Ag990 Il 2019-2026

What is the Ag990 Il

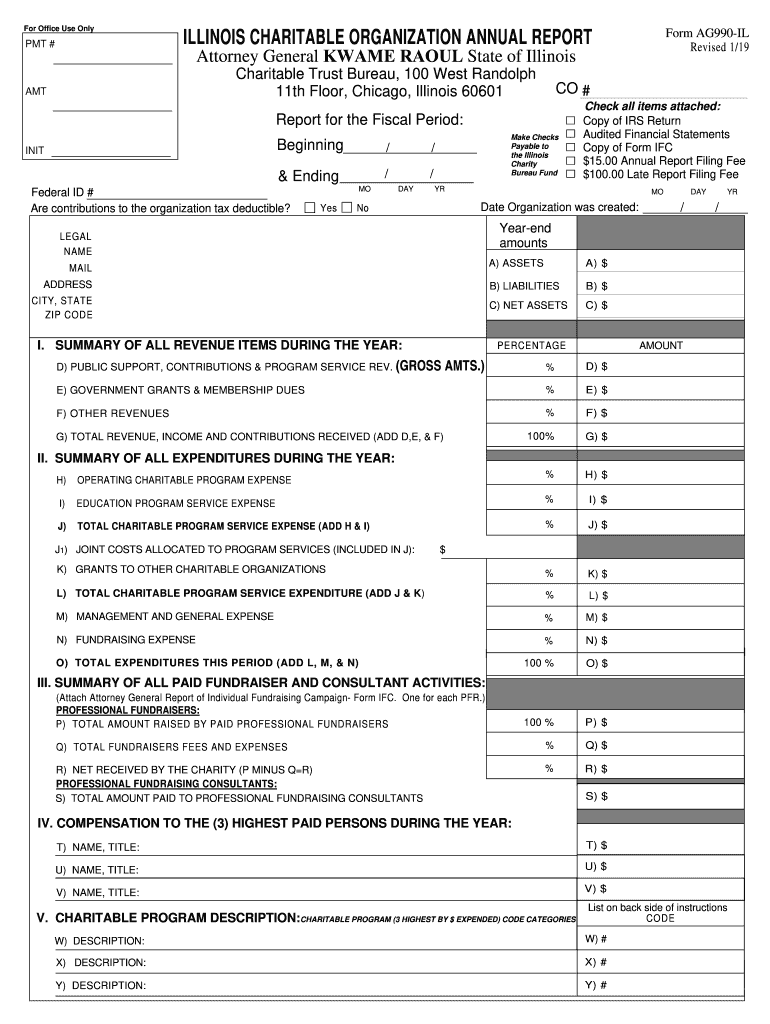

The Ag990 Il is a form used by charitable organizations in Illinois to report their annual activities and financial information to the Illinois Attorney General's office. This form is essential for maintaining compliance with state regulations governing charitable organizations. It helps ensure transparency and accountability in how these organizations operate, providing a detailed overview of their income, expenses, and overall financial health.

Steps to complete the Ag990 Il

Completing the Ag990 Il involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant supporting documentation. Next, fill out the form with accurate information regarding your organization’s activities, finances, and governance. It is crucial to double-check all entries for accuracy before submission. Finally, submit the completed form either electronically or by mail, ensuring that it is sent to the correct office and within the required deadlines.

Legal use of the Ag990 Il

The Ag990 Il serves as a legally recognized document that demonstrates a charitable organization’s compliance with state laws. To be considered valid, the form must be completed accurately and submitted on time. The information provided within the form can be used by the Illinois Attorney General to assess the organization’s adherence to regulations and can also be reviewed by the public, ensuring transparency in charitable operations. Failure to submit the form correctly may result in penalties or loss of charitable status.

Filing Deadlines / Important Dates

Timely submission of the Ag990 Il is critical for compliance. Organizations must file this form within six months after the end of their fiscal year. For instance, if your organization’s fiscal year ends on December 31, the Ag990 Il must be filed by June 30 of the following year. It is important to mark these deadlines on your calendar and allow sufficient time for preparation and submission to avoid any potential penalties.

Required Documents

To complete the Ag990 Il, several documents are typically required. These include:

- Financial statements, including income and expense reports

- Balance sheets detailing assets and liabilities

- Board meeting minutes that reflect governance activities

- Any additional documentation that supports the financial claims made in the form

Having these documents ready will streamline the completion process and ensure that all required information is accurately reported.

Form Submission Methods

The Ag990 Il can be submitted through various methods to accommodate different organizational preferences. Organizations may choose to file the form electronically through the Illinois Attorney General's website or send a hard copy via mail. In-person submissions may also be possible, depending on the office's policies. It is essential to confirm the preferred submission method and ensure that all required documents accompany the form to avoid delays.

Penalties for Non-Compliance

Failure to file the Ag990 Il on time or providing inaccurate information can lead to significant penalties. Organizations may face fines, loss of tax-exempt status, or other legal repercussions. It is crucial for organizations to understand the importance of compliance and to take the necessary steps to ensure that the form is completed and submitted accurately and on time. Regular audits and reviews of organizational practices can help mitigate risks associated with non-compliance.

Quick guide on how to complete kwame raoul gets late support amid concerns of attorney general

Effortlessly Prepare Ag990 Il on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Ag990 Il on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to alter and eSign Ag990 Il with ease

- Locate Ag990 Il and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Ag990 Il and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kwame raoul gets late support amid concerns of attorney general

How to make an electronic signature for the Kwame Raoul Gets Late Support Amid Concerns Of Attorney General in the online mode

How to create an electronic signature for your Kwame Raoul Gets Late Support Amid Concerns Of Attorney General in Chrome

How to generate an eSignature for signing the Kwame Raoul Gets Late Support Amid Concerns Of Attorney General in Gmail

How to make an electronic signature for the Kwame Raoul Gets Late Support Amid Concerns Of Attorney General right from your smartphone

How to generate an eSignature for the Kwame Raoul Gets Late Support Amid Concerns Of Attorney General on iOS

How to make an eSignature for the Kwame Raoul Gets Late Support Amid Concerns Of Attorney General on Android devices

People also ask

-

What is ag990, and how does it integrate with airSlate SignNow?

The ag990 is a powerful feature within airSlate SignNow that streamlines the eSigning process. It allows users to create, send, and manage documents seamlessly, ensuring secure and efficient transactions. By leveraging ag990, businesses can enhance their document management capabilities and improve overall productivity.

-

How much does airSlate SignNow cost with the ag990 feature?

Pricing for airSlate SignNow, including the ag990 feature, is tailored to fit various business needs. Plans start at an affordable rate that scales based on the number of users and features required. Investing in ag990 not only ensures compliance but also maximizes your return on investment through increased efficiency.

-

What are the key features of ag990 in airSlate SignNow?

Ag990 within airSlate SignNow offers robust features such as advanced document tracking, customizable templates, and secure cloud storage. It also includes user-friendly interfaces for both senders and signers, reducing friction in the eSigning process. These features help businesses stay organized while simplifying their workflow.

-

How does using ag990 benefit my business?

Utilizing ag990 can signNowly reduce the time it takes to get documents signed, allowing your business to close deals faster. The increased document visibility and streamlined processes enhance team collaboration and customer satisfaction. Ultimately, adopting ag990 positions your business for greater success and operational efficiency.

-

Does airSlate SignNow with ag990 offer mobile support?

Yes, airSlate SignNow with the ag990 feature is fully optimized for mobile devices. This ensures that users can send, sign, and manage documents on-the-go, making it ideal for remote work environments. The mobile experience is designed to be just as seamless as the desktop, providing flexibility and convenience.

-

What integrations are available with airSlate SignNow and the ag990 feature?

Ag990 integrates seamlessly with a variety of popular applications, including CRM systems, project management tools, and cloud storage solutions. This interoperability enhances workflow efficiency by allowing users to connect their existing tools directly with airSlate SignNow. With these integrations, you can automate processes and save time.

-

Is training available for using the ag990 feature in airSlate SignNow?

Absolutely! AirSlate SignNow provides comprehensive training resources for users to fully leverage the capabilities of the ag990 feature. Whether through webinars, tutorials, or one-on-one sessions, you can gain the knowledge needed to maximize your efficiency with airSlate SignNow.

Get more for Ag990 Il

- Sample athletic financial aid agreement letter athletic scholarships athleticscholarships form

- Liberty mutual direct depositach credit authorization form

- Affidavit of fraud notice of transaction dispute card cahp form

- How to begin ach payments market usa federal credit union form

- Application for charitable organization property tax form

- Western metal industry pension fund physical addre form

- Electronic funds transfer eft direct deposit form

- Fte word doc template federal title form

Find out other Ag990 Il

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself