R20128 2016-2026

What is the R20125?

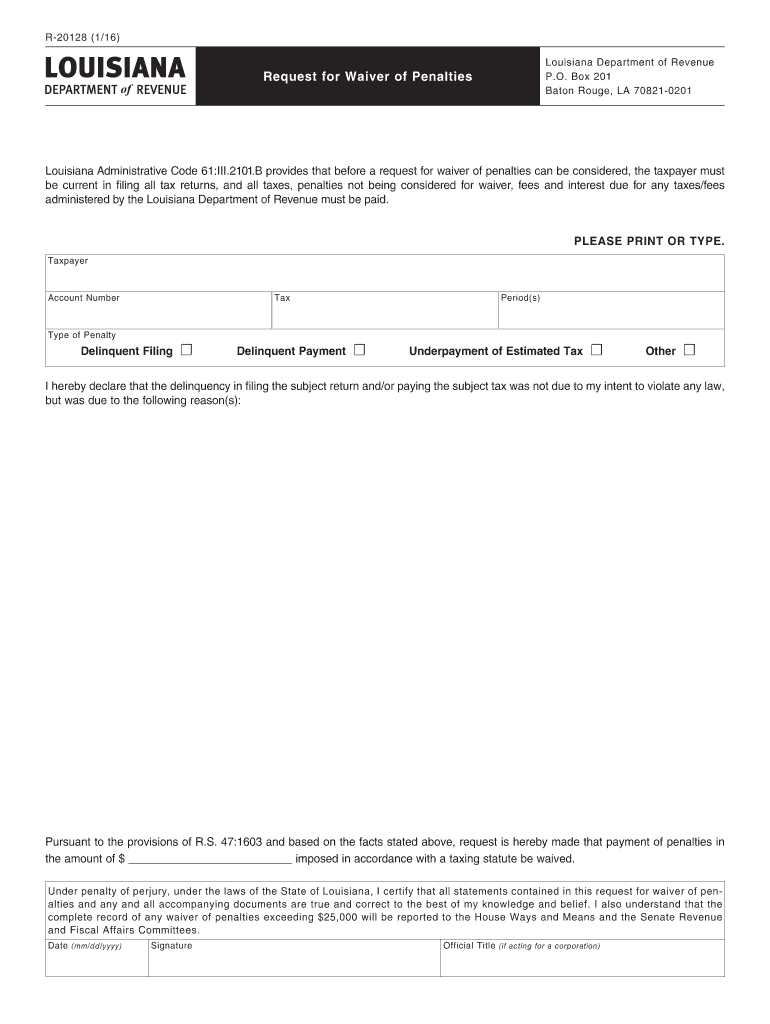

The R20125 form is a specific document used in the state of Louisiana, primarily associated with tax-related matters. It serves as a formal request or declaration that individuals or businesses must submit to comply with state regulations. Understanding the purpose and requirements of the R20125 is essential for ensuring proper compliance with Louisiana tax laws.

How to use the R20125

Utilizing the R20125 form involves several steps. First, gather all necessary information and documentation required for completion. This may include personal identification details, financial records, and any relevant tax information. Once you have all the information, fill out the form accurately, ensuring that all sections are completed as required. After filling out the form, review it for any errors before submission to avoid delays or complications.

Steps to complete the R20125

Completing the R20125 form can be straightforward if you follow these steps:

- Begin by downloading the form from the official Louisiana Department of Revenue website or accessing it through a trusted source.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide details related to the specific tax issue or request you are addressing with this form.

- Review all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal use of the R20125

The R20125 form must be used in accordance with Louisiana state laws. This includes adhering to deadlines for submission and ensuring that all information provided is truthful and accurate. Legal compliance is crucial as any discrepancies or omissions may result in penalties or delays in processing your request. Utilizing a reliable eSigning platform can help ensure that your submission meets all legal requirements.

Who Issues the Form

The Louisiana Department of Revenue is the official body responsible for issuing the R20125 form. This department oversees the collection of state taxes and ensures compliance with tax laws. For any questions or clarifications regarding the form, individuals can reach out to the Louisiana Department of Revenue directly for assistance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the R20125 form can lead to various penalties. These may include financial fines, interest on unpaid taxes, or legal action if the non-compliance is severe. It is essential to understand the implications of not submitting the form correctly and on time to avoid these potential consequences.

Quick guide on how to complete annual application for exemption from collection of louisiana sales taxes at certain fund raising activities

Effortlessly prepare R20128 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage R20128 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign R20128 effortlessly

- Find R20128 and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign R20128 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annual application for exemption from collection of louisiana sales taxes at certain fund raising activities

How to create an eSignature for the Annual Application For Exemption From Collection Of Louisiana Sales Taxes At Certain Fund Raising Activities online

How to create an electronic signature for your Annual Application For Exemption From Collection Of Louisiana Sales Taxes At Certain Fund Raising Activities in Chrome

How to make an eSignature for signing the Annual Application For Exemption From Collection Of Louisiana Sales Taxes At Certain Fund Raising Activities in Gmail

How to generate an electronic signature for the Annual Application For Exemption From Collection Of Louisiana Sales Taxes At Certain Fund Raising Activities right from your smart phone

How to generate an electronic signature for the Annual Application For Exemption From Collection Of Louisiana Sales Taxes At Certain Fund Raising Activities on iOS devices

How to make an electronic signature for the Annual Application For Exemption From Collection Of Louisiana Sales Taxes At Certain Fund Raising Activities on Android devices

People also ask

-

What is the significance of r 20128 in airSlate SignNow?

The term r 20128 refers to a specific regulatory guideline that ensures compliance when using airSlate SignNow for eSigning documents. By adhering to r 20128, businesses can sharpen their focus on legal validity and security, which enhances trust and credibility during the signing process.

-

How does airSlate SignNow pricing compare with other eSigning solutions focusing on r 20128?

airSlate SignNow offers competitive pricing plans that align with the requirements of businesses needing to comply with r 20128. Our cost-effective solutions make it easier for organizations of all sizes to access high-quality eSigning features without overspending.

-

What features does airSlate SignNow provide to meet r 20128 compliance?

airSlate SignNow incorporates features such as secure document storage, customizable workflows, and advanced authentication that ensure compliance with r 20128. These tools help businesses seamlessly manage their document signing tasks while maintaining regulatory standards.

-

How can airSlate SignNow benefit my business in relation to r 20128?

By using airSlate SignNow, your business can benefit from streamlined document workflows that comply with r 20128. This will not only save time but also enhance the overall efficiency of your operations, reducing the risk of legal complications while speeding up transaction processes.

-

Are there integrations available within airSlate SignNow to support r 20128 compliance?

Yes, airSlate SignNow offers various integrations with popular applications that help maintain compliance with r 20128. By connecting with CRM systems and document management tools, you can ensure that all aspects of your workflow adhere to regulatory guidelines.

-

Is there a free trial available for airSlate SignNow if I am concerned about r 20128 compliance?

Absolutely! airSlate SignNow provides a free trial that allows you to explore all the necessary features related to r 20128 compliance. This risk-free period will enable you to assess how our platform fits your business's eSigning requirements.

-

What types of documents can I eSign with airSlate SignNow while complying with r 20128?

With airSlate SignNow, you can eSign various document types such as contracts, agreements, and forms in a way that adheres to r 20128 compliance. This versatility ensures that all documents maintain their legal integrity regardless of the format.

Get more for R20128

- Division of liquor control 6606 tussing road p o box form

- Nys 50 t nys new york state withholding tax tables and methods revised 123 form

- Aha instructor monitor tool instructorit activity notice to primary tc form

- Miami dade badge application fill online printable fillable form

- A corporation as trustee under that deed of trust dated recorder countyofventura form

- Indiana department of workforce development attn form

- Gap protection claim form 100435115

- Workplace violence restraining order after hearing form

Find out other R20128

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form