Sa900man Use Form SA900 to File a Tax Return for a Trust or Estate for the Tax Year Ended 5 April 2023-2026

Understanding the SA900 Form

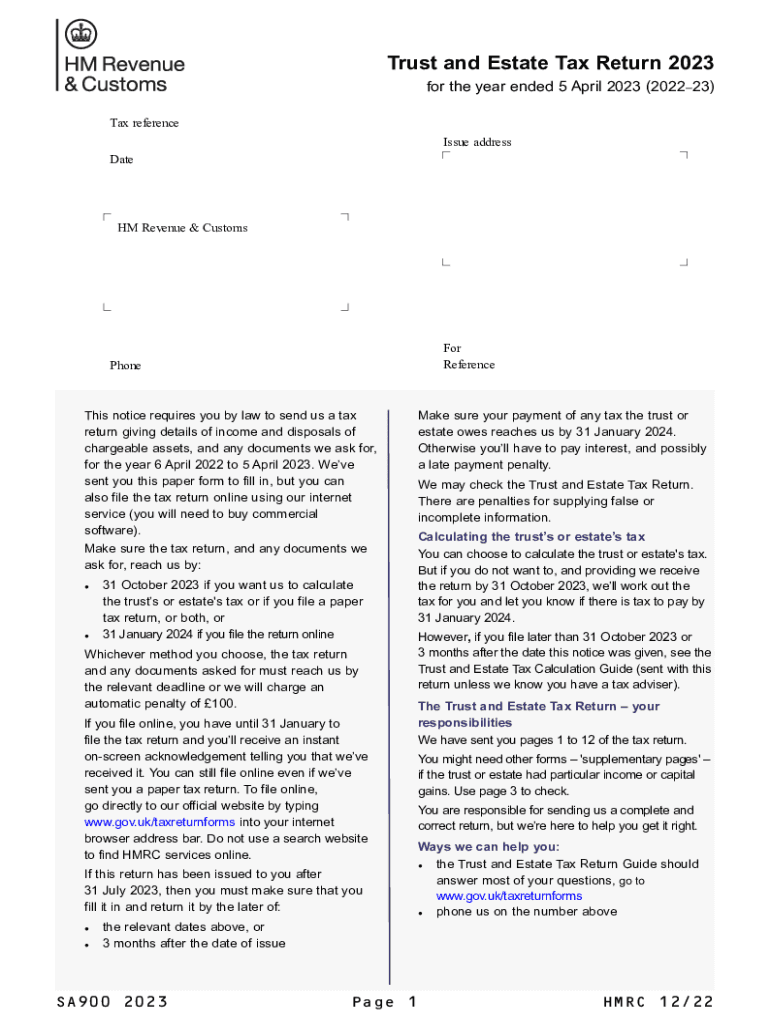

The SA900 form is a crucial document used to file a tax return for a trust or estate for the tax year ending on April 5. It is specifically designed for trustees or personal representatives who need to report income, gains, and any tax liabilities associated with the trust or estate. This form ensures compliance with the tax regulations set forth by HMRC, allowing for accurate reporting of financial activities during the specified tax year.

Steps to Complete the SA900 Form

Completing the SA900 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the trust or estate, including income statements and records of any gains. Next, fill out the form with precise details about the trust's income, expenses, and any distributions made to beneficiaries. It is essential to double-check all entries for accuracy before submission. Finally, ensure that the form is signed by the appropriate party, typically the trustee or personal representative, before sending it to HMRC.

Required Documents for the SA900 Form

To successfully complete the SA900 form, certain documents are required. These may include:

- Financial statements detailing income and expenditures of the trust or estate.

- Records of any capital gains realized during the tax year.

- Details of distributions made to beneficiaries.

- Previous tax returns or correspondence from HMRC related to the trust.

Having these documents on hand will facilitate a smoother completion process and help avoid potential errors.

Form Submission Methods

The SA900 form can be submitted through various methods, providing flexibility for the user. Options include:

- Online submission via HMRC's digital services, which allows for quicker processing.

- Mailing a paper version of the completed form to the designated HMRC address.

- In-person submission at local HMRC offices, although this may require an appointment.

Choosing the right submission method can impact the speed of processing and confirmation of receipt.

Penalties for Non-Compliance

Failure to file the SA900 form on time or inaccuracies in reporting can result in significant penalties. HMRC may impose fines for late submissions, which can escalate over time. Additionally, incorrect information may lead to further investigations or audits, resulting in additional charges or legal implications. It is crucial to adhere to the filing deadlines and ensure all information is accurate to avoid these penalties.

Digital vs. Paper Version of the SA900 Form

When considering how to submit the SA900 form, users have the option of completing it digitally or using a paper version. The digital version often allows for easier tracking and quicker processing times, as well as reduced risk of lost documents. Conversely, some individuals may prefer the tactile nature of a paper form. Regardless of the method chosen, it is important to ensure that the completed form is submitted correctly and on time.

Quick guide on how to complete sa900man use form sa900 to file a tax return for a trust or estate for the tax year ended 5 april

Complete Sa900man Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April effortlessly on any device

The management of online documents has gained popularity among enterprises and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the accurate format and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without any interruptions. Handle Sa900man Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

The most efficient way to modify and electronically sign Sa900man Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April with ease

- Locate Sa900man Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April and click on Get Form to initiate the process.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Verify all the details and press the Done button to save your modifications.

- Choose your preferred method to send your document, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Sa900man Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April to ensure effective communication at every step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa900man use form sa900 to file a tax return for a trust or estate for the tax year ended 5 april

Create this form in 5 minutes!

How to create an eSignature for the sa900man use form sa900 to file a tax return for a trust or estate for the tax year ended 5 april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SA900 trust tax return?

An SA900 trust tax return is a specific tax form required for trusts in the UK to report income and gains to HMRC. Filing an SA900 ensures that the trust complies with tax obligations and avoids potential penalties. Understanding how to complete this form accurately is crucial for trustees.

-

How can airSlate SignNow assist with filing an SA900 trust tax return?

airSlate SignNow offers a seamless platform for electronic signatures and secure document sharing, which can greatly simplify the process of compiling and submitting an SA900 trust tax return. The easy-to-use interface allows users to gather necessary signatures quickly, ensuring timely submission of the tax return.

-

What are the benefits of using airSlate SignNow for SA900 trust tax return?

Using airSlate SignNow for your SA900 trust tax return streamlines the signing process, reduces paper usage, and increases efficiency. With features like reminders and document tracking, you can ensure that all relevant parties complete their signatures, which is vital for timely filing.

-

Is airSlate SignNow a cost-effective solution for preparing the SA900 trust tax return?

Yes, airSlate SignNow provides an affordable pricing structure that can save you costs associated with traditional paper-based processes. By reducing administrative burdens and improving turnaround times, businesses can maximize their efficiency while managing SA900 trust tax returns.

-

Can airSlate SignNow integrate with accounting software for SA900 trust tax return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to pull in data easily while preparing your SA900 trust tax return. This integration helps in reducing data entry errors and streamlining the overall process.

-

What features does airSlate SignNow offer for managing SA900 trust tax returns?

airSlate SignNow offers features such as customizable templates, audit trails, and multi-signature options which are pivotal when managing SA900 trust tax returns. These features help ensure compliance and enhance the security of sensitive document management.

-

How secure is airSlate SignNow for handling SA900 trust tax return documents?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and complies with industry standards to safeguard sensitive information associated with SA900 trust tax returns. This integrity ensures that your documents are secure throughout the eSignature process.

Get more for Sa900man Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April

- Medical power of attorney wv form

- Reseller franchise agreement template form

- Fidelis rewards novu com intake form

- Part 130 certification surrogates court form

- Questionnaire for verification of nigerian documents form

- Jo anne bernal el paso county attorney 500 e san form

- Jo anne bernal county of el paso texas county attorney form

- Georgia seperation notice form

Find out other Sa900man Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF