Form 982 Rev February EFile

Understanding Form 982 Rev February EFile

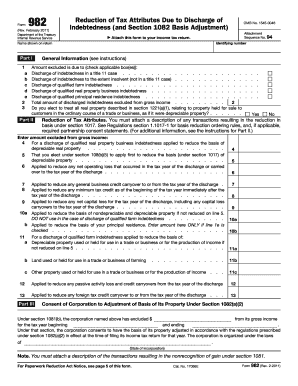

Form 982 Rev February is a tax form used by taxpayers to request a discharge of indebtedness income under specific circumstances. This form is particularly relevant for individuals who have had debts forgiven or canceled, which may otherwise be considered taxable income. The form helps taxpayers report the exclusion of this income, ensuring compliance with IRS regulations. It is essential for individuals who have experienced financial difficulties, such as bankruptcy or insolvency, to understand how to utilize this form effectively.

How to Complete Form 982 Rev February EFile

Completing Form 982 Rev February involves several key steps. First, gather all necessary financial documents that detail the canceled debts. Next, accurately fill out the form by providing personal information and the amount of debt discharged. It is crucial to indicate the reason for the exclusion of income, such as bankruptcy or insolvency. After completing the form, review it thoroughly for accuracy before submitting it electronically or by mail. Ensuring that all information is correct will help avoid delays or issues with the IRS.

Obtaining Form 982 Rev February EFile

Form 982 Rev February can be obtained directly from the IRS website or through tax preparation software that supports electronic filing. Taxpayers may also consult tax professionals who can provide guidance and help in acquiring the form. It is important to ensure that you have the most current version of the form, as updates may occur periodically. Accessing the form online allows for easy printing and completion, which is essential for timely filing.

Filing Deadlines for Form 982 Rev February EFile

Filing deadlines for Form 982 Rev February typically align with the taxpayer's annual tax return deadlines. For most individuals, this means submitting the form by April 15 of the following tax year. However, if an extension has been filed for the tax return, the form must be submitted by the extended deadline. It is essential to be aware of these deadlines to avoid penalties and ensure that the request for discharge of indebtedness is processed in a timely manner.

Key Elements of Form 982 Rev February EFile

Several key elements must be included when completing Form 982 Rev February. These include the taxpayer's identification information, the amount of debt discharged, and the specific section of the tax code under which the income is being excluded. Additionally, taxpayers must provide detailed explanations of the circumstances surrounding the debt cancellation. Accurate and complete information in these sections is vital for the IRS to process the form correctly.

Legal Use of Form 982 Rev February EFile

Form 982 Rev February is legally recognized by the IRS as a valid means for taxpayers to report the exclusion of canceled debt income. Utilizing this form correctly can help individuals avoid unnecessary taxation on forgiven debts. It is crucial for taxpayers to understand the legal implications of the form, including the requirement to report any forgiven debt accurately and the potential consequences of failing to do so. Consulting a tax professional can provide additional clarity on the legal aspects of using this form.

Quick guide on how to complete form 982 rev february efile

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you choose. Edit and eSign [SKS] while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 982 Rev February EFile

Create this form in 5 minutes!

How to create an eSignature for the form 982 rev february efile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 982 Rev February EFile?

Form 982 Rev February EFile is a tax form used to report the discharge of indebtedness and claim a reduction in tax attributes. It is essential for taxpayers who have had their debts forgiven and need to adjust their tax liabilities accordingly. Using airSlate SignNow, you can easily eSign and submit this form electronically.

-

How does airSlate SignNow simplify the process of completing Form 982 Rev February EFile?

airSlate SignNow streamlines the completion of Form 982 Rev February EFile by providing an intuitive interface for filling out and signing documents. Users can easily upload their forms, add necessary signatures, and send them securely. This eliminates the hassle of printing and mailing, making the process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for Form 982 Rev February EFile?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to a range of features that enhance the eSigning experience, including the ability to manage multiple documents like Form 982 Rev February EFile. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 982 Rev February EFile?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, which are particularly useful for managing Form 982 Rev February EFile. These features ensure that you can easily access, edit, and sign your documents from anywhere. Additionally, the platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other software for Form 982 Rev February EFile?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling Form 982 Rev February EFile. Whether you use CRM systems, accounting software, or other tools, you can connect them seamlessly to enhance productivity and efficiency.

-

What are the benefits of using airSlate SignNow for Form 982 Rev February EFile?

Using airSlate SignNow for Form 982 Rev February EFile provides numerous benefits, including time savings, enhanced security, and improved compliance. The platform ensures that your documents are signed and stored securely, reducing the risk of errors and delays. Additionally, the ease of use allows you to focus on your core business activities.

-

Is airSlate SignNow compliant with legal standards for Form 982 Rev February EFile?

Yes, airSlate SignNow complies with all relevant legal standards for electronic signatures, making it a reliable choice for Form 982 Rev February EFile. The platform adheres to regulations such as the ESIGN Act and UETA, ensuring that your electronically signed documents are legally binding and enforceable.

Get more for Form 982 Rev February EFile

Find out other Form 982 Rev February EFile

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word