Form CT 2 Rev January Uncle Fed's Tax*Board

What is the Form CT 2 Rev January Uncle Fed's Tax*Board

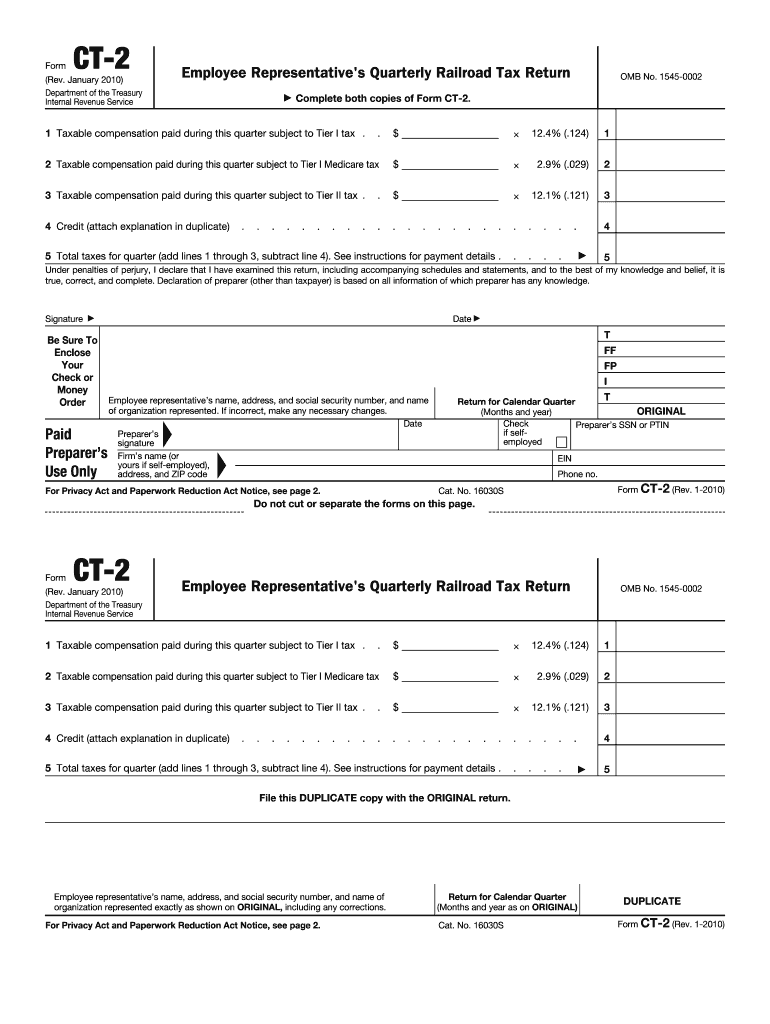

The Form CT 2 Rev January Uncle Fed's Tax*Board is a tax form utilized within the United States for specific reporting purposes. It is primarily associated with tax compliance and is essential for individuals and businesses to accurately report their financial activities to the appropriate tax authorities. This form helps ensure that taxpayers meet their obligations while providing necessary information to the IRS and state tax agencies.

How to use the Form CT 2 Rev January Uncle Fed's Tax*Board

Using the Form CT 2 Rev January Uncle Fed's Tax*Board involves several steps. First, gather all relevant financial documents and information required for completion. Next, carefully fill out each section of the form, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors or omissions before submitting it to the appropriate tax authority. Proper use of this form can help avoid penalties and ensure compliance with tax regulations.

Steps to complete the Form CT 2 Rev January Uncle Fed's Tax*Board

Completing the Form CT 2 Rev January Uncle Fed's Tax*Board requires a systematic approach:

- Collect necessary documentation, including income statements and previous tax returns.

- Begin filling out the form by entering personal information, such as your name, address, and Social Security number.

- Provide detailed financial information as required by the form, including income sources and deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form CT 2 Rev January Uncle Fed's Tax*Board

The Form CT 2 Rev January Uncle Fed's Tax*Board is legally binding and must be used in accordance with IRS regulations. It is critical for taxpayers to understand the legal implications of the information provided on this form. Misrepresentation or failure to file the form correctly can lead to penalties, including fines and potential legal action. Therefore, it is advisable to consult with a tax professional if there are any uncertainties regarding its legal use.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 2 Rev January Uncle Fed's Tax*Board vary depending on the specific tax year and the taxpayer's situation. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. It is important to stay informed about any changes to deadlines, as extensions may be available under certain circumstances. Keeping track of these dates can help avoid late fees and ensure timely compliance.

Form Submission Methods

The Form CT 2 Rev January Uncle Fed's Tax*Board can be submitted through various methods, including:

- Online submission via the IRS e-filing system, if applicable.

- Mailing the completed form to the designated tax authority address.

- In-person submission at local tax offices, if available.

Choosing the appropriate submission method can depend on individual preferences and specific circumstances, such as urgency and accessibility.

Quick guide on how to complete form ct 2 rev january uncle fed39s taxboard

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Edit and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we supply to complete your document.

- Emphasize specific sections of your documents or obscure sensitive information using the features that airSlate SignNow provides for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and possesses the same legal validity as a traditional ink signature.

- Review the details and hit the Done button to save your modifications.

- Select your preferred method for sharing your form, such as email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form CT 2 Rev January Uncle Fed's Tax*Board

Create this form in 5 minutes!

How to create an eSignature for the form ct 2 rev january uncle fed39s taxboard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 2 Rev January Uncle Fed's Tax*Board?

Form CT 2 Rev January Uncle Fed's Tax*Board is a tax form used for reporting specific tax information to the IRS. It is essential for businesses to ensure compliance with federal tax regulations. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining your tax reporting process.

-

How can airSlate SignNow help with Form CT 2 Rev January Uncle Fed's Tax*Board?

airSlate SignNow provides a user-friendly platform to complete and eSign Form CT 2 Rev January Uncle Fed's Tax*Board. Our solution simplifies the document management process, allowing you to focus on your business while ensuring that your tax forms are accurately completed and submitted on time.

-

What are the pricing options for using airSlate SignNow for Form CT 2 Rev January Uncle Fed's Tax*Board?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that make completing Form CT 2 Rev January Uncle Fed's Tax*Board efficient and cost-effective. Check our website for the latest pricing details.

-

Are there any features specifically designed for Form CT 2 Rev January Uncle Fed's Tax*Board?

Yes, airSlate SignNow includes features tailored for Form CT 2 Rev January Uncle Fed's Tax*Board, such as customizable templates, automated workflows, and secure eSigning. These features enhance the accuracy and speed of your tax form submissions, ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software for Form CT 2 Rev January Uncle Fed's Tax*Board?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage Form CT 2 Rev January Uncle Fed's Tax*Board alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are in sync.

-

What are the benefits of using airSlate SignNow for Form CT 2 Rev January Uncle Fed's Tax*Board?

Using airSlate SignNow for Form CT 2 Rev January Uncle Fed's Tax*Board provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your tax forms are completed accurately and stored securely, giving you peace of mind during tax season.

-

Is airSlate SignNow secure for handling Form CT 2 Rev January Uncle Fed's Tax*Board?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Form CT 2 Rev January Uncle Fed's Tax*Board. We utilize advanced encryption and security protocols to protect your sensitive information, ensuring that your tax documents remain confidential.

Get more for Form CT 2 Rev January Uncle Fed's Tax*Board

- Warning of default on residential lease rhode island form

- Landlord tenant closing statement to reconcile security deposit rhode island form

- Ri name change 497325239 form

- Name change notification form rhode island

- Commercial building or space lease rhode island form

- Rhode island legal form

- Rhode island legal 497325245 form

- Rhode island bankruptcy form

Find out other Form CT 2 Rev January Uncle Fed's Tax*Board

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement