Missouri POA Authority Tax Services Form

What is the Missouri POA Authority Tax Services

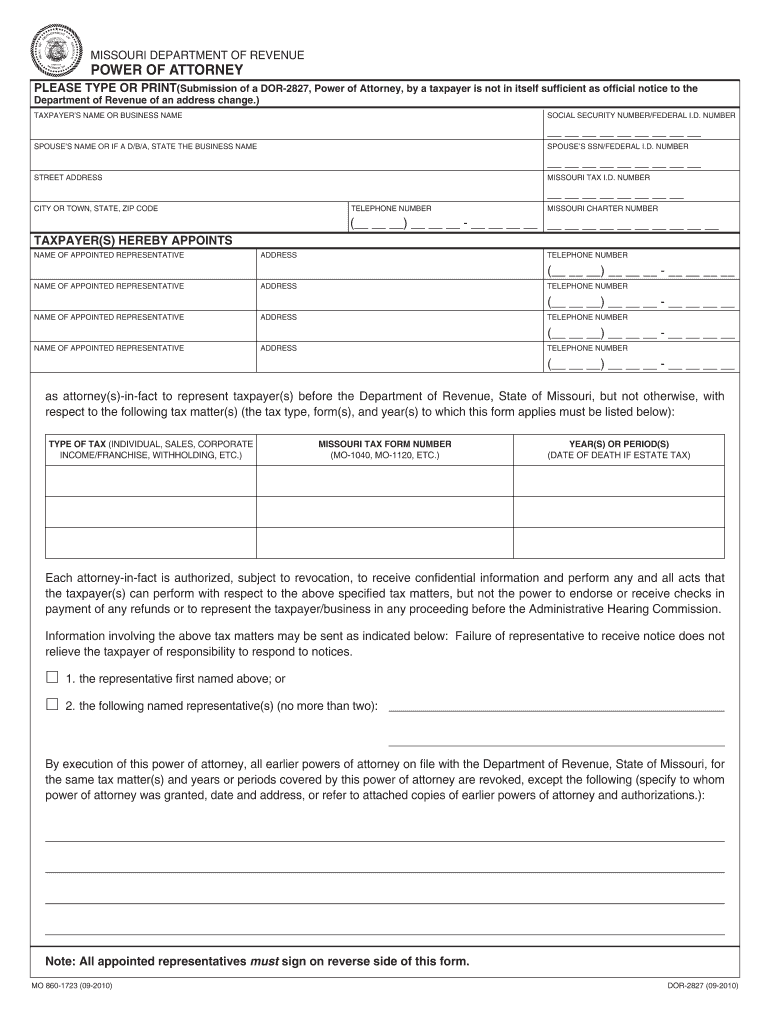

The Missouri POA Authority Tax Services form is a legal document that allows an individual to designate another person to act on their behalf in matters related to tax filings and obligations. This form is essential for taxpayers who may be unable to manage their tax affairs due to various reasons, such as illness, absence, or other personal circumstances. By completing this form, the designated representative gains the authority to communicate with the Missouri Department of Revenue and handle tax-related matters, ensuring that the taxpayer's interests are protected and managed effectively.

How to use the Missouri POA Authority Tax Services

Using the Missouri POA Authority Tax Services form involves several key steps. First, the principal (the person granting authority) must fill out the form accurately, providing their personal information and that of the designated representative. It is important to specify the scope of authority granted, which can range from limited to broad powers concerning tax matters. Once completed, the form must be signed and dated by the principal. After signing, the principal should provide a copy of the form to the designated representative and keep a copy for their records. The representative can then use the form to interact with the Missouri Department of Revenue on behalf of the principal.

Steps to complete the Missouri POA Authority Tax Services

Completing the Missouri POA Authority Tax Services form requires careful attention to detail. Follow these steps:

- Obtain the official form from the Missouri Department of Revenue.

- Fill in the principal's name, address, and Social Security number.

- Provide the representative's name, address, and contact information.

- Clearly outline the specific powers granted to the representative.

- Sign and date the form to validate it.

- Distribute copies to the representative and retain one for personal records.

Legal use of the Missouri POA Authority Tax Services

The legal use of the Missouri POA Authority Tax Services form is governed by state laws that outline the responsibilities and limitations of the designated representative. This form must be executed in accordance with Missouri law to ensure that it is valid and enforceable. The representative is legally obligated to act in the best interest of the principal and to adhere to the specified powers granted in the form. Misuse of authority can lead to legal consequences, including potential penalties for both the representative and the principal.

Required Documents

To successfully submit the Missouri POA Authority Tax Services form, certain documents may be required. These typically include:

- A completed and signed POA form.

- Identification for both the principal and the representative, such as a driver's license or Social Security card.

- Any additional documentation that may support the authority granted, depending on specific tax situations.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri POA Authority Tax Services form can vary based on the type of tax matters involved. It is crucial for the principal and the representative to be aware of important dates related to tax filings to avoid penalties. Generally, tax forms must be submitted by April fifteenth for individual income tax returns. However, if a representative is involved, they should ensure that the POA form is submitted well in advance of any filing deadlines to allow for proper processing.

Quick guide on how to complete missouri poa authority tax services

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign [SKS] seamlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Missouri POA Authority Tax Services

Create this form in 5 minutes!

How to create an eSignature for the missouri poa authority tax services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Missouri POA Authority Tax Services?

Missouri POA Authority Tax Services refer to the legal and tax-related services that allow individuals to grant power of attorney for tax matters in Missouri. This service ensures that your tax affairs are managed efficiently and in compliance with state regulations. Utilizing airSlate SignNow can simplify the process of creating and signing these documents.

-

How does airSlate SignNow facilitate Missouri POA Authority Tax Services?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning documents related to Missouri POA Authority Tax Services. Our solution streamlines the document workflow, allowing users to manage their tax-related documents securely and efficiently. This ensures that you can focus on your tax matters without the hassle of traditional paperwork.

-

What are the pricing options for Missouri POA Authority Tax Services with airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses utilizing Missouri POA Authority Tax Services. Our plans are designed to be cost-effective, ensuring that you receive maximum value for your investment. You can choose from various subscription options based on your document volume and feature requirements.

-

What features does airSlate SignNow offer for Missouri POA Authority Tax Services?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, specifically designed for Missouri POA Authority Tax Services. These features enhance the efficiency of managing your tax documents while ensuring compliance with legal standards. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Are there any integrations available for Missouri POA Authority Tax Services?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms to enhance your Missouri POA Authority Tax Services experience. This includes popular tools for accounting, CRM, and document management, allowing for a more streamlined workflow. These integrations help you manage your tax documents alongside your other business processes.

-

What are the benefits of using airSlate SignNow for Missouri POA Authority Tax Services?

Using airSlate SignNow for Missouri POA Authority Tax Services offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your tax documents digitally, saving time and resources. Additionally, the ability to eSign documents ensures that you can complete transactions quickly and securely.

-

How secure is airSlate SignNow for handling Missouri POA Authority Tax Services?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like those related to Missouri POA Authority Tax Services. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are safe and compliant with industry standards.

Get more for Missouri POA Authority Tax Services

- Amendment to living trust hawaii form

- Living trust property record hawaii form

- Financial account transfer to living trust hawaii form

- Assignment to living trust hawaii form

- Notice of assignment to living trust hawaii form

- Revocation of living trust hawaii form

- Letter to lienholder to notify of trust hawaii form

- Hawaii timber sale contract hawaii form

Find out other Missouri POA Authority Tax Services

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors