Personal Loans WNB Financial Form

Understanding Personal Loans from WNB Financial

Personal loans from WNB Financial are unsecured loans designed to help individuals meet various financial needs. These loans can be used for debt consolidation, home improvements, medical expenses, or any other personal financial requirement. Unlike secured loans, personal loans do not require collateral, making them accessible to a broader range of borrowers. WNB Financial offers competitive interest rates and flexible repayment terms, allowing borrowers to choose a plan that best fits their financial situation.

How to Obtain Personal Loans from WNB Financial

To obtain a personal loan from WNB Financial, potential borrowers should start by assessing their financial needs and determining the amount they wish to borrow. Next, applicants need to gather necessary documentation, including proof of income, identification, and any other financial information that may be required. After preparing the documentation, borrowers can apply online or visit a local branch to submit their application. WNB Financial typically reviews applications promptly, providing feedback on approval status and potential loan terms.

Steps to Complete the Personal Loan Application

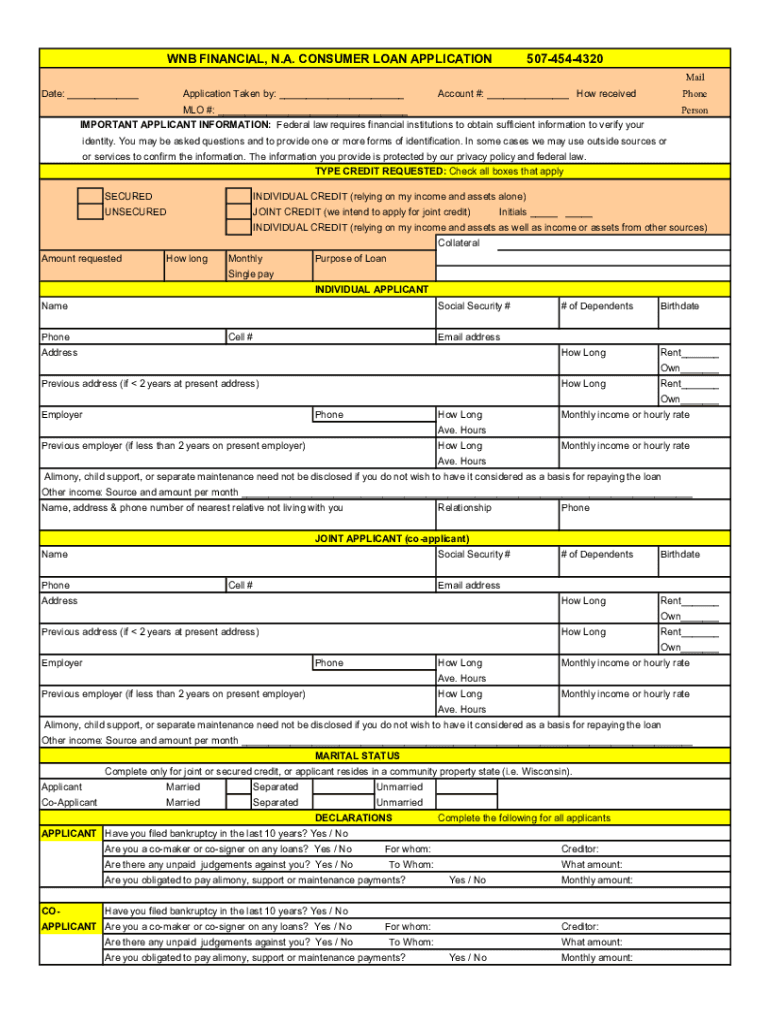

Completing the personal loan application with WNB Financial involves several key steps:

- Gather required documents, such as income verification and identification.

- Visit the WNB Financial website or a local branch to access the loan application.

- Fill out the application form with accurate personal and financial information.

- Submit the application along with any necessary documentation.

- Await approval and review the loan terms offered by WNB Financial.

Once approved, borrowers will receive instructions on how to access their funds and begin repayment.

Eligibility Criteria for Personal Loans from WNB Financial

Eligibility for personal loans from WNB Financial typically includes several criteria that applicants must meet:

- Applicants must be at least eighteen years old and a legal resident of the United States.

- A minimum credit score may be required, depending on the loan amount and terms.

- Proof of stable income or employment is necessary to demonstrate the ability to repay the loan.

- Debt-to-income ratio should fall within acceptable limits to ensure financial stability.

Meeting these criteria can improve the chances of loan approval and favorable terms.

Required Documents for Personal Loans

When applying for a personal loan with WNB Financial, applicants should prepare the following documents:

- Government-issued identification, such as a driver's license or passport.

- Proof of income, which may include pay stubs, tax returns, or bank statements.

- Social Security number for identity verification.

- Any additional documentation that may support the loan application, such as proof of residence.

Having these documents ready can streamline the application process and facilitate quicker approval.

Legal Use of Personal Loans from WNB Financial

Personal loans from WNB Financial can be used for various legal purposes, including:

- Consolidating high-interest debt to lower overall payments.

- Financing major purchases, such as home renovations or medical expenses.

- Covering unexpected expenses, such as car repairs or emergency bills.

It is important for borrowers to use personal loans responsibly and ensure that the funds are applied to legitimate financial needs.

Quick guide on how to complete personal loans wnb financial

Complete Personal Loans WNB Financial effortlessly on any device

Web-based document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Manage Personal Loans WNB Financial on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Personal Loans WNB Financial without hassle

- Obtain Personal Loans WNB Financial and click Get Form to begin.

- Make use of the tools we provide to submit your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious document searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Personal Loans WNB Financial and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal loans wnb financial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Personal Loans WNB Financial?

Personal Loans WNB Financial are unsecured loans designed to help individuals meet their financial needs. These loans can be used for various purposes, such as consolidating debt, covering unexpected expenses, or funding personal projects. With flexible terms and competitive rates, they provide a convenient solution for borrowers.

-

How do I apply for Personal Loans WNB Financial?

Applying for Personal Loans WNB Financial is a straightforward process. You can start by visiting the WNB Financial website and filling out the online application form. Once submitted, a representative will review your application and guide you through the next steps.

-

What are the interest rates for Personal Loans WNB Financial?

Interest rates for Personal Loans WNB Financial vary based on factors such as credit score and loan amount. Typically, WNB Financial offers competitive rates that can help you save money over the life of the loan. It's best to check their website or contact a representative for the most accurate rate information.

-

What are the benefits of Personal Loans WNB Financial?

Personal Loans WNB Financial offer several benefits, including quick access to funds, flexible repayment terms, and no collateral requirements. These loans can help you manage financial emergencies or achieve personal goals without the burden of high-interest rates. Additionally, WNB Financial provides excellent customer service to assist you throughout the process.

-

Can I use Personal Loans WNB Financial for debt consolidation?

Yes, Personal Loans WNB Financial are an excellent option for debt consolidation. By consolidating multiple debts into a single loan, you can simplify your payments and potentially lower your overall interest rate. This can lead to signNow savings and help you manage your finances more effectively.

-

What is the repayment period for Personal Loans WNB Financial?

The repayment period for Personal Loans WNB Financial typically ranges from 12 to 60 months, depending on the loan amount and your financial situation. This flexibility allows you to choose a repayment plan that fits your budget. Be sure to discuss your options with a WNB Financial representative.

-

Are there any fees associated with Personal Loans WNB Financial?

Personal Loans WNB Financial may have associated fees, such as origination fees or late payment fees. It's important to review the loan agreement carefully to understand all potential costs. WNB Financial strives to maintain transparency, so you can expect clear communication regarding any fees.

Get more for Personal Loans WNB Financial

Find out other Personal Loans WNB Financial

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast