*80160200* Taxation and Revenue Department New Mexico Tax Newmexico 2008

What is the 80160200 Taxation And Revenue Department New Mexico Tax Newmexico

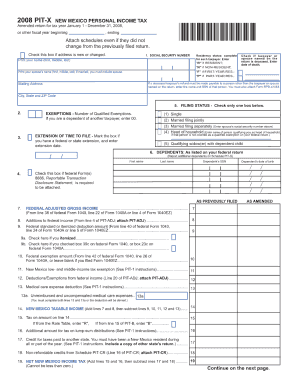

The 80160200 form is a crucial document issued by the Taxation and Revenue Department of New Mexico. It serves as a means for individuals and businesses to report their tax obligations to the state. This form encompasses various tax-related information, including income, deductions, and credits applicable under New Mexico tax law. Understanding the purpose and requirements of this form is essential for compliance and accurate tax reporting.

Steps to complete the 80160200 Taxation And Revenue Department New Mexico Tax Newmexico

Completing the 80160200 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with precise information, ensuring that all fields are completed as required. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form through the appropriate method, whether online, by mail, or in person.

Legal use of the 80160200 Taxation And Revenue Department New Mexico Tax Newmexico

The legal use of the 80160200 form is governed by New Mexico tax laws and regulations. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Additionally, it is crucial to retain copies of submitted forms for record-keeping and potential audits. Understanding the legal implications of this form can help taxpayers avoid penalties and ensure compliance with state tax requirements.

Required Documents

When completing the 80160200 form, several documents are typically required to substantiate the information provided. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can streamline the completion process and enhance the accuracy of the submitted information.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 80160200 form to avoid penalties. Typically, individual taxpayers must submit their forms by April 15 of each year. However, specific deadlines may vary based on individual circumstances, such as extensions or special provisions for certain taxpayers. Keeping track of these dates is vital for maintaining compliance with New Mexico tax laws.

Form Submission Methods (Online / Mail / In-Person)

The 80160200 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New Mexico Taxation and Revenue Department's website

- Mailing the completed form to the designated address

- In-person submission at local tax offices

Choosing the appropriate submission method can depend on personal preference and the urgency of the filing.

Quick guide on how to complete 80160200 taxation and revenue department new mexico tax newmexico

Complete *80160200* Taxation And Revenue Department New Mexico Tax Newmexico effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage *80160200* Taxation And Revenue Department New Mexico Tax Newmexico on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign *80160200* Taxation And Revenue Department New Mexico Tax Newmexico without breaking a sweat

- Acquire *80160200* Taxation And Revenue Department New Mexico Tax Newmexico and click Get Form to initiate.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign *80160200* Taxation And Revenue Department New Mexico Tax Newmexico and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 80160200 taxation and revenue department new mexico tax newmexico

Create this form in 5 minutes!

How to create an eSignature for the 80160200 taxation and revenue department new mexico tax newmexico

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the *80160200* Taxation And Revenue Department New Mexico Tax Newmexico?

The *80160200* Taxation And Revenue Department New Mexico Tax Newmexico plays a crucial role in ensuring compliance with state tax laws and regulations. Understanding its significance helps businesses navigate their tax obligations effectively, which can be facilitated by using airSlate SignNow for eSignatures and document management.

-

How can airSlate SignNow help with New Mexico tax documentation?

airSlate SignNow streamlines the process of preparing and signing tax documents for the *80160200* Taxation And Revenue Department New Mexico Tax Newmexico. With its easy-to-use interface, businesses can easily send, sign, and store essential tax documents, ensuring they meet all regulatory requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs. Each plan provides access to various features that can aid in managing documents related to the *80160200* Taxation And Revenue Department New Mexico Tax Newmexico, making it a cost-effective solution.

-

What features does airSlate SignNow provide for tax compliance?

airSlate SignNow offers features like customizable templates, secure eSignature capabilities, and robust storage solutions. These features are instrumental for businesses dealing with the *80160200* Taxation And Revenue Department New Mexico Tax Newmexico, ensuring they maintain tax compliance and organized documentation.

-

Is airSlate SignNow user-friendly for managing New Mexico tax documents?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for businesses to manage their New Mexico tax documents. Its intuitive interface simplifies the signing and sharing process, particularly for documents related to the *80160200* Taxation And Revenue Department New Mexico Tax Newmexico.

-

Can airSlate SignNow integrate with other business tools for tax management?

airSlate SignNow offers integration capabilities with various business applications, enhancing the document management process. This is particularly beneficial for tasks related to the *80160200* Taxation And Revenue Department New Mexico Tax Newmexico, as it allows seamless workflow and data transfer.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides several benefits, including increased efficiency, reduced errors, and secure document handling. These advantages ensure businesses can effectively manage compliance with the *80160200* Taxation And Revenue Department New Mexico Tax Newmexico requirements.

Get more for *80160200* Taxation And Revenue Department New Mexico Tax Newmexico

Find out other *80160200* Taxation And Revenue Department New Mexico Tax Newmexico

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free