CFWB 015 Referral to Employer for Employee Income Information CFWB 015 Referral to Employer for Employee Income Information 2022

Understanding the CFWB 015 Referral To Employer For Employee Income Information

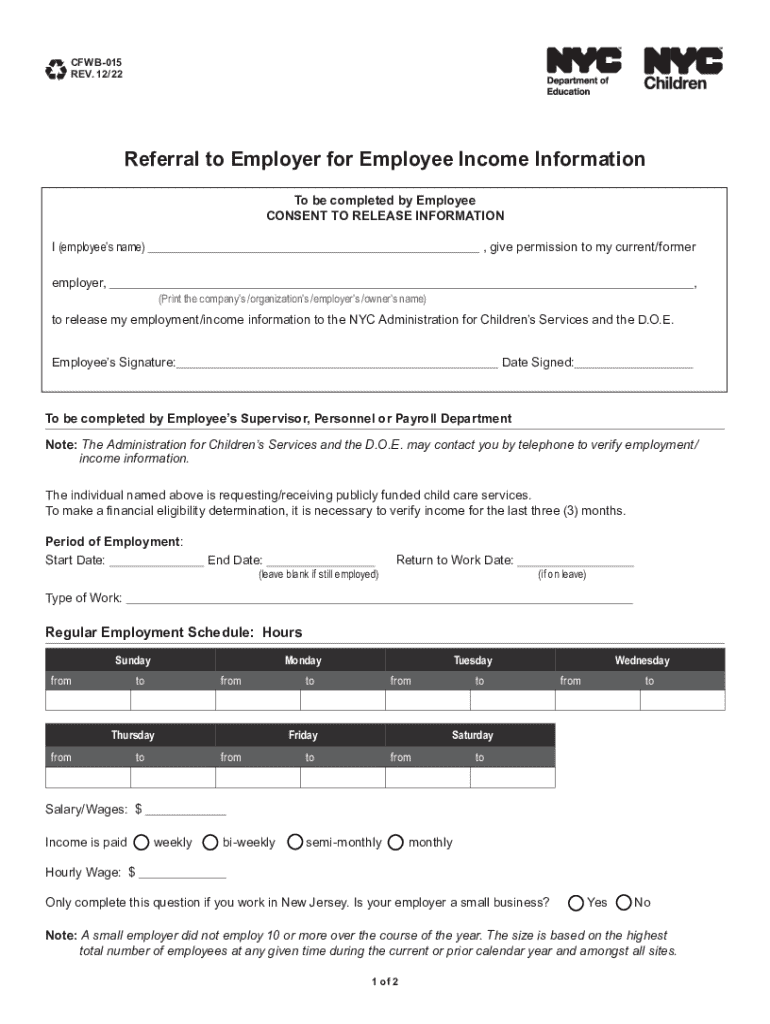

The CFWB 015 Referral To Employer For Employee Income Information is a crucial document used to request income verification from an employee's employer. This form is typically utilized in various contexts, including government assistance programs, loan applications, and other financial assessments where proof of income is necessary. By providing accurate and timely income information, employers can help facilitate the verification process, ensuring that employees receive the support or services they need.

How to Use the CFWB 015 Referral To Employer For Employee Income Information

Using the CFWB 015 Referral To Employer For Employee Income Information involves a straightforward process. First, the requesting party, such as a government agency or financial institution, fills out the form with the necessary details about the employee. This includes the employee's name, social security number, and the specific income information required. Once completed, the form is sent to the employer, who is responsible for providing the requested income verification. It is essential for employers to respond promptly to ensure that the employee's application or request is processed without delays.

Steps to Complete the CFWB 015 Referral To Employer For Employee Income Information

Completing the CFWB 015 Referral To Employer For Employee Income Information involves several key steps:

- Gather necessary employee information, including full name, social security number, and employment details.

- Fill out the form accurately, ensuring all required fields are completed.

- Specify the type of income verification needed, such as gross income, bonuses, or other compensation.

- Submit the completed form to the appropriate employer contact, either via mail or electronically.

- Follow up with the employer to confirm receipt and inquire about the timeline for providing the requested information.

Legal Use of the CFWB 015 Referral To Employer For Employee Income Information

The CFWB 015 Referral To Employer For Employee Income Information is legally recognized as a valid request for income verification. Employers are typically obligated to provide accurate income information as requested, as long as the request complies with relevant privacy laws and regulations. It is important for both employers and employees to understand their rights and responsibilities regarding the use of this form, ensuring that all information is handled confidentially and appropriately.

Key Elements of the CFWB 015 Referral To Employer For Employee Income Information

Several key elements are essential to the CFWB 015 Referral To Employer For Employee Income Information:

- Employee Identification: The form must include identifying details about the employee to ensure accurate processing.

- Income Details: Clearly specify the type of income required and the period it covers.

- Employer Information: Include contact information for the employer to facilitate communication.

- Signature: The form may require a signature from the employee to authorize the release of their income information.

Examples of Using the CFWB 015 Referral To Employer For Employee Income Information

There are various scenarios where the CFWB 015 Referral To Employer For Employee Income Information may be used, including:

- Government Assistance Programs: Agencies may request this form to verify income for eligibility in programs such as food assistance or housing support.

- Loan Applications: Financial institutions often require proof of income to assess an applicant's ability to repay a loan.

- Child Support Cases: Courts may use this form to determine income levels for calculating support obligations.

Quick guide on how to complete cfwb 015 referral to employer for employee income information cfwb 015 referral to employer for employee income information

Effortlessly Prepare CFWB 015 Referral To Employer For Employee Income Information CFWB 015 Referral To Employer For Employee Income Information on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delay. Handle CFWB 015 Referral To Employer For Employee Income Information CFWB 015 Referral To Employer For Employee Income Information on any platform with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and Electronically Sign CFWB 015 Referral To Employer For Employee Income Information CFWB 015 Referral To Employer For Employee Income Information with Ease

- Find CFWB 015 Referral To Employer For Employee Income Information CFWB 015 Referral To Employer For Employee Income Information and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to confirm your changes.

- Select your preferred method to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign CFWB 015 Referral To Employer For Employee Income Information CFWB 015 Referral To Employer For Employee Income Information to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cfwb 015 referral to employer for employee income information cfwb 015 referral to employer for employee income information

Create this form in 5 minutes!

How to create an eSignature for the cfwb 015 referral to employer for employee income information cfwb 015 referral to employer for employee income information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CFWB 015 Referral To Employer For Employee Income Information?

The CFWB 015 Referral To Employer For Employee Income Information is a document used to request income verification from an employer. This form is essential for various applications, including loans and government assistance programs. Utilizing airSlate SignNow simplifies the process of sending and signing this document electronically.

-

How does airSlate SignNow facilitate the CFWB 015 Referral To Employer For Employee Income Information?

airSlate SignNow allows users to easily create, send, and eSign the CFWB 015 Referral To Employer For Employee Income Information. Our platform streamlines the workflow, ensuring that all parties can access and sign the document quickly. This efficiency helps reduce delays in obtaining necessary income information.

-

What are the pricing options for using airSlate SignNow for the CFWB 015 Referral To Employer For Employee Income Information?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that enhance the management of documents like the CFWB 015 Referral To Employer For Employee Income Information. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document handling.

-

What features does airSlate SignNow offer for managing the CFWB 015 Referral To Employer For Employee Income Information?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage for the CFWB 015 Referral To Employer For Employee Income Information. These tools help ensure that your documents are handled securely and efficiently. Additionally, you can automate reminders for signers to expedite the process.

-

Can I integrate airSlate SignNow with other software for the CFWB 015 Referral To Employer For Employee Income Information?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for the CFWB 015 Referral To Employer For Employee Income Information. You can connect with CRM systems, cloud storage solutions, and more to streamline your document management process. This flexibility allows you to work within your existing systems seamlessly.

-

What are the benefits of using airSlate SignNow for the CFWB 015 Referral To Employer For Employee Income Information?

Using airSlate SignNow for the CFWB 015 Referral To Employer For Employee Income Information provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our electronic signature solution ensures that your documents are signed quickly and securely, allowing you to focus on your core business activities. This can lead to faster processing times and improved customer satisfaction.

-

Is airSlate SignNow secure for handling the CFWB 015 Referral To Employer For Employee Income Information?

Absolutely, airSlate SignNow prioritizes security for all documents, including the CFWB 015 Referral To Employer For Employee Income Information. We utilize advanced encryption and compliance with industry standards to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

Get more for CFWB 015 Referral To Employer For Employee Income Information CFWB 015 Referral To Employer For Employee Income Information

Find out other CFWB 015 Referral To Employer For Employee Income Information CFWB 015 Referral To Employer For Employee Income Information

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document