Instructions for Form M 6 Hawaii Estate Tax Return Rev Hawaii Gov 2016

What is the Instructions For Form M-6 Hawaii Estate Tax Return Rev

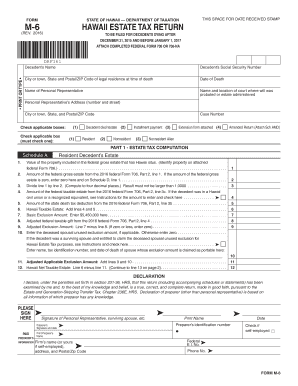

The Instructions for Form M-6 Hawaii Estate Tax Return Rev provide essential guidance for individuals and entities responsible for filing estate tax returns in the state of Hawaii. This form is designed to assist taxpayers in accurately reporting the value of an estate and calculating the corresponding tax obligations. It outlines the necessary steps, required documentation, and specific calculations needed to ensure compliance with Hawaii's estate tax laws.

Steps to complete the Instructions For Form M-6 Hawaii Estate Tax Return Rev

Completing the Instructions for Form M-6 involves several key steps:

- Review the eligibility criteria to determine if the estate is subject to Hawaii estate tax.

- Gather all necessary documentation, including asset valuations, debts, and any prior tax returns.

- Follow the detailed instructions provided within the form to accurately fill out each section.

- Calculate the total estate tax liability based on the provided guidelines.

- Sign and date the form, ensuring that all information is complete and accurate before submission.

Required Documents

When preparing to complete the Instructions for Form M-6, it is important to gather the following documents:

- Death certificate of the decedent.

- Inventory of all assets, including real estate, bank accounts, and personal property.

- Documentation of any debts or liabilities associated with the estate.

- Previous tax returns, if applicable, to provide context for the estate's financial history.

Filing Deadlines / Important Dates

Timely submission of the Instructions for Form M-6 is crucial to avoid penalties. The filing deadline is generally nine months after the date of death of the decedent. Extensions may be available, but it is important to file any requests for extensions before the original deadline to ensure compliance with state regulations.

Legal use of the Instructions For Form M-6 Hawaii Estate Tax Return Rev

The Instructions for Form M-6 serve a legal purpose by ensuring that estate tax returns are filed in accordance with Hawaii state law. Proper completion and submission of this form not only fulfill legal obligations but also help in the accurate assessment of estate taxes owed. Failure to comply with these instructions can result in penalties, interest on unpaid taxes, and potential legal complications for the estate's executor or administrator.

State-specific rules for the Instructions For Form M-6 Hawaii Estate Tax Return Rev

Hawaii has unique estate tax regulations that differ from federal guidelines. The Instructions for Form M-6 detail state-specific rules, including exemption thresholds, tax rates, and deductions applicable to estates. Understanding these rules is essential for accurate reporting and compliance. Taxpayers should be aware of any recent changes to state laws that may affect their filing.

Quick guide on how to complete instructions for form m 6 hawaii estate tax return rev hawaiigov

Your assistance manual on how to prepare your Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov

If you're wondering how to complete and submit your Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov, here are some quick guidelines on how to make tax declaration smoother.

To begin, you just need to sign up for your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document tool that allows you to modify, draft, and finalize your tax forms easily. With its editor, you can alternate between text, checkboxes, and electronic signatures, and return to adjust information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov in no time:

- Create your account and start working on PDFs in minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that filing on paper can lead to mistakes in returns and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form m 6 hawaii estate tax return rev hawaiigov

FAQs

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

Create this form in 5 minutes!

How to create an eSignature for the instructions for form m 6 hawaii estate tax return rev hawaiigov

How to generate an eSignature for your Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaiigov online

How to make an electronic signature for your Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaiigov in Google Chrome

How to make an eSignature for signing the Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaiigov in Gmail

How to create an eSignature for the Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaiigov from your mobile device

How to make an eSignature for the Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaiigov on iOS

How to generate an electronic signature for the Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaiigov on Android

People also ask

-

What are the key features of the airSlate SignNow platform for handling 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.'?

airSlate SignNow provides a user-friendly interface for managing your documents, including the 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.' It offers customizable templates, secure eSigning options, and cloud storage, making it easier to complete and submit forms for Hawaii estate tax.

-

How can airSlate SignNow help me with submitting the 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.'?

With airSlate SignNow, you can fill out and eSign the 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.' online, streamlining the entire submission process. The platform ensures that your documents are securely stored and readily accessible, allowing you to manage estate tax forms efficiently.

-

Is there a free trial available for airSlate SignNow to help with 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.'?

Yes, airSlate SignNow offers a free trial that allows users to explore its features, including support for the 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.' You can take advantage of this trial to test the eSigning and document management capabilities before committing to a subscription.

-

What pricing plans are available for using airSlate SignNow services?

airSlate SignNow offers flexible pricing plans to cater to different needs. Whether you require basic functionalities for 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.' or advanced features for team collaboration, there are options to fit any budget.

-

Does airSlate SignNow integrate with other applications to assist with Hawaii estate tax forms?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, enhancing your workflow when dealing with 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.' Integrations with platforms like Google Drive, Dropbox, and Salesforce allow for efficient management of your estate tax documents.

-

What security measures are in place when using airSlate SignNow for sensitive documents like Hawaii estate tax returns?

airSlate SignNow prioritizes security with advanced encryption protocols to protect your documents, including 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.' Additionally, it complies with industry standards, ensuring that your sensitive information remains safe during storage and transmission.

-

How do I get started with airSlate SignNow for my Hawaii estate tax returns?

Getting started with airSlate SignNow is easy! Simply sign up for an account, select the necessary templates for 'Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov.,' and begin creating and eSigning your documents online in just a few steps.

Get more for Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov

- Somaliland visa application form

- 18882994181 form

- A self checklist for providing a culturally responsive instructional environment form

- Appendix 3 c vacancy reconditioning log form

- Lolc online trading form

- Levy refund request form saskatchewan cattlemens association

- Crm no building act building regulations 201 form

- Restaurant purchase agreement template form

Find out other Instructions For Form M 6 Hawaii Estate Tax Return Rev Hawaii gov

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed