil and gas operations. It ensures compliance with state regulations and facilitates the proper management of resources. Using airSlate SignNow, you can easily create, send, and eSign this form to streamline your processes.

-

How can airSlate SignNow help with the New Mexico Pit X Form?

airSlate SignNow provides a user-friendly platform to manage the New Mexico Pit X Form efficiently. You can customize the form, add necessary fields, and send it for eSignature in just a few clicks. This not only saves time but also ensures that your documents are legally binding and secure.

-

Is there a cost associated with using airSlate SignNow for the New Mexico Pit X Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost depends on the features you choose, but it remains a cost-effective solution for managing the New Mexico Pit X Form and other documents. You can start with a free trial to explore the platform before committing.

-

What features does airSlate SignNow offer for the New Mexico Pit X Form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning for the New Mexico Pit X Form. Additionally, you can track document status in real-time and integrate with other applications to enhance your workflow. These features make it easier to manage your documentation needs.

-

Can I integrate airSlate SignNow with other software for the New Mexico Pit X Form?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow when handling the New Mexico Pit X Form. Whether you use CRM systems, cloud storage, or project management tools, you can connect them seamlessly with airSlate SignNow.

-

What are the benefits of using airSlate SignNow for the New Mexico Pit X Form?

Using airSlate SignNow for the New Mexico Pit X Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document management, which can signNowly speed up your business processes. Additionally, it helps ensure compliance with state regulations.

-

Is airSlate SignNow secure for handling the New Mexico Pit X Form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the New Mexico Pit X Form. The platform employs advanced encryption and security protocols to protect your documents and data. You can trust that your information is secure while using airSlate SignNow.

Get more for New Mexico Pit X Form

Find out other New Mexico Pit X Form

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple