Alberta Personal Tax Credits Return IATSE Local 210 2024

What is the Alberta Personal Tax Credits Return IATSE Local 210

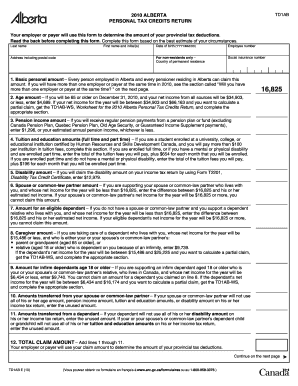

The Alberta Personal Tax Credits Return IATSE Local 210 is a specific tax form used by members of the International Alliance of Theatrical Stage Employees (IATSE) Local 210. This form allows individuals to claim various personal tax credits that can reduce their overall tax liability. It is essential for eligible members to accurately complete this form to ensure they receive the maximum benefits available under the tax laws.

How to use the Alberta Personal Tax Credits Return IATSE Local 210

To effectively use the Alberta Personal Tax Credits Return IATSE Local 210, individuals must first gather all necessary personal and financial information. This includes details about income, deductions, and any applicable tax credits. Once the required information is collected, members can fill out the form, ensuring that all sections are completed accurately. After completing the form, it can be submitted electronically or via mail, depending on the preferred method of submission.

Steps to complete the Alberta Personal Tax Credits Return IATSE Local 210

Completing the Alberta Personal Tax Credits Return IATSE Local 210 involves several key steps:

- Gather personal information, including Social Security numbers and income statements.

- Identify applicable tax credits based on eligibility, such as those for dependents or education.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the chosen method, either online or by mail.

Eligibility Criteria

Eligibility for the Alberta Personal Tax Credits Return IATSE Local 210 typically includes being a member of IATSE Local 210 and meeting specific income thresholds. Members must also be able to provide documentation that supports their claims for tax credits. It is crucial for individuals to review the eligibility requirements carefully to ensure compliance and maximize their potential tax benefits.

Required Documents

When completing the Alberta Personal Tax Credits Return IATSE Local 210, members should prepare several key documents:

- Proof of income, such as pay stubs or W-2 forms.

- Documentation for any claimed deductions or credits, including receipts and tax statements.

- Identification documents, such as a driver's license or Social Security card.

Form Submission Methods

The Alberta Personal Tax Credits Return IATSE Local 210 can be submitted through various methods. Members may choose to file online using designated tax software or submit a paper form by mail. Each method has its own advantages, such as the speed of electronic filing versus the traditional approach of mailing a physical form. It is important to choose the method that aligns with individual preferences and timelines.

Quick guide on how to complete alberta personal tax credits return iatse local 210

Effortlessly Prepare Alberta Personal Tax Credits Return IATSE Local 210 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Alberta Personal Tax Credits Return IATSE Local 210 on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Alter and eSign Alberta Personal Tax Credits Return IATSE Local 210 with Ease

- Locate Alberta Personal Tax Credits Return IATSE Local 210 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of delivery for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Alberta Personal Tax Credits Return IATSE Local 210 and ensure outstanding communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alberta personal tax credits return iatse local 210

Create this form in 5 minutes!

How to create an eSignature for the alberta personal tax credits return iatse local 210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alberta Personal Tax Credits Return IATSE Local 210?

The Alberta Personal Tax Credits Return IATSE Local 210 is a form that allows members of IATSE Local 210 to claim personal tax credits in Alberta. This form helps ensure that you receive the appropriate tax benefits based on your personal circumstances. Completing this return accurately can lead to signNow savings on your taxes.

-

How can airSlate SignNow help with the Alberta Personal Tax Credits Return IATSE Local 210?

airSlate SignNow simplifies the process of completing and submitting the Alberta Personal Tax Credits Return IATSE Local 210. With our easy-to-use platform, you can eSign documents securely and efficiently, ensuring that your tax credits return is filed correctly and on time. This streamlines your workflow and reduces the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for the Alberta Personal Tax Credits Return IATSE Local 210?

airSlate SignNow offers flexible pricing plans that cater to different needs, including individual and business users. Our cost-effective solutions ensure that you can manage your Alberta Personal Tax Credits Return IATSE Local 210 without breaking the bank. Check our website for the latest pricing details and choose the plan that suits you best.

-

Are there any features specifically designed for the Alberta Personal Tax Credits Return IATSE Local 210?

Yes, airSlate SignNow includes features tailored for the Alberta Personal Tax Credits Return IATSE Local 210, such as customizable templates and automated reminders. These features help you stay organized and ensure that you never miss a deadline. Our platform is designed to enhance your experience while managing your tax credits return.

-

What benefits does airSlate SignNow provide for filing the Alberta Personal Tax Credits Return IATSE Local 210?

Using airSlate SignNow for your Alberta Personal Tax Credits Return IATSE Local 210 offers numerous benefits, including increased efficiency and reduced errors. Our platform allows for quick eSigning and document sharing, making the filing process smoother. Additionally, you can access your documents anytime, anywhere, ensuring you stay on top of your tax obligations.

-

Can I integrate airSlate SignNow with other tools for the Alberta Personal Tax Credits Return IATSE Local 210?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications, enhancing your ability to manage the Alberta Personal Tax Credits Return IATSE Local 210. Whether you use accounting software or project management tools, our integrations help streamline your workflow and improve productivity.

-

Is airSlate SignNow secure for handling the Alberta Personal Tax Credits Return IATSE Local 210?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information, including the Alberta Personal Tax Credits Return IATSE Local 210. You can trust that your documents are safe and secure while using our platform.

Get more for Alberta Personal Tax Credits Return IATSE Local 210

- Mississippi note 497315652 form

- Notice of option for recording mississippi form

- Life documents planning package including will power of attorney and living will mississippi form

- Ms attorney form

- Essential legal life documents for baby boomers mississippi form

- Revocation of general durable power of attorney mississippi form

- Essential legal life documents for newlyweds mississippi form

- Essential legal life documents for military personnel mississippi form

Find out other Alberta Personal Tax Credits Return IATSE Local 210

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF