Consumer Deposit Accounts Disclosure & Fee Schedule Form

Understanding the Consumer Deposit Accounts Disclosure & Fee Schedule

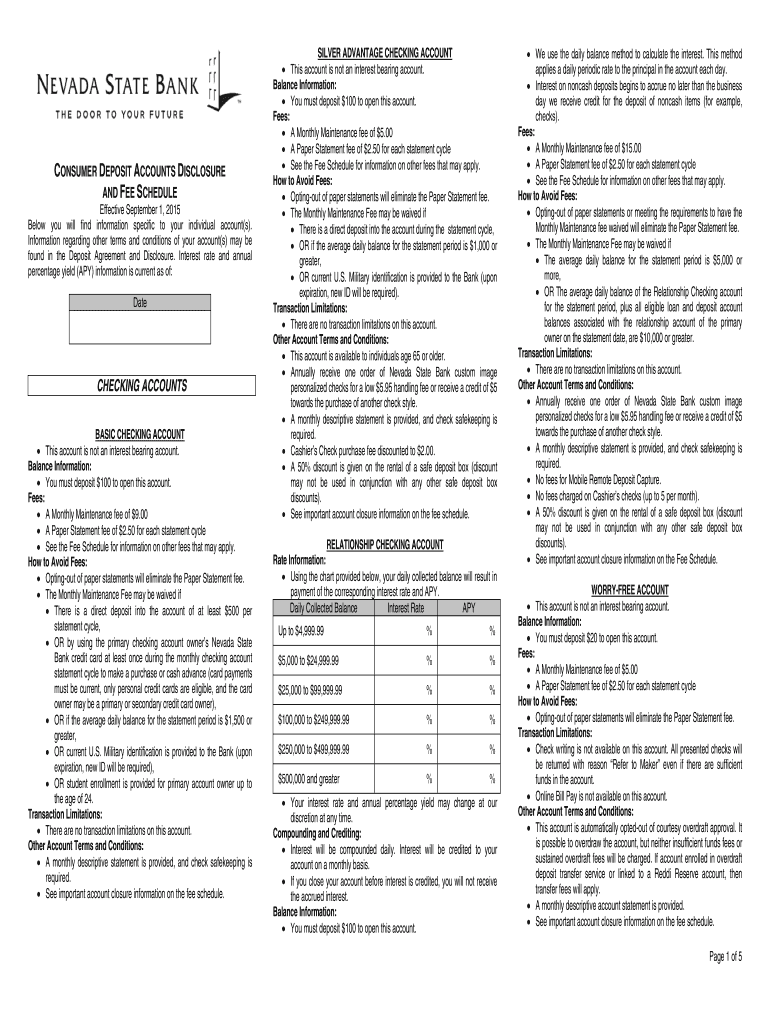

The Consumer Deposit Accounts Disclosure & Fee Schedule provides essential information regarding the terms and conditions associated with various deposit accounts. This document outlines the fees, interest rates, and other important details that consumers need to understand when opening or maintaining an account. It is designed to ensure transparency and help consumers make informed financial decisions.

Key Elements of the Consumer Deposit Accounts Disclosure & Fee Schedule

This disclosure includes several critical components:

- Account Types: A detailed description of the different types of deposit accounts available, such as checking, savings, and money market accounts.

- Fees: A comprehensive list of fees associated with each account type, including monthly maintenance fees, ATM fees, and overdraft charges.

- Interest Rates: Information on the interest rates applicable to various accounts, including how rates may change over time.

- Minimum Balance Requirements: Details on any minimum balance requirements to avoid fees or earn interest.

How to Obtain the Consumer Deposit Accounts Disclosure & Fee Schedule

- Bank Website: Most financial institutions provide downloadable versions of this disclosure on their official websites.

- In-Branch Request: Customers can request a printed copy directly from their bank branch during a visit.

- Customer Service: Contacting customer service via phone or email can also yield a copy of the disclosure.

Steps to Complete the Consumer Deposit Accounts Disclosure & Fee Schedule

Completing the Consumer Deposit Accounts Disclosure & Fee Schedule involves understanding the information presented and ensuring that you are aware of all terms:

- Review Account Options: Identify which account type best suits your needs based on the descriptions provided.

- Understand Fees: Carefully read through the fee schedule to be aware of any costs that may apply.

- Check Interest Rates: Take note of the interest rates associated with your chosen account to understand potential earnings.

- Ask Questions: If any part of the disclosure is unclear, consider reaching out to your bank for clarification.

Legal Use of the Consumer Deposit Accounts Disclosure & Fee Schedule

The Consumer Deposit Accounts Disclosure & Fee Schedule is a legally mandated document that financial institutions must provide to consumers. It ensures compliance with federal regulations aimed at protecting consumers by promoting transparency in banking practices. Understanding this document is essential for consumers to safeguard their rights and make informed choices about their financial products.

Examples of Using the Consumer Deposit Accounts Disclosure & Fee Schedule

Practical applications of the Consumer Deposit Accounts Disclosure & Fee Schedule include:

- Comparing Accounts: Consumers can use the disclosure to compare different accounts offered by various banks, helping them choose the best option.

- Budgeting: Knowing the fees associated with an account allows consumers to budget effectively and avoid unexpected charges.

- Understanding Changes: When a bank updates its fee schedule, consumers can refer to the disclosure to understand how these changes affect their accounts.

Quick guide on how to complete consumer deposit accounts disclosure amp fee schedule

Effortlessly Prepare [SKS] on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign [SKS] Without Stress

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Consumer Deposit Accounts Disclosure & Fee Schedule

Create this form in 5 minutes!

How to create an eSignature for the consumer deposit accounts disclosure amp fee schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Consumer Deposit Accounts Disclosure & Fee Schedule?

The Consumer Deposit Accounts Disclosure & Fee Schedule provides essential information about the terms and conditions of deposit accounts, including fees, interest rates, and other important details. This document is crucial for understanding your rights and responsibilities as a consumer. It ensures transparency and helps you make informed decisions regarding your banking options.

-

How can I access the Consumer Deposit Accounts Disclosure & Fee Schedule?

You can easily access the Consumer Deposit Accounts Disclosure & Fee Schedule through our website or by contacting our customer service team. We provide this document in a user-friendly format to ensure you have all the necessary information at your fingertips. Additionally, it is available in both digital and printed formats for your convenience.

-

What types of fees are included in the Consumer Deposit Accounts Disclosure & Fee Schedule?

The Consumer Deposit Accounts Disclosure & Fee Schedule outlines various fees associated with your deposit accounts, such as monthly maintenance fees, overdraft fees, and transaction fees. Understanding these fees is essential for managing your account effectively and avoiding unexpected charges. We strive to keep our fees competitive and transparent.

-

Are there any benefits to reviewing the Consumer Deposit Accounts Disclosure & Fee Schedule?

Yes, reviewing the Consumer Deposit Accounts Disclosure & Fee Schedule allows you to understand the costs and benefits associated with your deposit accounts. It helps you identify potential savings and choose the right account that fits your financial needs. By being informed, you can make better financial decisions and maximize your banking experience.

-

How often is the Consumer Deposit Accounts Disclosure & Fee Schedule updated?

The Consumer Deposit Accounts Disclosure & Fee Schedule is updated regularly to reflect any changes in fees, terms, or regulations. We recommend checking this document periodically to stay informed about your account. Our commitment to transparency ensures that you always have access to the most current information.

-

Can I compare different accounts using the Consumer Deposit Accounts Disclosure & Fee Schedule?

Absolutely! The Consumer Deposit Accounts Disclosure & Fee Schedule allows you to compare different deposit accounts side by side. By reviewing the fees and features of each account, you can make an informed choice that best suits your financial goals. This comparison tool is invaluable for selecting the right banking solution.

-

What should I do if I have questions about the Consumer Deposit Accounts Disclosure & Fee Schedule?

If you have any questions regarding the Consumer Deposit Accounts Disclosure & Fee Schedule, our customer service team is here to help. You can signNow out via phone, email, or live chat for assistance. We are dedicated to providing you with clear answers and support to ensure you fully understand your account details.

Get more for Consumer Deposit Accounts Disclosure & Fee Schedule

Find out other Consumer Deposit Accounts Disclosure & Fee Schedule

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors