Ptin Renewal Form

What is the PTIN Renewal?

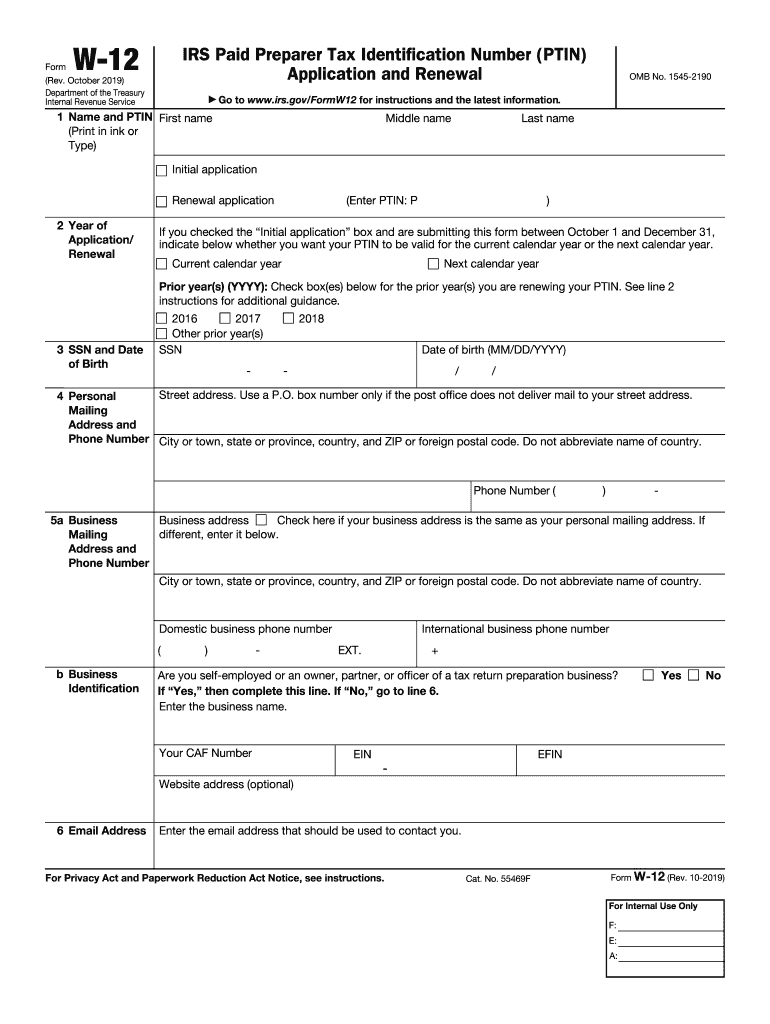

The Preparer Tax Identification Number (PTIN) renewal is a process that tax professionals must complete annually to maintain their ability to prepare federal tax returns for compensation. The PTIN serves as a unique identifier for tax preparers and is essential for compliance with IRS regulations. Without a valid PTIN, tax professionals cannot legally prepare tax returns, making the renewal process crucial for their practice.

Steps to Complete the PTIN Renewal

Renewing your PTIN involves several straightforward steps. First, you must visit the IRS PTIN system online. After logging in or creating an account, you will need to provide your personal information, including your name, address, and Social Security number. Next, you will confirm your previous PTIN details and complete any required updates. Finally, you will submit your renewal application and pay the associated fee. It is advisable to complete this process well before the tax season to avoid any delays.

Required Documents for PTIN Renewal

When renewing your PTIN, certain documents may be necessary to ensure a smooth process. Typically, you will need:

- Your Social Security number

- Personal identification information, such as your address and phone number

- Any previous PTIN information, if applicable

Having these documents readily available can expedite the renewal process and help prevent any issues with your application.

IRS Guidelines for PTIN Renewal

The IRS has established specific guidelines for PTIN renewal that all tax preparers must follow. It is important to renew your PTIN annually, as failure to do so can result in penalties and the inability to prepare tax returns legally. The IRS also emphasizes the importance of providing accurate information during the renewal process to avoid complications. Additionally, tax preparers must adhere to ethical standards and continuing education requirements as part of maintaining their PTIN.

Penalties for Non-Compliance with PTIN Renewal

Tax preparers who fail to renew their PTIN by the deadline may face significant penalties. These can include fines and the inability to prepare tax returns for compensation. The IRS takes compliance seriously, and non-compliance can lead to legal repercussions and damage to a preparer's professional reputation. It is essential to prioritize the renewal process to avoid these consequences.

Eligibility Criteria for PTIN Renewal

To be eligible for PTIN renewal, applicants must meet certain criteria set by the IRS. Primarily, individuals must be tax professionals who prepare or assist in preparing federal tax returns for compensation. Additionally, applicants must have a valid Social Security number. Those who do not meet these criteria will not be able to renew their PTIN and should consult the IRS for further guidance.

Quick guide on how to complete about form w 12 irs paid preparer tax identification number

Easily Prepare Ptin Renewal on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and seamlessly. Handle Ptin Renewal on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Ptin Renewal

- Obtain Ptin Renewal and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, laborious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Ptin Renewal and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form w 12 irs paid preparer tax identification number

How to generate an eSignature for the About Form W 12 Irs Paid Preparer Tax Identification Number in the online mode

How to create an eSignature for the About Form W 12 Irs Paid Preparer Tax Identification Number in Google Chrome

How to create an electronic signature for signing the About Form W 12 Irs Paid Preparer Tax Identification Number in Gmail

How to generate an eSignature for the About Form W 12 Irs Paid Preparer Tax Identification Number straight from your mobile device

How to create an electronic signature for the About Form W 12 Irs Paid Preparer Tax Identification Number on iOS devices

How to generate an eSignature for the About Form W 12 Irs Paid Preparer Tax Identification Number on Android devices

People also ask

-

What is govptin 2019 w and how does it relate to airSlate SignNow?

Govptin 2019 w is a specific designation that may impact how businesses manage their documentation requirements. With airSlate SignNow, you can easily prepare and eSign documents related to govptin 2019 w, ensuring compliance and efficiency in your processes.

-

How much does airSlate SignNow cost for businesses needing govptin 2019 w compliance?

The pricing for airSlate SignNow varies based on the plan selected, which can accommodate businesses needing to handle govptin 2019 w compliance. You can choose from various subscription options designed to meet different budget and feature needs, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing govptin 2019 w documents?

AirSlate SignNow provides a range of features ideal for managing govptin 2019 w documents, including customizable templates, real-time tracking, and secure cloud storage. These features facilitate seamless document management while ensuring that you adhere to necessary regulations.

-

Can airSlate SignNow integrate with my existing systems for govptin 2019 w management?

Yes, airSlate SignNow is designed to integrate smoothly with various platforms, allowing organizations to manage their govptin 2019 w documentation alongside existing workflows. This integration capability helps streamline processes and boost overall productivity.

-

What are the benefits of using airSlate SignNow for govptin 2019 w documentation?

Employing airSlate SignNow for your govptin 2019 w documentation offers numerous benefits, including increased efficiency and reduced errors in document handling. Additionally, the user-friendly interface simplifies the eSigning process, making it accessible for all team members.

-

Is airSlate SignNow suitable for small businesses dealing with govptin 2019 w?

Absolutely! AirSlate SignNow is tailored for businesses of all sizes, including small businesses managing govptin 2019 w. Its flexible pricing and features allow small enterprises to efficiently manage their document workflows without overspending.

-

How secure is airSlate SignNow for handling sensitive govptin 2019 w data?

Security is a top priority for airSlate SignNow, especially when handling sensitive govptin 2019 w data. The platform uses advanced encryption and complies with industry standards to ensure your documents are safe and secure throughout the signing process.

Get more for Ptin Renewal

- Form women and infants hospital of rhode island

- Health insurance census form excel 15083427

- The rch specialist clinics are the royal childrens form

- Restrictive covenant agreement sample form

- Physicians statement ohio department of public safety form

- Statement of conversion foreign or non registered to form

- Vs 400rev form

- Notice for final hearing non jury trial state of florida fifth judicial form

Find out other Ptin Renewal

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document