Hawaii Income Tax Return Forms N 20 2018

What is the Hawaii Income Tax Return Forms N 20

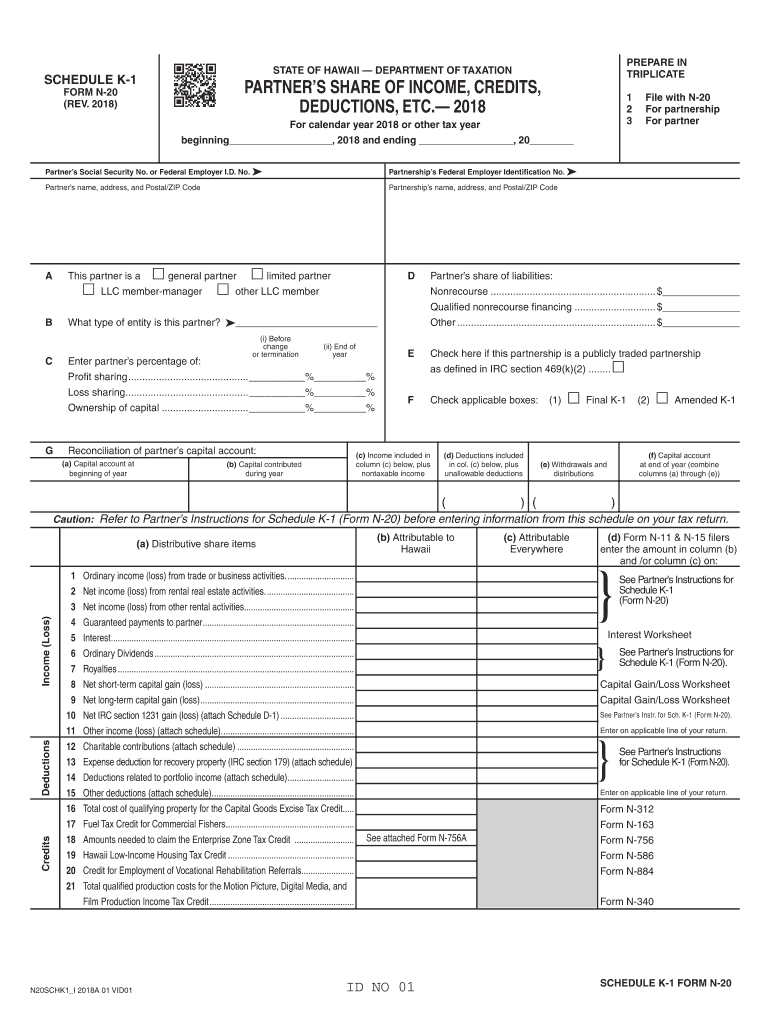

The Hawaii Income Tax Return Forms N 20 is a specific tax document designed for corporations operating within the state of Hawaii. This form is essential for reporting income, deductions, and tax liabilities. It is used by various business entities, including corporations, to ensure compliance with state tax regulations. Understanding this form is crucial for accurate tax reporting and adherence to Hawaii's tax laws.

How to use the Hawaii Income Tax Return Forms N 20

Using the Hawaii Income Tax Return Forms N 20 involves several key steps. First, gather all necessary financial documents, including income statements, expense reports, and previous tax returns. Next, accurately fill out the form by entering your business's financial information in the designated fields. Ensure that all calculations are correct to avoid discrepancies. After completing the form, review it for accuracy before submission. This careful approach helps in maintaining compliance with state tax requirements.

Steps to complete the Hawaii Income Tax Return Forms N 20

Completing the Hawaii Income Tax Return Forms N 20 can be streamlined by following these steps:

- Gather all relevant financial documents, including income and expense records.

- Download the form from the official Hawaii tax website or access it through a digital platform.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Double-check calculations and ensure all necessary signatures are included.

- Submit the form either online or via mail, depending on your preference.

Legal use of the Hawaii Income Tax Return Forms N 20

The Hawaii Income Tax Return Forms N 20 must be used in accordance with state tax laws to ensure its legal validity. This includes accurately reporting all income and adhering to deadlines set by the Hawaii Department of Taxation. Misuse of the form or failure to comply with legal requirements can result in penalties or audits. Therefore, understanding the legal implications of this form is essential for all businesses operating in Hawaii.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Income Tax Return Forms N 20 are critical for compliance. Generally, the forms must be submitted by the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this typically means an April deadline. It is important to keep track of these dates to avoid late fees or penalties, ensuring timely compliance with state tax obligations.

Required Documents

To successfully complete the Hawaii Income Tax Return Forms N 20, certain documents are required. These include:

- Income statements detailing revenue generated during the tax year.

- Expense reports that outline all business-related expenditures.

- Previous tax returns for reference and consistency.

- Any additional documentation that supports claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Income Tax Return Forms N 20 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Hawaii Department of Taxation's website, which may offer a streamlined process.

- Mailing the completed form to the appropriate tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete hawaii form n 20 2018 2019

Your assistance manual on how to prepare your Hawaii Income Tax Return Forms N 20

If you’re curious about how to finalize and file your Hawaii Income Tax Return Forms N 20, here are a few straightforward guidelines to simplify tax reporting.

To start, you only need to create your airSlate SignNow account to transform your online document handling. airSlate SignNow is an extremely user-friendly and powerful document tool that enables you to modify, draft, and complete your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to adjust details as necessary. Optimize your tax management with enhanced PDF editing, eSigning, and easy sharing capabilities.

Adhere to the steps below to complete your Hawaii Income Tax Return Forms N 20 in just a few minutes:

- Create your account and start processing PDFs in moments.

- Utilize our directory to find any IRS tax document; explore various versions and schedules.

- Click Get form to access your Hawaii Income Tax Return Forms N 20 in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checkmarks).

- Employ the Sign Tool to place your binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your version, submit it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting physically can lead to return errors and delay reimbursements. Moreover, before e-filing your taxes, check the IRS website for filing regulations in your area.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form n 20 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 20 2018 2019

How to generate an electronic signature for your Hawaii Form N 20 2018 2019 online

How to create an electronic signature for the Hawaii Form N 20 2018 2019 in Chrome

How to generate an electronic signature for putting it on the Hawaii Form N 20 2018 2019 in Gmail

How to create an eSignature for the Hawaii Form N 20 2018 2019 straight from your smartphone

How to make an eSignature for the Hawaii Form N 20 2018 2019 on iOS

How to generate an eSignature for the Hawaii Form N 20 2018 2019 on Android OS

People also ask

-

What are hitax hawaii gov forms n 20?

The hitax hawaii gov forms n 20 are specific tax forms required for reporting certain income in Hawaii. These forms help individuals and businesses accurately file their state taxes. It’s crucial to use the correct forms to avoid penalties and ensure compliance with Hawaii state tax regulations.

-

How can airSlate SignNow help with hitax hawaii gov forms n 20?

airSlate SignNow allows users to easily fill, sign, and send the hitax hawaii gov forms n 20 digitally. Our platform enhances efficiency by streamlining the document management process, reducing the need for paper forms. This helps in timely submissions and ensures that you stay compliant with Hawaii's tax requirements.

-

Are there any costs associated with using airSlate SignNow for hitax hawaii gov forms n 20?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing you to choose the one that best fits your requirements for managing hitax hawaii gov forms n 20. The pricing is competitive, providing a cost-effective solution for document management. You can review our pricing page for specific plans tailored to your needs.

-

What features does airSlate SignNow offer for handling hitax hawaii gov forms n 20?

Our platform offers features like customizable templates, electronic signatures, document tracking, and secure storage specifically tailored for hitax hawaii gov forms n 20. These tools enhance user experience and ensure compliance with tax regulations. Furthermore, integrating these features simplifies your document workflow.

-

Can I integrate airSlate SignNow with other tools for hitax hawaii gov forms n 20?

Yes, airSlate SignNow seamlessly integrates with various applications and tools to facilitate efficient processing of hitax hawaii gov forms n 20. You can connect it with your CRM, cloud storage, and other business apps to streamline documentation. This integration capability enhances your overall workflow and improves productivity.

-

How does eSigning improve the submission of hitax hawaii gov forms n 20?

eSigning through airSlate SignNow allows for a quick and secure way to sign hitax hawaii gov forms n 20 electronically. This saves time by eliminating the need for printing, signing, and scanning documents. Moreover, eSigning ensures that your forms are submitted faster, making compliance with filing deadlines easier.

-

Is airSlate SignNow secure for handling hitax hawaii gov forms n 20?

Absolutely, airSlate SignNow prioritizes security, ensuring that all data related to hitax hawaii gov forms n 20 is protected. We employ advanced encryption methods and secure storage solutions to safeguard your sensitive information. Compliance with legal and regulatory standards is also a key focus of our platform.

Get more for Hawaii Income Tax Return Forms N 20

- Deephaven parking permit form

- Mass earned sick time form

- Church budget request form 258402252

- Plumbing installation checklist form

- Form gst reg 06

- 25 fillable 03 breakout audio visual form

- Texas lottery electronic funds transfer authorization form txbingo

- State of arizona affidavit of shared residence form

Find out other Hawaii Income Tax Return Forms N 20

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy