Individual Income Tax Return North Carolina Form

What is the Individual Income Tax Return North Carolina

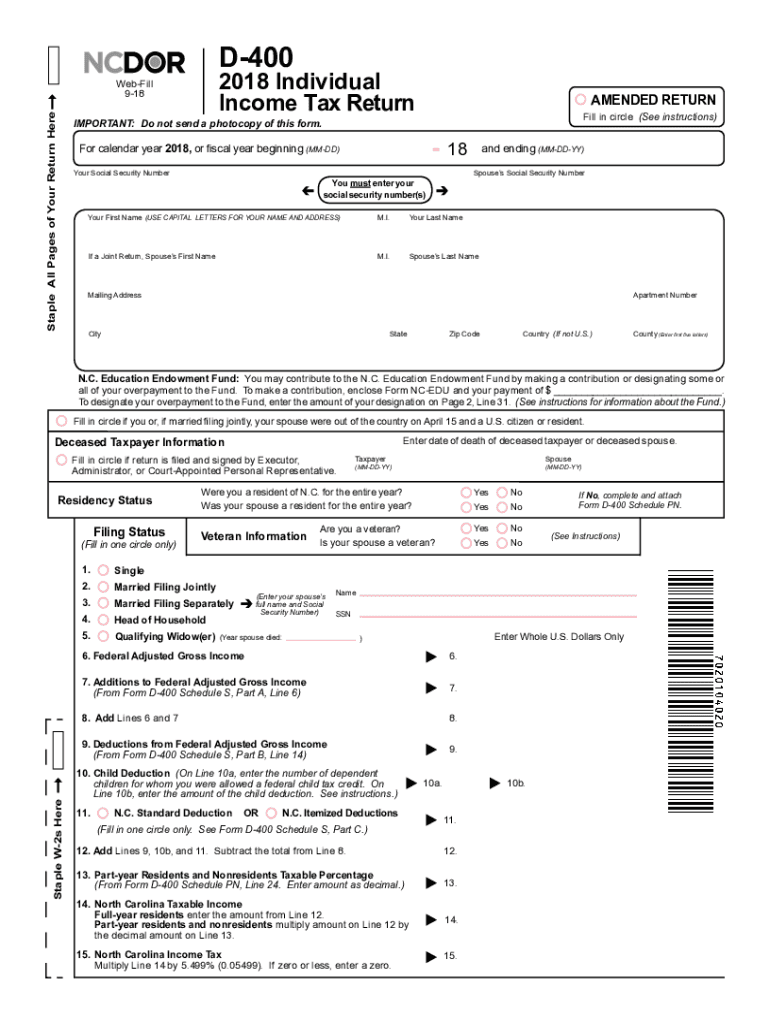

The Individual Income Tax Return in North Carolina, commonly referred to as the NC D-400, is a crucial document for residents and those earning income within the state. This form is used to report personal income and calculate the amount of tax owed to the state. The D-400 is essential for ensuring compliance with North Carolina's tax laws and is required for individuals who meet specific income thresholds. Understanding this form is vital for accurate tax reporting and avoiding potential penalties.

Steps to complete the Individual Income Tax Return North Carolina

Completing the NC D-400 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status, which will affect your tax rate and deductions. After that, fill out the form by reporting all income, claiming deductions, and calculating tax credits. It is important to double-check all entries for accuracy. Finally, submit the form either electronically or by mail, ensuring it is sent before the filing deadline to avoid penalties.

Legal use of the Individual Income Tax Return North Carolina

The legal use of the NC D-400 is governed by state tax laws, which require accurate reporting of income and adherence to filing deadlines. Filing this form correctly is essential for compliance with North Carolina tax regulations. Failure to file or inaccuracies can result in penalties, interest on unpaid taxes, and potential legal action. Therefore, it is crucial to understand the legal implications of submitting this form and to ensure that all information is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the NC D-400 are typically aligned with federal tax deadlines. For most individuals, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these dates to avoid late fees and penalties. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest charges.

Required Documents

To successfully complete the NC D-400, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits being claimed

- Previous year’s tax return for reference

Having these documents organized and accessible will streamline the process of completing the tax return and ensure that all necessary information is included.

Form Submission Methods (Online / Mail / In-Person)

The NC D-400 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online filing through approved tax software

- Mailing a paper form to the North Carolina Department of Revenue

- In-person submission at designated tax offices

Online filing is often the quickest and most efficient method, allowing for immediate processing and confirmation of receipt.

Quick guide on how to complete 2018 individual income tax return d 400

Complete Individual Income Tax Return North Carolina effortlessly on any gadget

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Individual Income Tax Return North Carolina on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Individual Income Tax Return North Carolina with ease

- Find Individual Income Tax Return North Carolina and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Individual Income Tax Return North Carolina to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 individual income tax return d 400

How to create an electronic signature for the 2018 Individual Income Tax Return D 400 online

How to make an eSignature for your 2018 Individual Income Tax Return D 400 in Google Chrome

How to make an eSignature for signing the 2018 Individual Income Tax Return D 400 in Gmail

How to make an eSignature for the 2018 Individual Income Tax Return D 400 from your smartphone

How to create an eSignature for the 2018 Individual Income Tax Return D 400 on iOS

How to make an eSignature for the 2018 Individual Income Tax Return D 400 on Android devices

People also ask

-

What are 2018 NC tax forms?

The 2018 NC tax forms are official documents required by the North Carolina Department of Revenue for filing state income taxes. These forms include various schedules and instructions for individuals and businesses to accurately report their income and deductions. Ensuring you have the correct forms is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow help with 2018 NC tax forms?

airSlate SignNow offers a streamlined solution for creating, sending, and eSigning your 2018 NC tax forms. This tool allows you to digitally fill out and execute your forms quickly, reducing the time spent on administrative tasks. The user-friendly interface ensures that even those unfamiliar with digital documents can navigate easily.

-

Are there any costs associated with using airSlate SignNow for 2018 NC tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to individual users and businesses. You can choose a plan that best fits your budget and needs, which includes the ability to manage and eSign documents like your 2018 NC tax forms. With competitive pricing, it's a cost-effective solution for document management.

-

Can I send 2018 NC tax forms to multiple recipients using airSlate SignNow?

Absolutely! airSlate SignNow allows you to send your 2018 NC tax forms to multiple recipients in one go. This feature is particularly beneficial for accounting professionals and businesses needing to gather documents from various parties. You can enhance collaboration and streamline the signing process efficiently.

-

What features does airSlate SignNow offer for managing 2018 NC tax forms?

airSlate SignNow features tools such as templates, custom branding, and advanced editing options, all designed to make managing your 2018 NC tax forms a breeze. It also provides secure cloud storage and tracking capabilities, so you can monitor the status of your documents in real-time. These features ensure you have everything you need to manage your forms effectively.

-

Is airSlate SignNow compliant with eSignature laws for 2018 NC tax forms?

Yes, airSlate SignNow complies with eSignature laws, ensuring that your electronically signed 2018 NC tax forms are legally valid. This compliance provides peace of mind, knowing your documents will be recognized by authorities. Using a compliant eSignature solution helps streamline your tax filing process.

-

Can I integrate airSlate SignNow with other software for my 2018 NC tax forms?

Yes, airSlate SignNow seamlessly integrates with various software platforms, enhancing your workflow when managing 2018 NC tax forms. Whether it's accounting software or project management tools, these integrations allow for greater efficiency and coordination. You can easily link your SignNow account and improve productivity.

Get more for Individual Income Tax Return North Carolina

Find out other Individual Income Tax Return North Carolina

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple