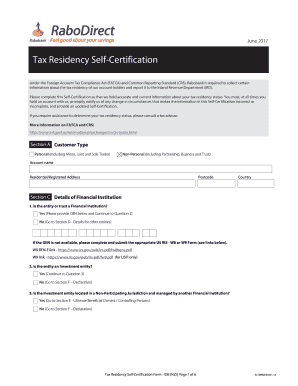

Tax Residency Self Certification Rabodirect Co Nz Form

Understanding the New Zealand Tax Residency Self Certification Form

The New Zealand tax residency self certification form is a crucial document for individuals and entities seeking to clarify their tax residency status in New Zealand. This form is essential for compliance with New Zealand tax laws and for ensuring that the correct tax obligations are met. It helps determine whether a person is considered a tax resident in New Zealand, which can significantly impact tax liabilities and reporting requirements.

Steps to Complete the New Zealand Tax Residency Self Certification Form

Completing the New Zealand tax residency self certification form involves several key steps:

- Gather necessary information: Collect personal details, including your name, address, date of birth, and tax identification number.

- Determine residency status: Assess whether you meet the criteria for tax residency in New Zealand based on the duration of your stay and other relevant factors.

- Fill out the form: Accurately complete all sections of the form, ensuring that all information is correct and up to date.

- Review and sign: Carefully review the completed form for any errors before signing it to confirm the accuracy of the information provided.

Required Documents for the New Zealand Tax Residency Self Certification Form

When completing the New Zealand tax residency self certification form, it is important to have the following documents ready:

- Proof of identity, such as a passport or government-issued ID.

- Documentation supporting your residency status, which may include utility bills, rental agreements, or tax returns.

- Your tax identification number or equivalent from your home country.

Legal Use of the New Zealand Tax Residency Self Certification Form

The New Zealand tax residency self certification form serves a legal purpose in confirming an individual's tax residency status. This form is often required by financial institutions and other entities to ensure compliance with tax regulations. Failing to provide accurate information on this form can lead to penalties and complications with tax authorities.

Form Submission Methods for the New Zealand Tax Residency Self Certification Form

The New Zealand tax residency self certification form can typically be submitted through various methods:

- Online submission: Many institutions offer the option to submit the form electronically through their secure portals.

- Mail: You can also print the form and send it via postal service to the relevant authority.

- In-person: Some individuals may prefer to submit the form in person at designated offices or service centers.

Eligibility Criteria for the New Zealand Tax Residency Self Certification Form

To be eligible to complete the New Zealand tax residency self certification form, individuals must meet specific criteria. Generally, this includes:

- Being a resident or non-resident for tax purposes in New Zealand.

- Having a tax identification number or equivalent from another jurisdiction.

- Providing accurate and truthful information regarding residency status.

Quick guide on how to complete tax residency self certification rabodirect co nz

Effortlessly complete Tax Residency Self Certification Rabodirect co nz on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Tax Residency Self Certification Rabodirect co nz on any device using airSlate SignNow's Android or iOS applications and streamline your document-centered tasks today.

How to modify and electronically sign Tax Residency Self Certification Rabodirect co nz effortlessly

- Obtain Tax Residency Self Certification Rabodirect co nz and click Get Form to begin.

- Use the tools we offer to finish your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional signature in ink.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tax Residency Self Certification Rabodirect co nz and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax residency self certification rabodirect co nz

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Zealand tax residency self certification form?

The New Zealand tax residency self certification form is a document that individuals use to declare their tax residency status in New Zealand. This form is essential for compliance with tax regulations and helps ensure that the correct tax rates are applied. By using airSlate SignNow, you can easily complete and eSign this form online.

-

How can I access the New Zealand tax residency self certification form through airSlate SignNow?

You can access the New Zealand tax residency self certification form directly through the airSlate SignNow platform. Simply log in to your account, navigate to the document templates, and select the form you need. Our user-friendly interface makes it easy to fill out and eSign the form quickly.

-

Is there a cost associated with using the New Zealand tax residency self certification form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans are flexible and cater to various needs, ensuring you can access the New Zealand tax residency self certification form without breaking the bank. Check our pricing page for more details.

-

What features does airSlate SignNow offer for the New Zealand tax residency self certification form?

airSlate SignNow offers a range of features for the New Zealand tax residency self certification form, including customizable templates, secure eSigning, and document tracking. These features streamline the process, making it easier for you to manage your tax residency documentation efficiently. Additionally, our platform ensures compliance with legal standards.

-

How does airSlate SignNow ensure the security of my New Zealand tax residency self certification form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your New Zealand tax residency self certification form and other documents. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can I integrate airSlate SignNow with other applications for managing the New Zealand tax residency self certification form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to manage the New Zealand tax residency self certification form seamlessly. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the New Zealand tax residency self certification form?

Using airSlate SignNow for the New Zealand tax residency self certification form provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, allowing you to focus on your core business activities while ensuring compliance with tax regulations.

Get more for Tax Residency Self Certification Rabodirect co nz

- Steadfast management company inc rental application form

- Fire pump test form hose monster

- Cigar shop reporting form form 35 7500

- 680 3a e form 2015 2019

- 5 early childhood pre k health record supplement form

- Worksheet 6 executive summary and tceq tceq state tx form

- Ipsas checklist v10 final deloitte form

- Aru event sanctioning application australian rugby union form

Find out other Tax Residency Self Certification Rabodirect co nz

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template