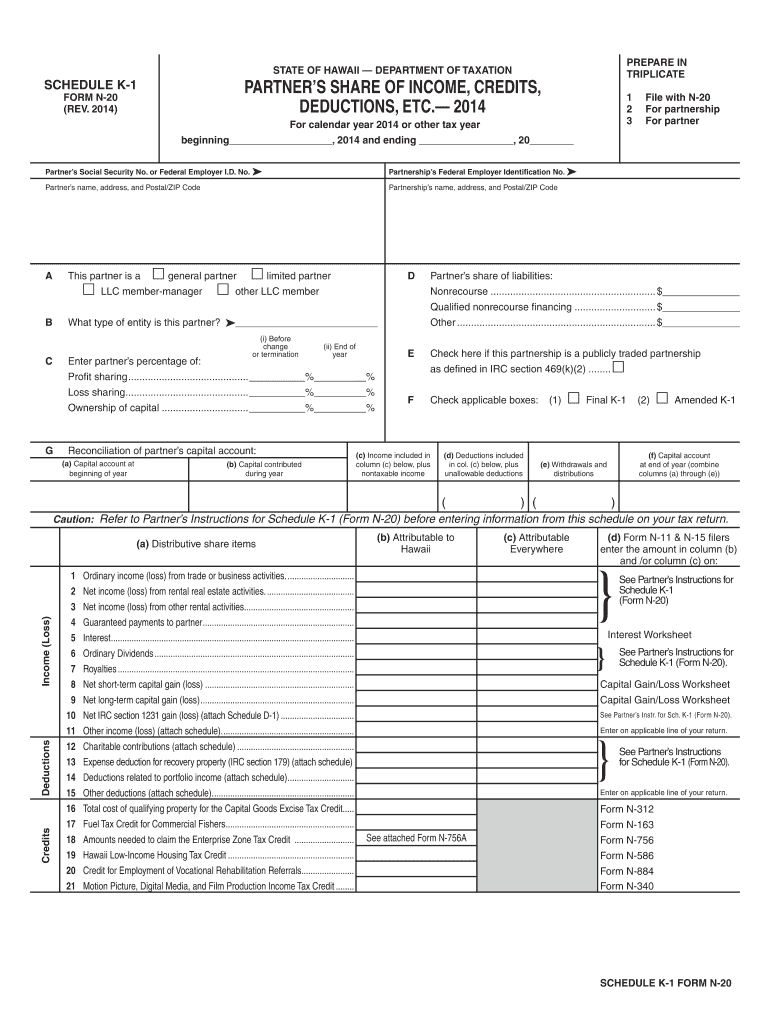

Form N 20 2014

What is the Form N-20

The Form N-20 is a tax document used primarily in the United States for reporting income earned by corporations and partnerships. This form is essential for entities that need to disclose their financial activities to the Internal Revenue Service (IRS). It provides a structured format for taxpayers to report their earnings, expenses, and other relevant financial information. By accurately completing this form, businesses can ensure compliance with federal tax regulations while also facilitating the assessment of their tax obligations.

How to use the Form N-20

Using the Form N-20 involves several key steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, expense reports, and any supporting documentation related to deductions or credits. Next, fill out the form by entering the required information in the designated fields. It is crucial to double-check all entries for accuracy to avoid potential issues with the IRS. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the taxpayer and the requirements set by the IRS.

Steps to complete the Form N-20

Completing the Form N-20 involves a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all relevant financial documents, including income statements and receipts.

- Begin filling out the form by entering the entity's name, address, and identification number.

- Report total income in the appropriate section, including all sources of revenue.

- Detail allowable deductions and expenses to arrive at the taxable income.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, ensuring it is sent to the correct IRS address.

Legal use of the Form N-20

The legal use of the Form N-20 is governed by IRS regulations, which require accurate and truthful reporting of financial information. Failing to complete the form correctly can lead to penalties, including fines or audits. It is essential for taxpayers to understand the legal implications of submitting this form, as it serves as a formal declaration of income and expenses. Additionally, utilizing electronic signatures can enhance the security and validity of the submission, aligning with current IRS guidelines for e-signatures.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-20 are critical for compliance with IRS regulations. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the entity's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances. Marking these dates on a calendar can help ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form N-20 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online Submission: Many taxpayers opt for electronic filing through IRS-approved software, which can streamline the process and reduce errors.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate IRS address. Ensure proper postage and tracking to confirm delivery.

- In-Person Submission: Taxpayers can also visit local IRS offices to submit the form directly, although this option may require an appointment.

Quick guide on how to complete form n 20 2014

Your assistance manual on how to prepare your Form N 20

If you’re curious about how to establish and submit your Form N 20, here are some straightforward recommendations on how to simplify tax declaration.

To start, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document platform that enables you to alter, produce, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to modify information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Form N 20 in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to access any IRS tax form; browse through variations and schedules.

- Click Obtain form to open your Form N 20 in our editor.

- Input the needed fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Please be aware that submitting on paper may increase return errors and delay reimbursements. Additionally, before e-filing your taxes, ensure you check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 20 2014

FAQs

-

What are the tips for filling out the IIFT CV FORM for 2014?

CV form is the first impression that you make on the interviewer when it comes to IIFT.Mathematically, resume + about yourself+career goal+ why MBA? + your life story =CV formSo make it genuine and interesting at the same time. Achievements need not be older than your 9th standard, if there aren't many after 9th then go for older ones.The last question "Anything else you want to include" which is an optional question should be answered with something very genuine and don't try to fake it.Keep a photocopy of your CV form and ask your friends to ask you cross questions on your answers and grill you for each one of them.

-

How do I fill the 2015 IBPS form if I don't remember the 2014 registration number?

Generally You should get in your email. If you didnt get, then don worry. Thats Not compulsory to fill the registration of ibps 2014. You can see the point. There is not * mark against it. Only * marked are compulsory to fill up. So Just chill.

-

How can I fill the improvement form for class 12th, CBSE 2014-15?

The forms are available in November or December only. You can't apply for an improvement now!And worse? You can't apply even for next session; it has to be in the year just after you graduated from your high school.

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

Create this form in 5 minutes!

How to create an eSignature for the form n 20 2014

How to make an electronic signature for the Form N 20 2014 in the online mode

How to create an eSignature for your Form N 20 2014 in Google Chrome

How to generate an eSignature for signing the Form N 20 2014 in Gmail

How to make an electronic signature for the Form N 20 2014 right from your smart phone

How to make an electronic signature for the Form N 20 2014 on iOS

How to make an eSignature for the Form N 20 2014 on Android devices

People also ask

-

What is Form N 20 and how can airSlate SignNow help with it?

Form N 20 is a document used for various legal and business purposes. With airSlate SignNow, you can easily upload, sign, and send Form N 20 securely. Our platform ensures compliance and simplifies the eSignature process, making it an ideal solution for handling this important document.

-

Is there a cost associated with using airSlate SignNow for Form N 20?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Each plan allows users to manage documents like Form N 20 efficiently. We provide a cost-effective solution that scales with your business requirements.

-

Can I customize the Form N 20 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize Form N 20 to fit your specific requirements. You can add fields, adjust layouts, and incorporate your branding, ensuring that the document meets your needs perfectly.

-

What features does airSlate SignNow offer for managing Form N 20?

airSlate SignNow provides a range of features for managing Form N 20, including eSignatures, document tracking, and templates. These tools streamline the signing process and enhance collaboration among team members, ensuring that your documents are handled efficiently.

-

Does airSlate SignNow integrate with other applications for Form N 20 management?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when managing Form N 20. You can connect it with CRM software, cloud storage services, and more, making it easier to access and send documents.

-

How secure is airSlate SignNow when handling Form N 20?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to ensure that your Form N 20 and other documents are protected against unauthorized access.

-

Can I track the status of my Form N 20 with airSlate SignNow?

Yes, airSlate SignNow offers document tracking features that allow you to monitor the status of your Form N 20. You will receive real-time notifications when the document is viewed, signed, or completed, providing you with complete visibility throughout the process.

Get more for Form N 20

- Joint commission safer matrix template form

- From beartown answer key form

- 01 116 form

- Zbxdkpv form

- Dsm 5 self rated level 1 cross cutting symptom measure adult name age sex form

- Editable map of massachusetts towns 613036019 form

- Restorative agreement template form

- Restorative justice agreement template 787747027 form

Find out other Form N 20

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free