Utah Withholding State Form 2015-2026

What is the Utah Withholding State Form

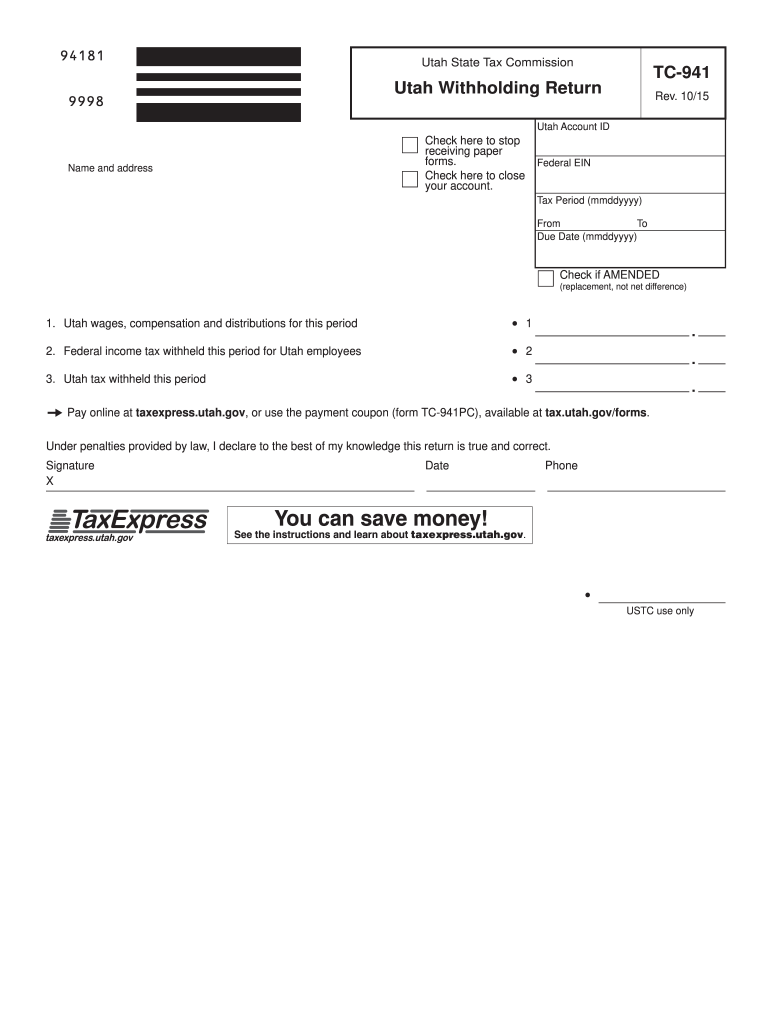

The Utah withholding state form, commonly referred to as the TC-941, is a crucial document for employers in Utah. It is used to report and remit state income tax withheld from employees' wages. This form ensures compliance with state tax laws and helps maintain accurate tax records. Employers must file this form quarterly, detailing the amount withheld for each employee, which is essential for both state revenue and employee tax obligations.

Steps to complete the Utah Withholding State Form

Completing the TC-941 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee details and the total amount of state income tax withheld during the reporting period. Next, fill out the form with precise figures, ensuring that calculations are correct. After completing the form, review it for any errors before submission. Finally, submit the form either electronically or via mail, depending on your preferred method.

How to obtain the Utah Withholding State Form

The TC-941 form can be easily obtained from the Utah State Tax Commission's official website. This resource provides the latest version of the form, along with any updates or changes in filing requirements. Additionally, employers can access the form through various tax software solutions that support Utah state tax filings, ensuring they have the most current information at their fingertips.

Legal use of the Utah Withholding State Form

The Utah withholding state form is legally binding when completed correctly and submitted on time. It must adhere to the guidelines set forth by the Utah State Tax Commission, including accurate reporting of withheld amounts. Failure to comply with these regulations can result in penalties or interest charges. Therefore, it is essential for employers to understand the legal implications of this form and ensure that it is filled out and submitted in accordance with state laws.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the TC-941 form to avoid penalties. The form is due on the last day of the month following the end of each quarter. Specifically, for the first quarter, the deadline is April 30; for the second quarter, it is July 31; for the third quarter, it is October 31; and for the fourth quarter, it is January 31 of the following year. Keeping track of these dates is vital for maintaining compliance with state tax regulations.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Utah withholding state form can lead to significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential audits. The Utah State Tax Commission emphasizes the importance of timely and accurate filings to avoid these consequences. Employers should stay informed about their obligations to prevent any issues related to non-compliance.

Quick guide on how to complete tc 941 form 2015 2019

Complete Utah Withholding State Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage Utah Withholding State Form on any device using airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest way to edit and eSign Utah Withholding State Form without any hassle

- Obtain Utah Withholding State Form and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Utah Withholding State Form and ensure exceptional communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 941 form 2015 2019

How to generate an eSignature for the Tc 941 Form 2015 2019 online

How to create an electronic signature for the Tc 941 Form 2015 2019 in Google Chrome

How to generate an eSignature for putting it on the Tc 941 Form 2015 2019 in Gmail

How to create an eSignature for the Tc 941 Form 2015 2019 straight from your smartphone

How to make an eSignature for the Tc 941 Form 2015 2019 on iOS devices

How to create an eSignature for the Tc 941 Form 2015 2019 on Android devices

People also ask

-

What is Utah tax withholding and how does it work?

Utah tax withholding refers to the process by which employers deduct state income tax from their employees' paychecks before issuing them. This ensures that the appropriate tax amounts are remitted to the state of Utah on behalf of the employee, thus preventing any large tax liabilities at the end of the year.

-

How can airSlate SignNow help with managing Utah tax withholding forms?

airSlate SignNow offers a streamlined solution for managing Utah tax withholding forms by allowing businesses to easily send, receive, and eSign necessary documents. Utilizing our platform minimizes paperwork and enhances efficiency in tracking and submitting required forms for compliant tax withholding in Utah.

-

Are there any costs associated with using airSlate SignNow for Utah tax withholding purposes?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features that facilitate the management of Utah tax withholding documents. We provide a cost-effective solution that reduces administrative burdens, ensuring you only pay for what you require without compromising on quality.

-

What features does airSlate SignNow provide for handling tax withholding documents?

AirSlate SignNow provides several features such as customizable templates, secure electronic signatures, automatic reminders, and an intuitive dashboard to manage Utah tax withholding documents effectively. These tools enhance productivity, ensuring you focus on your core business activities while maintaining compliance.

-

Can I integrate airSlate SignNow with other software to manage Utah tax withholding?

Absolutely! airSlate SignNow offers seamless integrations with various HR and payroll software solutions, making it easy to manage Utah tax withholding alongside your existing systems. These integrations enhance workflow efficiency and ensure that the necessary tax documents are processed accurately.

-

How does airSlate SignNow improve compliance for Utah tax withholding?

By using airSlate SignNow, businesses can ensure that their Utah tax withholding processes are compliant with state regulations. The platform allows for easy tracking of document statuses, secure storage of signed documents, and automated reminders, all of which contribute to seamless compliance.

-

What are the benefits of using airSlate SignNow for Utah tax withholding?

The benefits of using airSlate SignNow for Utah tax withholding include increased efficiency, reduced paperwork, and improved accuracy in document management. Businesses can save time and resources by utilizing our platform, allowing them to focus on their growth while staying compliant with tax obligations.

Get more for Utah Withholding State Form

Find out other Utah Withholding State Form

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast